Expediting Malaysia’s energy transformation journey

29 Jul 2023

ECONOMY Minister Rafizi Ramli was very honest when he admitted that bureaucracy and non-streamlined government policies have often limited the private sector from fully embracing green technology.

Citing Sime Darby Property Bhd as an example, he says the developer had faced issues in rolling out solar panels for its townships.

“Application for solar power quota had to be made individually by the buyers. So, it becomes quite restrictive to large-scale property developers.

“They can’t package the whole thing as part and parcel of the township.

“The best that they can do is to wait for the buyers to apply for the quotas themselves first,” he told reporters after launching the National Energy Transition Roadmap (NETR) on Thursday.

With the NETR, Rafizi, or rather the administration of Datuk Seri Anwar Ibrahim, is committed to bringing such issues to an end.

The government wants to simplify the process behind solar power quota applications, allowing large-scale urban property developers to include solar panels in their full pricing packages.

Ultimately, property developers can also venture into energy storage systems (ESS) for the townships, Rafizi says.

This is just one example of how accelerated public-private partnerships can take place under the NETR.

The minister was loud and clear that the government is willing to work closely with businesses to fast-track and facilitate their involvement in the renewable energy (RE) landscape.

This includes expedited policy changes and incentives from the government’s side in making sure that committed clean energy projects can take off as per their timeline.

The NETR aims to provide clarity for the business sector, particularly on how the government plans to transform the RE scene into something that is innovation-driven and sufficiently profitable in the long run.

The first part of the NETR outlined 10 flagship catalytic projects based on six energy transition levers, namely, energy efficiency; RE; hydrogen; bioenergy; green mobility; and carbon capture, utilisation and storage or CCUS.

Meanwhile, the second and final part of the NETR will focus on establishing the low-carbon pathway, energy mix and emissions reduction targets needed for the energy sector.

Particularly on hydrogen, Rafizi sees the development of hydrogen capabilities as an opportunity for Malaysia to take the lead in the field of alternative fuel, much like the early days of liquefied natural gas when Malaysia helped countries in the Middle East build the entire chain in the 1980s.

Citing similarities with the situation then, the minister acknowledges the progress made in Sarawak, which is very much ahead in terms of expertise and implementation

The government’s enthusiasm in spearheading transformation in the country’s RE journey seems to be well-received by the investing community.

The Invest Malaysia event, where the NETR was launched, was packed with fund managers, analysts, decision makers and other industry players.

The NETR, expected to open up investment opportunities between RM435bil and RM1.85 trillion by 2050, is designed to be primarily driven by the private sector, with government agencies to be strategic facilitators.

The roadmap is not merely about energy transition, but also about creating an entire economic ecosystem by tapping into energy transition potentials.

RHB Research is positive on the NETR as it paves the way to expedite energy transition in Malaysia, lifting the RE projects’ potential returns via energy exports.

However, the research house cautions that the success of the NETR still depends on diligent execution and stringent policy implementation.

In the past, Malaysia has seen the introduction of many blueprints and policy documents. But amid changes in ministers, poor implementation and policy flip-flops, many of the ambitious plans have failed to achieve their intended targets.

Hence, this time around, how different will the NETR be? Can the current government implement the NETR in the best way it was intended?

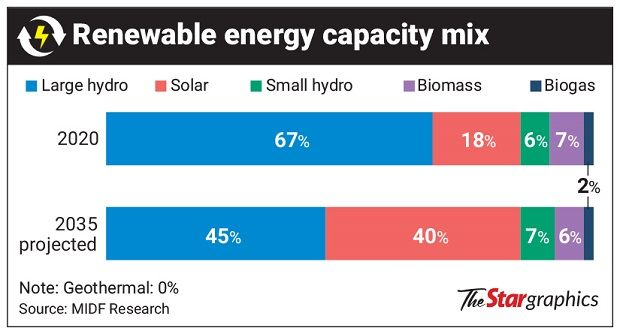

MIDF Research calls the NETR “a firm policy layout” for energy transition.

The roadmap should drive a rerating of the utilities sector on improved growth and environmental, social and governance (ESG) profile, it says in a note.

MIDF Research also notes that there will be several hybrid solar and hydropower power plants established under the NETR.

This includes a one-gigawatt (GW) hybrid solar plant with an integrated RE industrial park to be developed by UEM Group in collaboration with Itramas Corp Sdn Bhd.

Meanwhile, Tenaga Nasional Bhd (TNB) will be developing a 2.5GW hybrid hydro floating solar at its Kenyir and Sungai Perak hydro power plants.

“We learnt that these hybrid projects are being considered for export capacity to Singapore, which requires a rather demanding 75% load factor for clean energy supply.

“TNB is also investing some RM35bil for grid development between 2025 and 2030, which it expects to recover via higher tariffs for RE export and green programmes for consumers,” according to MIDF Research.

MIDF Research also points out that the NETR’s focus on Sabah energy security is a “pleasant surprise”.

“Sabah suffers from (power) undercapacity, yet it accounts for 35% of Malaysia’s RE resource. Hence, we believe the move to unlock Sabah’s RE potential is a step in the right direction,” it says.

Beyond implementation issues, a key risk that could affect the NETR’s success is the availability of funding. While the private sector is increasingly eager to undertake RE-related projects, funding by traditional and alternative financing providers should also grow in tandem.

Tan Sri Mohamad Norza Zakaria, the executive chairman and president of Citaglobal Bhd, highlights that public funding alone might not be enough for the country’s energy transition journey.

This is considering the fact that the quantum of investments into renewables as a whole is very high, he says.

“If we could encourage investments from international organisations, financial institutions and investors to come into the Malaysian RE segment, this would be a big boost not just to the sector but to the economy as a whole.

“The positive is that ESG is now high on the checklist of most governments and corporations. Hence, there likely won’t be a shortage of international investors,” he says.

Mohamad Norza notes that the demand from institutional investors looking to invest in renewables is already high at the moment, especially for RE projects that offer attractive rates of returns.

“By implementing large-scale, growth-inducing RE projects, Malaysia will not only attract foreign direct investment, but this will also be a new multiplier effect for our economy,” according to him.

Abundant business opportunities

Analysts are positive that engineering, procurement, construction and commissioning (EPCC) players will be key beneficiaries under the NETR.

This includes local solar contractors such as Solarvest Holdings Bhd, Samaiden Group Bhd, Sunview Group Bhd and Pekat Group Bhd.

Reservoir Link Energy Bhd, a sub-contractor and mounting structure provider, will also benefit from higher job flows, according to RHB Research.

“Assuming an EPCC contract is valued at RM2.5mil per MW, a minimum four-GW solar capacity investment could translate to about RM10bil worth of job opportunities for such players in the next few years.

“We believe this is a structural uplift to these operators, given that previous large-scale solar (LSS) or Corporate Green Power Programme or CGPP rollout is only 800MW to 1,000MW per cycle,” it says.

The NETR also aims to establish a pilot RE zone that will encompass an industrial park, zero-carbon city, residential development and data centre.

“We believe rising data centre investment could potentially benefit data centre developers and contractors such as YTL Power International Bhd, Gamuda Bhd, MN Holdings Bhd and Sunway Construction Group Bhd,” adds RHB Research.

Meanwhile, Kenanga Research applauds two important policy decisions by the government, namely, lifting the export ban on RE and the setting up of a central electricity exchange operated by a single-market aggregator.

This would enable the rapid scaling up of RE production in the country, in line with the government’s revised target for RE to be 70% of Malaysia’s total energy mix by 2050.

“The higher target is expected to create new economic opportunities in addition to attracting multinational companies, especially RE100 to operate in Malaysia.

“According to the World Economic Forum’s Energy Transition Index 2023, Malaysia is ranked as the best country in South-East Asia in terms of readiness to transition to RE.

“We are second among emerging countries and 35th globally,” says Kenanga Research.

In addition to analysts, a number of business leaders have voiced their support following the launch of the NETR.

One of them is Solarvest’s executive director and group chief executive officer Davis Chong Chun Shiong, who says that the NETR demonstrates a clear and promising direction for the country’s energy future.

“We are looking forward to the development of utility-scale ESS, which will accelerate RE transition with private sector investment and enhance the grid stability and reliability.

“The forthcoming Energy Efficiency and Conservation Act (EECA) is set to play a role in regulating energy-intensive users, buildings and products, further bolstering Malaysia’s journey towards a greener and more energy-efficient nation,” he says.

According to Chong, Solarvest is delighted with the Sarawak Hydrogen Hub initiative, as the company has already launched its test bed at the Centre for Technology Excellence Sarawak in the last few months.

Green hydrogen, produced through electrolysis using electricity from solar energy, offers a transformative opportunity as it offers a lower cost of production.

Green hydrogen plays a vital role in RE integration as excess solar energy can be harnessed for hydrogen production, enhancing the grid’s ability to integrate RE sources effectively.

“Hydrogen acts as a balancing mechanism, adding flexibility and stability to the overall energy system.

“This synergy between solar and hydrogen technologies holds great potential for Solarvest in advancing sustainable and efficient energy solutions,” he says.

Looking ahead, Chong says the green mobility ecosystem presents exciting opportunities, especially with the government’s plans to instal 10,000 electric charging stations along highways and at selected commercial buildings.

“At Solarvest, we are actively exploring vehicle-to-grid (V2G) technology, aiming to turn EVs into mobile batteries that efficiently charge and discharge electricity,” he adds.

According to Chong, Solarvest is excited about the decision to allow cross-border RE trade through the establishment of an electricity exchange system.

“We are looking forward to the government’s selection of private sector players to actively contribute to all the energy transition initiatives outlined in the NETR, along with the timeline for kick-starting and completing these projects for the successful realisation of Malaysia’s transition towards a low-carbon economy,” he adds.

Citaglobal’s Mohamad Norza also welcomes the government’s proactive measures under the NETR. He expressed his hopes that the government will provide the necessary incentives and policies to assist the private sector.

On its part, Citaglobal has been actively venturing into different areas of RE. For example, in June 2023, Citaglobal inked a memorandum of understanding (MoU) with PETRONAS Global Technical Solutions Sdn Bhd for the strategic collaboration in RE technologies such as battery energy storage system, waste to energy and CCUS, among others.

This week, the company signed an MoU with Abu Dhabi Future Energy Company PJSC, which may pave the way for the development of a two-GW solar farm in Pahang to meet local and export RE demands.

“We are also already in the midst of partnering with extremely reputable and established players to produce affordable renewables that can both reduce our emissions significantly, and diversify our energy supply.

“For RE technology to be a Malaysian mass public good, we welcome policies and processes in place to encourage participation and incentivise investments.

“Perhaps the streamlining of regulatory processes to avoid bottlenecks and red tape will be helpful to all players,” Mohamad Norza says.

At the launch of the NETR, Rafizi made a big promise to the industry players that the scale of reforms that will be put in place under the roadmap had only happened once or twice in Malaysia’s history.

Going forward, the market will keep a watchful eye on the government, monitoring whether the measures under the NETR are delivered as promised.

If that is accomplished, Malaysia may rise to be a global leader in energy transition, with local companies being key players in the global RE landscape.

Source: The Star