This site

is mobile

responsive

As the global economy grapples with a sharp slowdown, Malaysia emerges as a beacon of growth and investment. The country has approved RM83.7 billion in investments for the first quarter of 2024 (Q12024), marking a remarkable 13% increase from RM74.1 billion in the same period last year. These investments span across various economic sectors, encompassing 1,257 projects set to create 29,027 new job opportunities for Malaysians.

Foreign investments (FI) assume a pivotal role, contributing RM47.0 billion, which accounts for 56.2% of the total investments. Domestic investments (DI) are equally commendable at RM36.7 billion, making up the remaining 43.8%. Austria leads the pack of foreign investors with RM30.1 billion, followed by Singapore at RM5.6 billion, The Netherlands at RM3.6 billion, The People’s Republic of China at RM3.4 billion, and The United States of America at RM632.8 million.

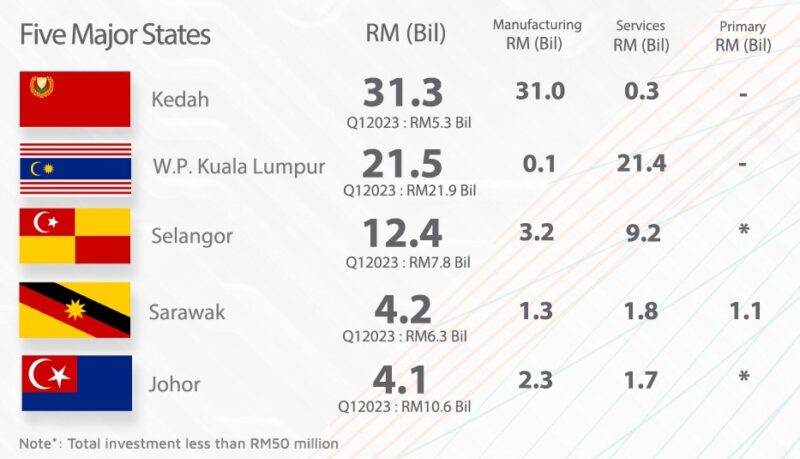

Kedah takes the lead with RM31.3 billion of approved investments, followed by W.P. Kuala Lumpur (RM21.5 billion), Selangor (RM12.4 billion), Sarawak (RM4.2 billion), and Johor (RM4.1 billion). These substantial investments underscore the diverse economic landscape and regional potential across Malaysia.

Malaysia’s manufacturing sector continues to thrive with RM43.0 billion in approved investments, a staggering 174.9% increase from Q12023. The sector boasts 252 projects, expected to generate 17,991 new jobs, with 80.8% for Malaysians. Of these, 50.6% are in management, professional, technical, supervisory, and skilled labour roles. Foreign investments dominate the sector with RM38.2 billion, while domestic investments contribute RM4.8 billion.

Key indices such as Capital Investment per Employee (CIPE) and the Managerial, Technical, and Supervisory (MTS) index have shown significant improvement. The CIPE stands at RM2.4 million, indicating higher economic complexity, and the MTS index has risen to 44.2%, reflecting the creation of higher-quality job opportunities.

The electrical and electronics (E&E) industry is a major driver, with RM34.3 billion in approved investments. Malaysia’s neutral stance amidst global geopolitical uncertainties has bolstered its position in the semiconductor industry, reinforced by the National Semiconductor Strategy (NSS) aiming to attract RM500 billion in investments.

Notable projects in the manufacturing sector include:

Malaysia’s services sector continues to demonstrate its resilience and attractiveness to investor recording RM39.3 billion in investments across 994 projects and set to create 10,988 employment opportunities. DI is notably high, accounting for RM30.6 billion (77.9%), while FI contributes RM8.7 billion (22.1%).

The substantial DI underscores the country’s stable economic environment and the Government’s strategic initiatives for digital transformation and infrastructure enhancement. With particular strength in the information and communications subsectors, especially data centres and cloud computing, Malaysia is integrating advanced AI technologies to drive sustainable and innovative growth.

Notable projects in the services sector include:

The primary sector secured RM1.4 billion in approved investments across 11 projects, mainly in mining. These approved investments are expected to create 48 new jobs and and are primarily driven by domestic sources, contributing RM1.3 billion, while foreign sources add RM161.1 million.

The primary sector, including agriculture and plantation, saw steady interest, focusing on resource extraction and primary processing activities.

Malaysia’s investment landscape remains robust, with MITI and MIDA steering numerous high-level overseas investment missions. As of May 31, 2024, MIDA is pursuing 1,775 proposed projects worth RM68 billion, with ongoing negotiations for high-potential leads totaling RM60.4 billion.

Effective June 1, 2024, InvestKL has been absorbed under MIDA, streamlining functions, reducing investors confusion and enhancing investment facilitation through cumulative expertise. This strategic move aligns with the MADANI Government’s commitment to optimising public resources and delivering superior services, solidifying Malaysia’s position as a premier global services hub.

With forward-thinking policies and bold initiatives, Malaysia stands as a premier destination for both global and local investors, driving prosperity and innovation for the nation and rakyat.