This site

is mobile

responsive

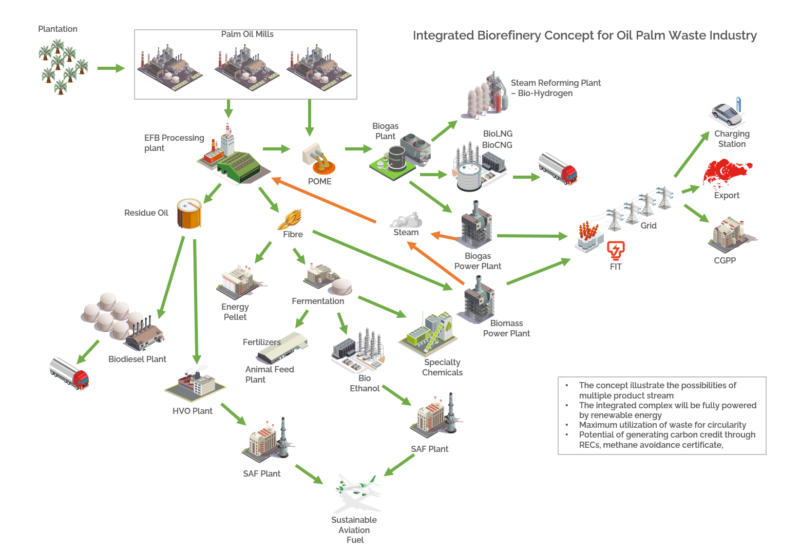

The shift from traditional refineries to advanced biorefineries marks a significant leap towards achieving a circular economy, minimising waste, optimising resource use and reducing reliance on fossil fuels. While the concept of biorefineries is not new, recent scientific advancements, technological breakthroughs, and a growing demand for sustainability have propelled advanced biorefineries into the spotlight.

Advances in biotechnology, chemical engineering, and process optimisation have led to the development of advanced biorefineries. These state-of-the-art facilities use a variety of cutting-edge techniques, including enzymatic hydrolysis, fermentation, pyrolysis, gasification, and supercritical fluid extraction, to convert biomass into a wide range of products, including biofuels, bioproducts, and bioenergy.

The integration of advanced sensors, automation, and artificial intelligence has further revolutionised the industry. Real-time monitoring and control systems ensure optimal efficiency, minimal energy consumption and enhanced overall performance. This seamless combination of biology, chemistry, engineering, and digitalisation has unlocked the true potential of biorefineries, propelling them to the forefront of sustainable manufacturing.

Investing in an advanced biorefinery requires a significant financial commitment. Therefore, it is important to establish diverse revenue streams to mitigate risk. A well-designed biorefinery should produce multiple products, maximising profitability and ensuring a sustainable business model.

Advanced biorefineries offer a number of environmental and economic benefits. By replacing fossil fuels with biofuels, they can significantly reduce greenhouse gas emissions and fight climate change. Additionally, the production of bioplastics and biomaterials can help to alleviate the burden of plastic waste, providing a sustainable alternative to petroleum-based materials.

Malaysia’s biomass potential offers a unique opportunity to advance bio-refinery technology. As the world’s second-largest palm oil producer, Malaysia boasts a substantial biomass resource base, primarily from the palm oil industry. Two significant sources include empty fruit bunches (EFB) and palm oil mill effluent (POME). Annually, Malaysia generates approximately 20 million tonnes of EFB and 63 million tonnes of POME, presenting significant prospects for waste valorisation and circular economy initiatives.

Investments from the private sector are essential to upgrading Malaysia’s value chains. The Government can play a role by providing incentives and support for businesses investing in sustainable production. However, the private sector must be the primary driver of this change.

Recent milestones, such as the National Energy Transition Roadmap (NETR) and the lifting of the ban on Renewable Energy (RE) exports, holds significant promise for the energy sector. This paves the way for biomass and biogas power plants, with market-driven pricing and energy exchange mechanism expected to accelerate innovation in energy transmission, grid expansion, and smart grid development.

Efficient logistics planning remains crucial in mitigating transportation costs associated with mobilising feedstock from mills and plantations to aggregation centres. The Government is actively formulating incentives and funding opportunities to encourage businesses to enter this high-impact industry.

Beyond EFB and POME, Malaysia possesses substantial palm oil biomass resources, including palm kernel shell (PKS), palm kernel cake (PKC), oil palm trunk (OPT), oil palm fronds, contributing significantly to the local economy, food security, and job creation.

Development Financial Institutions (DFIs) offer diverse funding preferences and risk levels for sustainable initiatives.

Additionally, the Budget Malaysia MADANI 2023 includes the RM3 billion GTFS 4.0, a popular financing scheme for green technology projects in Malaysia by MGTC.

Bank Negara Malaysia has also introduced the RM800 million High-Tech and Green Facility (HTG) and the RM1 billion Low Carbon Transition Facility (LCTF) to support green initiatives.

Alternatives financing avenues are presented by Bursa Malaysia, including the Voluntary Carbon Market (VCM) and Bursa Carbon Exchange (BCX). Joint venture entities like Bursa Malaysia RAM Capital Sdn. Bhd. also facilitate a new debt fundraising platform, providing flexibility in raising funds for listed and unlisted small to mid-sized companies.

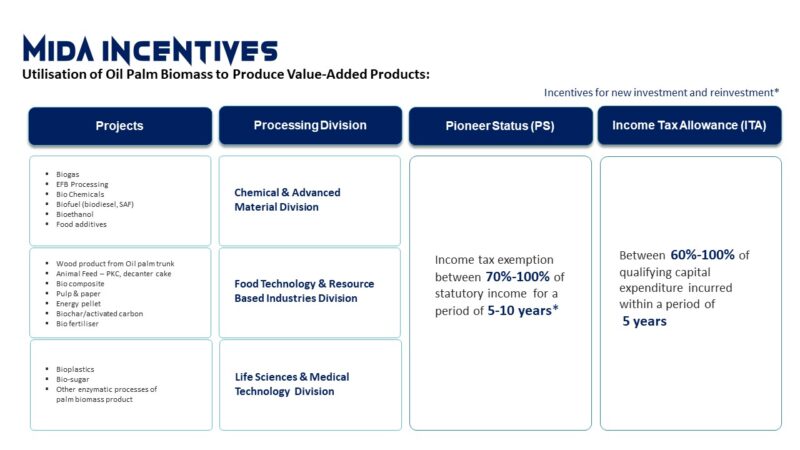

MIDA offers incentives for various biomass projects, providing further support for the industry.

In the forthcoming years, advanced biorefineries are poised to proliferate, becoming an integral part of our global supply chains. They are set to drive innovation, stimulate economic growth, and champion environmental stewardship. Nevertheless, it is vital for the company to closely monitor the carbon lifecycle analysis (LCA) and emissions throughout its supply chain, including Scope 1, Scope 2 and Scope 3 emissions. Addressing challenges such as feedstock availability, technology scalability, and market competitiveness is paramount to fully realise the potential of advanced biorefineries. By overcoming challenges and capitilising on the advantages of advanced biorefineries, we can usher in a new era of sustainable manufacturing.

For more information, please get in touch with the MIDA Chemical and Advanced Material Division at https://www.mida.gov.my/staffdirectory/chemical-and-advanced-material/