There Are Many Reasons Why This Crop Is Of Global Importance

This site

is mobile

responsive

Oil palm (Elaeis guineensis) is the most important global oil crop, accounting for around 40 per cent of all traded vegetable oil. This second largest source of global edible oil has attained the International Sustainability and Carbon Certification for bio-based feedstocks, and renewables catering to energy, food, feed, and chemicals sectors.

Oil palm remains a crucial plantation crop for Malaysia as the country holds 25 per cent of the world’s palm oil production capacity. Having been cultivated since the 1960s through a scheme to eradicate poverty among the rural population, palm oil plantations today sprawl over 5.89 million hectares across both Peninsula and East Malaysia, according to the Malaysian Palm Oil Board (MPOB).

Oil Palm – to the Sustainable Rescue

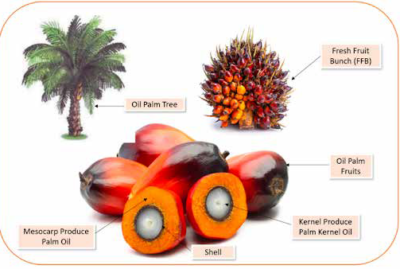

An oil palm tree begins producing fruits in bunches after 30 months of field planting, and has 20 to 30 years of economic life. Tenera, a mixed hybrid between dura and pisifera, is the common species planted here for its high ratio of palm oil and palm kernel oil yields.

Oil palm trees are highly productive for their natural, versatile, healthy, and cost-effective raw materials as well as abundance of supply. There are multiple uses for each tree part, from the fruits to processed palm oil residues in addition to possessing the ability to produce bioenergy/biofuels. The crux starts with the oil palm fruit, which produces palm oil (produced from the mesocarp), and palm kernel oil (produced from the kernel).

Enriching Source in Food Based Products

The trans-fat-free and cholesterol-free palm oil boast a balanced ratio of unsaturated and saturated fatty acids. Its genetics contain 40 per cent oleic acid (monounsaturated fatty acid), 10 per cent linoleic acid (polyunsaturated fatty acid), 45 per cent palmitic acid, and five (5) per cent stearic acid (saturated fatty acids). This composition results in a cost-effective edible oil that is suitable for various food applications including being made into cooking/frying oil, shortening, margarine, and

confectionery fats.

Its high resistance to oxidation results in a longer shelf life for products, raising its suitability for solid

fat products and high demand from the liquid cooking oil segment, as well as industrial applications. Further downstream products that are blended with palm oil or palm kernel oil range from vegetable ghee (vanaspati), margarine and spreads, confectionery, and non-dairy products.

Malaysia accounted for 30 per cent or 15.6 million tonnes of global exports of palm oil and fats in

2021, with export revenue hitting RM106 billion due to the surge of global demand as economies recovered post-COVID-19.

A total of 451 companies are actively operating as oil palm millers, while 49 companies operate refineries to produce downstream oil palm products in Malaysia. Foreign investors include; Cargill, Unifuji, Wilmar, Rikevita, Adeka Foods, Golden Suntech, and Musim Mastika. These global players are increasing ventures into further development and formulating downstream palm oil food products.

In tandem with this, local palm oil producers such as Sime Plantation, IOI Corp, Kuala Lumpur Kepong, and Felda Global Ventures have ridden Malaysia’s global leadership in the industry by becoming international suppliers and expanding their operations to other countries.

Government agencies such as MPOB continue to develop and market new niche applications, and palm oil enhancements. Its perfector pilot plant and laboratory facilities are also rented out to manufacturers for preparation of new palm oil-based food product formulation and process optimisation. These include emulsion-based, powdered and consumer foods such as pourable

margarine, mayonnaise, soup-mixes, imitation cheese, and micro-encapsulated palm oil. In

addition, new processes such as red palm oil or red palm olein have been infused into healthier cooking and salad oils.

Functional Derivatives in Oleo Chemical and Non-Food Products

Driving the growth of consumer products are the growing middle-income groups in Asia, the Middle

East, and Latin America, especially in the cosmetics, and home and personal care markets. Basic oleochemicals (including fatty acids, fatty alcohols, methyl esters, and glycerine) constitute 99 per cent of the palm oil used in non-food downstream production.

The main raw materials used for basic oleochemicals in Malaysia are crude palm kernel oil (CPKO) and palm stearin; two (2) remarkable key ingredients in soaps, cosmetics, personal care products, candles, animal feed, and lubricating greases (for the processing of tinplate and coating iron plates), as well as for use in the pharmaceutical industry and biofuels.

The majority of the industry players producing oleochemical products are established Malaysian companies. At the same time, some major global players, namely Emery, Kao, Procter & Gamble, Oleon, Evyap, and IFFCO are here to enliven the industry. The existence of these global players in Malaysia enhances the prosperity and diversity of the industry.

In embracing the climate change and global sustainability agenda, global industries are progressing into further palm oil research and potentiality, including specialty oleochemicals with broad applications, excellent product performance, are value-added recycles. These are safe for human use, and are environmentally compatible and biodegradable.

Palm Biomass – Expanding Opportunities into Renewable Energy

The oil palm harvesting produces an enormous quantity of lignocellulosic biomass in large leaves of a palm tree or oil palm fronds and oil palm trunks at plantation sites. In addition, the extraction of palm oil from fresh fruit bunches results in a large quantity of waste in the form of palm kernel shells, empty fruit bunches, palm kernel cake, mesocarp fibres and palm oil mill effluent.

In Malaysia’s case, more than 95 million tonnes of oil palm biomass were generated across the country in 2021, leading to the advancement of the biomass industry along with the increasing global demand for bioenergy. Palm-biomass has also expanded its applications to cover raw materials for animal feed, furniture parts, paperboard, biopolymer, bioethanol, and vitamin ingredients.

Further downstream, the evolution of new technology allows for more beneficial outcomes from palm-biomass, where the recovery of oils, fatty acids, and other derivatives are made possible.

Palm biomass is even gaining attention in the Climate Change agenda. Malaysia is working to increase the share of renewable energy to 31 per cent of Malaysia’s total energy generation capacity by the end of 2025, as part of its efforts to achieve carbon-neutral status by 2050. Presently, the country has the capability to produce more than 2,400 megawatts (MW) of biomass and 410 MW of biogas, which are equivalent to produce 82 MW and 113 MW of electricity, respectively.

The global renewable energy mandates by North Asian markets have also triggered higher interest from Japan and South Korea to set up manufacturing facilities in Malaysia to produce

biomass pellets, thus driving oil palm stakeholders to pursue further measures and processes.

Product investments in this segment have been increasing, including three biomass pellets projects of RM152.5 million approved in 2021. Results are also showing through incremental of Malaysia’s palm biomass exports from RM77 million in 2015 to RM222 million in 2020.

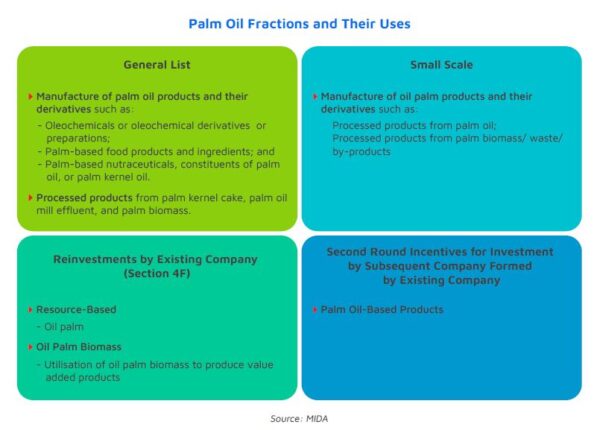

Strong Facilitation Eorts from the Government

The Malaysian Government extends its full support to companies wanting to invest in technology intensive processes to produce high-value add palm oil products, apart from the utilisation of biomass to produce value added products. Accordingly, the project is be eligible for Pioneer Status with income tax exemption of 70 per cent of statutory income for five (5) years or an Investment Tax Allowance of 60 per cent on qualifying capital expenditure incurred within a period of five (5) years, to offset against 70 per cent of statutory income in years of assessment (see the table).

Global players are also welcomed to explore innovations in the oil palm and biomass ecosystem, as Malaysia is strongly aligned with the mission of the Roundtable on Sustainable Palm Oil in cultivating a biodiverse ecosystem throughout the palm oil supply chain.