This site

is mobile

responsive

The term ‘electric automobiles’ is no longer uncommon in the global automotive business because it is the rage. Clean energy, zero carbon emissions, and air pollution issues can all be reduced once the world moves toward Environmental, Social, and Governance objectives (also known as ESG). The industry is undoubtedly preparing for the ambitious goal of zero emissions set for 2050 – a goal that will mostly be driven by electric vehicles (EV), which play such a crucial role in this matter.

The market for EV is growing fast everywhere. As of the end of 2021, the number of electric cars on the roads globally were about 16.5 million – triple the amount in 2018. Global sales of electric cars have kept rising strongly in 2022, with two million sold in the first quarter, up by 75% compared to the same period of 2021. The People’s Republic of China (China), was the main driving force behind the increase in EV sales in 2021, being responsible for half of the growth; approximately 3.3 million more vehicles were sold in China in 2021 compared to the number sold to the entire world in 2020. Following the 2020 boom, sales in Europe continued to expand strongly (up 65% to 2.3 million) – and after two years of decline, sales in the United States also increased (to 630,000).

Similar patterns emerged in the first quarter of 2022, with sales in China more than doubling compared to the first quarter of 2021 (accounting for the majority of worldwide growth); this compares to a rise of 60% in the United States and 25% in Europe.

The ASEAN EVs Market was valued at USD498.9 million (RM 2.31 billion) in 2021, and is expected to reach USD2.7 billion by 2027, registering a compound annual growth rate (CAGR) of 32.7% during the forecast period (2022-2027).

Effects on the Malaysian transportation sector

Malaysia’s transportation sector is certainly booming, resulting in a large energy demand. However, the sector intensively suffers from low energy conversion efficiency of combustion engines (18.8% in 2019) therefore, the high number of private vehicles have increased the overall carbon dioxide (CO2) emission rate significantly.

Since the transportation sector proved to be one the biggest contributor to annual greenhouse gas (GHG) emissions, a new way out was required.

Incorporating EV culture into the Malaysian economy lends itself very well as a prospective solution; however, the challenge would be to inaugurate mass use and encourage the purchasing of EV.

In line with global recognition and emphasis on green growth, the Government of Malaysia committed to drive sustainability and inclusivity as outlined in the Twelfth Malaysia Plan (12MP), with the commitment to achieve net zero carbon emissions by 2050 at the earliest.

Malaysia EV industry and its ecosystem

The booming demand for efficient and low-emission vehicles is expected to rise more significantly over the next decade as governments and countries continue to implement measures amid the rising prices of petroleum and to navigate the solutions to address climate change.

The Malaysian EV market is currently in the initial stage of ecosystem growth and market expansion. Nonetheless, Malaysia can always benefit from its position as one of the leading electrical and electronics (E&E) manufacturing hubs in Southeast Asia and take the lead in producing high-value E&E parts and components for EV which would be crucial to ensure the success of this initiative.

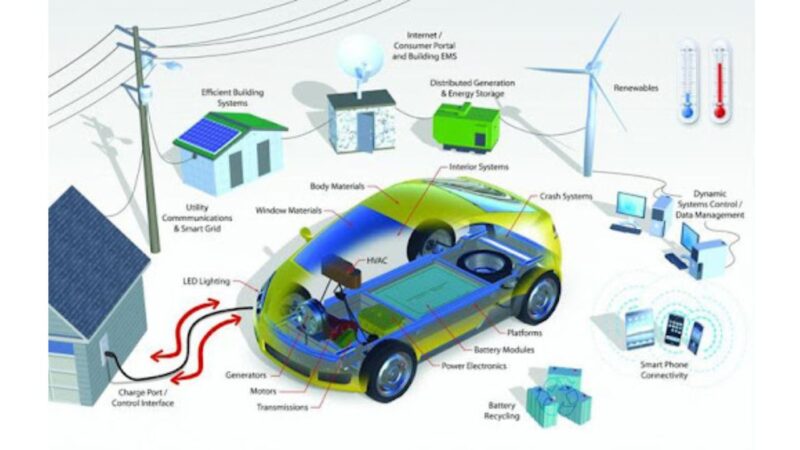

The substantial size and diversity of the local E&E ecosystem specifically, with regards to the EV supply chain is the key strength of Malaysia’s EV ecosystem, which can support the manufacturing and assembly of EV and Autonomous Vehicles (AVs) due to the presence of a mature technological topography that spans through R&D of crucial component manufacturing, (such as sensors and transceivers) that will eventually spur technology transfers and developmental know-how for the local automotive industry.

Malaysia is a producer for materials related to EV battery manufacturing – not only does the country have reputable local companies that are equipped factory automation lines for battery cells and battery packs production which can support EV battery manufacturing activities; it also possesses a comprehensive E&E ecosystem, particularly for front-end to back-end semiconductor manufacturing activities.

The country continues to be an attractive base for global automotive manufacturers, where Honda, Toyota, Nissan, Mercedes-Benz, and BMW are just some of the global automotive giants which have set up their operations to take advantage of buoyant consumer demand.

Already, many companies have expressed interests in setting up EV charging stations across Malaysia, Singapore, and Thailand, as they anticipate a market expansion on the EV industry’s growth. As such, the EV industry cannot operate in a silo, and needs to offer a complete ecosystem in order to flourish. In that respect, Malaysia should look to differentiate itself from its neighbours and focus on its unique role in the value chain in order to be more competitive.

Guiding principles to EV development

Malaysia has undertaken various policies and initiatives to develop the EV Ecosystem alongside its other government agencies and ministries. The National Automotive Policy (NAP) 2020 has emphasised the need for adoption of Energy Efficient Vehicle (EEV) including EVs in line with Malaysia’s commitment to reducing carbon emissions under the UN Framework Convention on Climate Change. The NAP has also outlined several specific initiatives to strengthen the local EV ecosystem that will spur technological transfers and develop know-how in order for the local automotive industry to continue thriving.

In addition to the above policies, The Low Carbon Mobility Blueprint (LCMB) 2021-2030 was introduced by The Ministry of Environment and Water (KASA) to assess the best options in energy and greenhouse gas (GHG) mitigation planning in the transport sector.

The aspiration highlighted by the Government under the LCMB is to achieve at least 15% of EV out of the total industry volume (TIV) by 2030, with 10,000 units of Charging Facilities built by 2025 (comprising 9,000 alternating current (AC) units and 1,000 direct current (DC) units).

Recently, the Government has launched the New Energy Policy (2022 – 2040), that highlighted the percentage of EV is set at 38% from the total industry volume (TIV) by 2040 under the Low Carbon Nation Aspiration target.

Issues and challenges in the development of EV

It must be noted that the road towards realising the full potential of EV would be a lot bumpier without the collective action of key stakeholders across the value chain, including manufacturers, policymakers, property players, infrastructure providers, and day-to-day consumers.

One primary issue is the unaffordability of EV; the price of EV and batteries are relatively expensive, due to low localisation for critical parts and components – which would certainly be a factor for a buyer who is considering the purchase and maintenance costs. Other factors include regulatory policies; the availability of charging infrastructure; vehicle service points, and road infrastructure. These alone are strong enough concerns for car-purchasing Malaysians to think about when considering the switch from Internal Combustion Engine vehicles (ICE) to EV – which, in turn, could translate to low adoption of EV.

Furthermore, it has been observed among prospective EV users that psychological factors – including as risk perception; corporate culture; and company image – play a significant role for fleet purchasers (that is, buying more than one vehicle at a time), whereas attitudes, lifestyle, personality, and self-image become essential focus points for private individuals. Interestingly, regardless of whether the buyers are private or fleet consumers, the environmental issue is one the lowest priorities considered when purchasing an EV.

From an investment perspective, the EV ecosystem – especially its critical components (battery management systems or BMS; battery pack and capacity; Artificial Intelligence or AI; on-board charging; charging infrastructure; and modular-based battery swapping technology) – is in its early stages in Malaysia. As such, there are vast investment opportunities for potential investors.

Establishment of the EV Task Force

To address the issues and challenges, the Government has formed an Electric Vehicle Taskforce to facilitate policy formation on EV and to streamline EV incentives towards the adoption of EV in Malaysia. This initiative is in line with the National Investment Aspirations (NIA) to elevate the focus on Environmental, Social and Corporate Governance (ESG) issues across all sectors. Led by MITI, the Taskforce members include various ministries, agencies (including MIDA), and representatives from the industries to spearhead EV development holistically in Malaysia.

The established Taskforce is currently looking into rationalising the EV agenda in Malaysia, and proposing recommendations for a comprehensive policy, which will help encourage EV manufacturers to make Malaysia their automated regional hub and to propel the adoption of EV as the preferred choice of local consumers. As the co-secretariat alongside MITI, MIDA is actively committed to attracting potential investment to Malaysia, while seizing opportunities to spur the EV automotive segment.

Encouragement to the EV segment

Besides the above-mentioned policies and the Taskforce initiatives, the Government has also offered incentives under the 2022 budget. These incentives including offering exemptions for whole import duty, excise duty, and sales tax for locally-assembled EV until 31 December 2025, and exemptions for whole import duty and excise duty for imported EV until 31 December 2023 – will simultaneously support EV manufacturers and encourage EV ownership, which is expected to raise the EV industry and ecosystem while also allowing for more green investments and for the creation of high-skilled job opportunities in Malaysia.

Additionally, there will be tax exemptions that will come into play. A road tax exemption of up to 100% will be provided for EV on top of individual income tax relief of up to RM2,500 for the purchase, installation, rent, hire purchase, and subscription fees for EV charging facilities. Special tax incentives are also available for the development of critical EV components (as mentioned earlier).

All of these policies and initiatives are being set down for the next couple of years, as the Government targets for Malaysia to participate significantly in the regional electric mobility market by 2030. These measures should see the local automotive industry generally thriving into the next generation as the world moves towards clean energy, a safe environment, and better living for humankind.

Driving investment into the EV segment

MIDA is committed to driving quality investments to support the EV supply chain and its ecosystem in Malaysia. We are optimistic that EV will steadily gain popularity and become more mainstream, particularly since there is growing demand for green transportation within the ASEAN region.

Encouragingly, the investments from two prominent EV global players from South Korea – Samsung SDI Energy Malaysia to produce EV battery cells, and SK Nexilis to manufacture electro-deposited copper foil for EV batteries are a testament to the assurance that investors have regarding Malaysia’s commitment to a greener future. Additionally, prominent automobile manufacturer Volvo Car Malaysia has announced an electrification plan to produce its first assembled EV at it manufacturing facility in Shah Alam, Selangor.

Spurred by these signs of confidence, Malaysia will continue to welcome more of such investments which – along with the proactive initiatives already in place – should see the country become a prominent global value chain player and preferred technology partner for EV. As such, MIDA will continue to be a networking conduit in connecting companies and technology solution providers both international and local in efforts to assist and facilitate industry players in their digitalisation journey, as well as pushing the nation towards achieving low the carbon mobility agenda in line with the National Investment Aspirations and Sustainability Agenda.

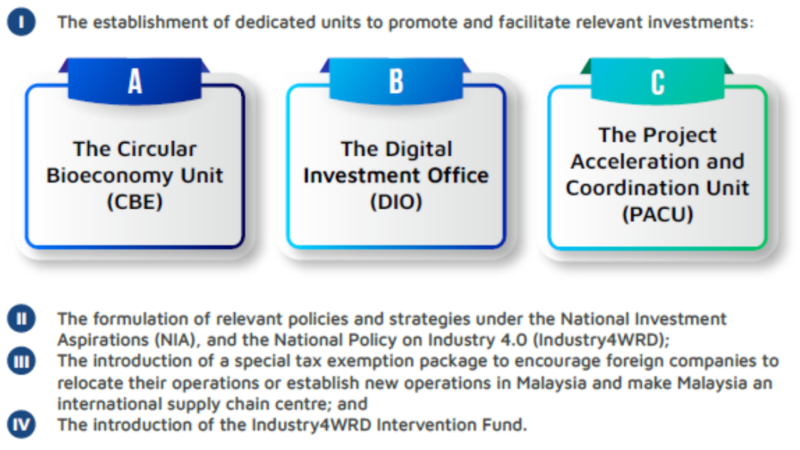

As the Government’s principal investment promotion and development agency, MIDA continues to be at the forefront of attracting and facilitating investors and ensuring that Malaysia continues to maintain its position as an investor-friendly destination for long-term growth, for both foreign and domestic businesses. Among the efforts undertaken are:-