Investments in water need to keep pace with influx of data centres

15 Jul 2024

By Kamarul Azhar / The Edge Malaysia

I am going to be honest with you. Data centres are not environmentally sustainable,” admits an investor, who is setting up a data centre in Selangor. “And the only reason people come to Malaysia to invest is that Singapore doesn’t want data centres anymore.”

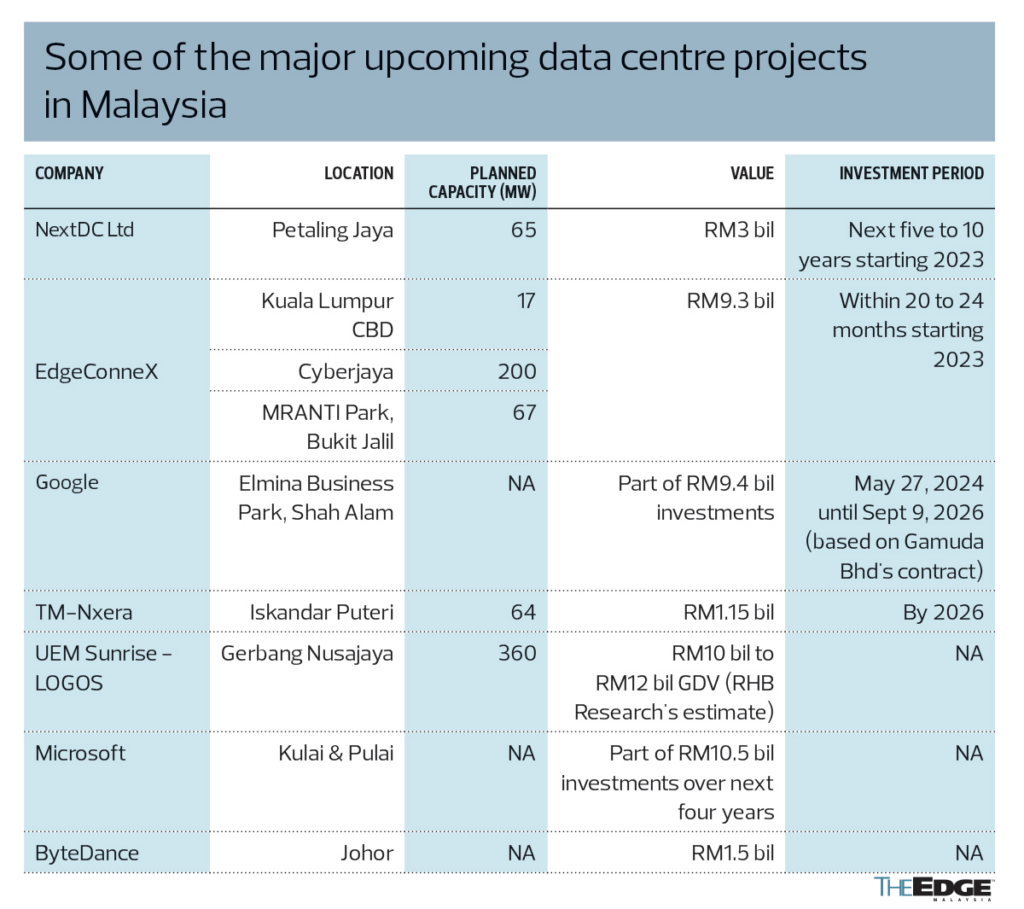

Malaysia has seen an influx of data centre investments over the last three years, coinciding with Singapore’s moratorium on the energy-guzzling boxes between 2019 and 2022. The moratorium was lifted last year.

Between 2021 and 2023, data centre investments approved by the Ministry of Investment, Trade and Industry (Miti) totalled RM114.7 billion, making up 79% of total approved digital investments during that period.

The influx is pushing Malaysia into becoming the region’s new data centre hub, catching up with Singapore.

One factor that could throw a spanner in the works, however, is water.

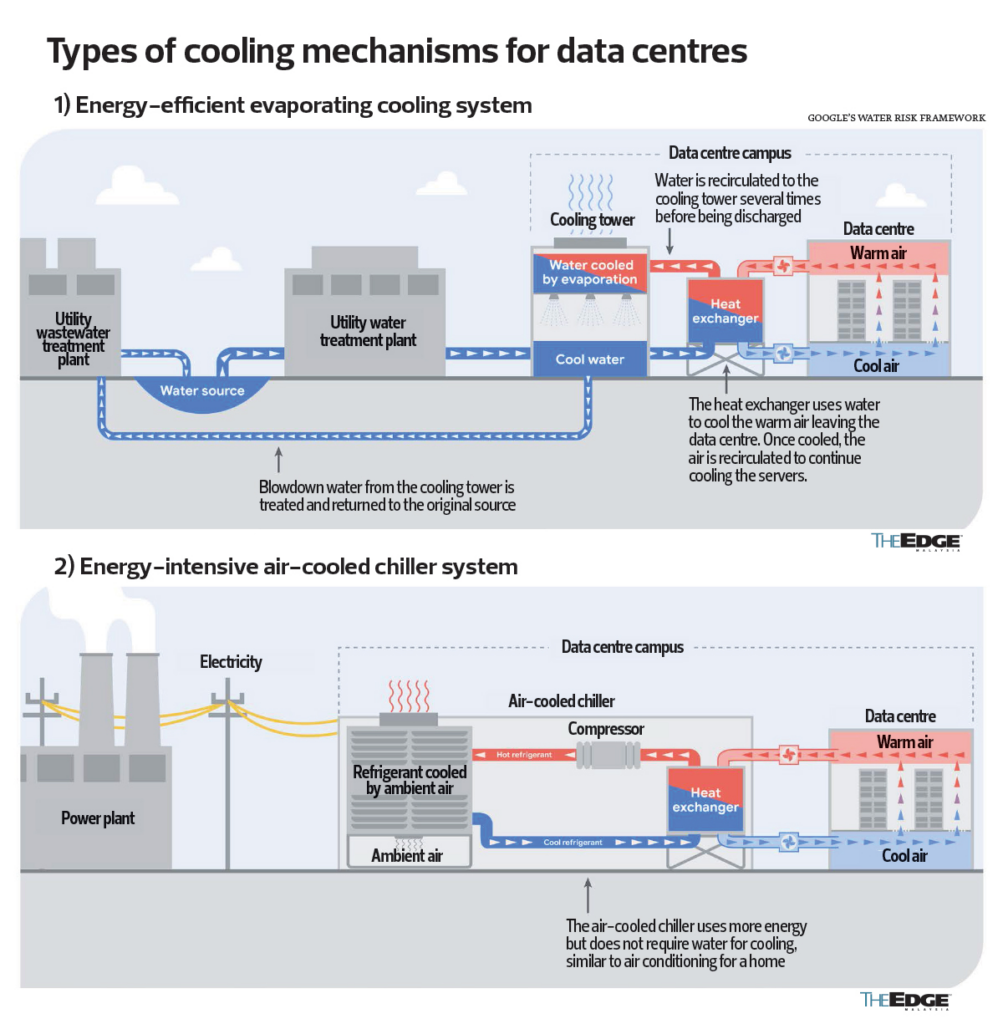

According to Google, in 2021, its average data centre consumed about 450,000 gallons of water per day, or around 1.7 million litres per day (MLD). The company says this is roughly the same amount of water used to irrigate 17 acres of turf lawn grass once, or to grow the cotton for the manufacture of 160 pairs of jeans.

Considering that the entire state of Johor — where billions of ringgit in data centre investments have been committed — used 1,407MLD of water in 2022, 1.7MLD is not much. Still, 1.7MLD is only the average water usage for one data centre.

Over the last two years, Johor has attracted 50 data centre investments, according to its Menteri Besar Datuk Onn Hafiz Ghazi. The Global Data Centre Index 2024 report by DC Byte says Johor is the fastest-growing market in Southeast Asia, with more than 1.6gw of total supply.

For a typical 100mw data centre, water usage is around 1.1 million gallons per day, or 4.2MLD. Each data centre uses a different level of water, however, and has a different level of efficiency.

“When it comes to water usage, it is about using precision cooling,” says the data centre player whom The Edge spoke to. “But even with precision cooling, on average you can make your data centre [only] 30% green.”

Precision cooling uses cooling mediums that are more complex and that require greater attention to maintenance than comfort cooling in order for the data centre to deliver peak performance. These cooling methods include air, chilled water and refrigerants.

Essentially, data centres require a lot of water to cool their servers — and this is posing a problem for Johor, which has seen an influx of data centre investments in recent years.

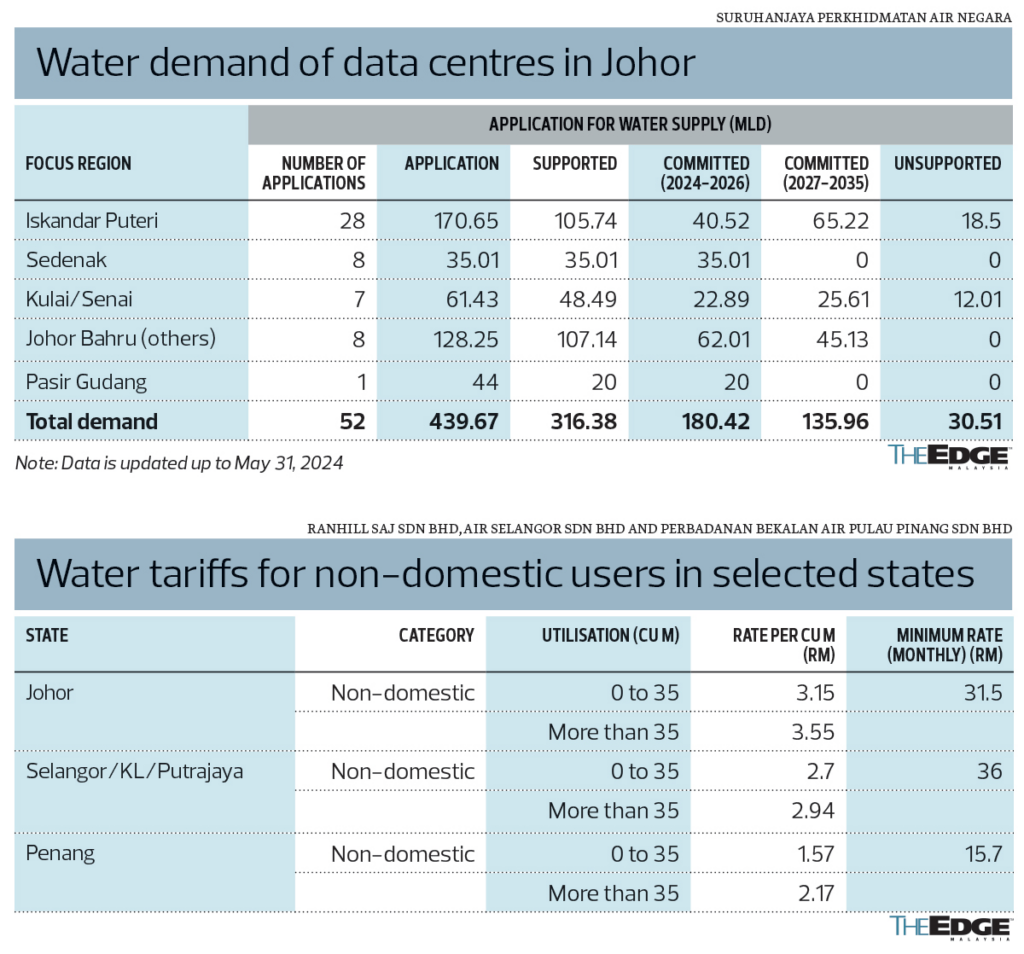

According to Charles Santiago, chairman of industry regulator Suruhanjaya Perkhidmatan Air Negara (SPAN), normal annual demand growth for water in Johor is 2.5%, or about 50MLD. With the influx of data centres, however, the requests so far have been for an additional average of 26MLD each year until 2036.

“That’s an additional 1.3% per year above the normal organic growth,” Santiago says.

While Johor has no major water supply issues like Kedah and Kelantan, investments in water infrastructure will have to keep up with demand, especially now that the state is receiving huge investments in data centres and other industries.

According to SPAN’s Water and Sewerage Fact Book 2022, Johor’s reserve margin stood at 11.5% in 2022. Non-revenue water (NRW) — water produced by water treatment plants (WTPs) but not billed to customers, as it is lost during transfer and distribution — stood at 26.3%.

Ranhill SAJ Sdn Bhd (RSAJ), the state’s water operator, aims to increase its reserve margin to 25% in 2029. To achieve this, all the water supply infrastructure development projects in the state must be completed by RSAJ as planned.

It is not known how RSAJ intends to raise the water reserve margin to 25% in just five years. According to Santiago, Johor’s current reserve margin is already at 16.9%, an impressive jump of 5.4 percentage points in just three years.

“Development of infrastructure in Johor is carried out according to plan for the period of 2024 to 2030 to meet supply and demand. Feedback by RSAJ on the water supply situation is still manageable,” he says.

The question of whether there is enough water in Johor to cater for the demand by data centres, as well as the organic demand growth in the state, is being asked by not just the public and industry players, but by state officials as well.

On May 30, Johor Bahru City Council mayor Datuk Mohd Noorazam Osman said the supply of water and power continues to be a major challenge in Johor despite the boom in data centre investments. He said there should be greater collaboration between the government and private sector, including in the building of desalination plants to ensure adequate water supply and partnering with developers to build industrial parks equipped with enough power and water infrastructure for high-tech industries.

“People are too hyped up about data centres nowadays, but the issue in Johor is water and power. Areas with potential for power supply are Pasir Gudang and Kulai,” Mohd Noorazam said during a panel discussion at The Johor Conversations 2024 event in May.

“As a local authority, I believe that while promoting investments is important, it should not come at the expense of the local and domestic needs of the people.”

In June, the state’s Investment, Trade, Consumer Affairs and Human Resources Committee chairman Lee Ting Han said although the water supply in the state was currently sufficient, early preparations should be made for the long term. These include building new water treatment plants and installing new piping to connect water sources to new areas, as well as exploring new water sources through Johor Special Water, a body owned by Permodalan Darul Takzim.

Data from RSAJ shows that it has received applications for 439.67MLD of water between 2024 and 2035 from data centres. Of this amount, 316.38MLD have been supported, while the remaining 30.51MLD have yet to be supported by the water operator.

“Investors need to refer to RSAJ, which has also been appointed as a SPAN Water Supply Certifying Agency (CA). [A CA’s responsibility] is to check the adequacy of the water supply,” Santiago says.

Meanwhile, Pengurusan Air Selangor Sdn Bhd, the sole water operator in Selangor, Kuala Lumpur and Putrajaya, is aware of the increase in demand for water from data centres, and is planning accordingly to ensure that the water supply infrastructure can support the needs of these facilities without compromising on the overall water supply to consumers or other sectors.

Selangor’s 15.34% water reserve margin could be good enough to support the additional demand coming from the data centres, on top of the organic growth in the state as well as in Kuala Lumpur and Putrajaya.

In addition, Air Selangor is already working on major water resources and treatment projects. It is currently embarking on the second phase of the Langat 2 scheme, as well as the Rasau water supply scheme, in efforts to boost its water reserve margins to 17.7% by 2030.

As for Johor, the government intends to upgrade the functions of the Sembrong dam in Kluang. RSAJ recently awarded Ranhill Utilities Bhd (KL:RANHILL) a RM283.8 million contract to reduce the NRW levels in the state, between January 2024 and December 2026.

RSAJ is a joint venture between Ranhill and Syarikat Air Johor Sdn Bhd, a state-owned company that manages Johor’s water resources. Ranhill, which has 80% interest in RSAJ, is 53.19%-owned by YTL Power International Bhd (KL:YTLP).

YTL Power emerged as the new controlling shareholder of Ranhill after its 70%-owned subsidiary SIPP Power Sdn Bhd acquired the shares held by Tan Sri Hamdan Mohamad for RM405.2 million on May 28. Prior to that, YTL Power was Ranhill’s major shareholder, with a 21.77% stake.

The change in controlling shareholder at Ranhill could mark a new phase for the group. YTL Power is also a big player in data centres, having kicked off the trend in Johor in 2021 with a deal for a 500mw data centre with Sea Ltd.

Regulators playing catch-up with data centre boom

“Currently, there are no specific regulations on data centres in Malaysia, in terms of water and energy usage. However, we the players are taking things into our own hands, as customers are demanding that data centres be green,” says the data centre player whom The Edge spoke to.

An online search shows that the Malaysian Communications and Multimedia Commission is drafting a technical code for the specifications for green data centres. The technical code provides the minimum requirements for green data centres. These include areas such as environmental conditions, energy management, air management, cooling management, IT equipment and lighting, power chain management, space management, information management, governance and guidelines.

At the same time, Johor executive council member Lee said in June that the state government, in collaboration with the Department of Town and Country Planning (PLANMalaysia@Johor) was drawing up the Johor State Data Centre Development Planning Guidelines to coordinate and monitor data centre development planning.

The Johor State Data Centre Development Coordination Committee (JPPDNJ) has been set up, comprising state and federal agencies including the Johor Economic Planning Division, Invest Johor, Malaysia Investment Development Authority (Mida), Malaysia Digital Economy Corp, Iskandar Regional Development Authority, Tenaga Nasional Bhd (KL:TENAGA), RSAJ, the Land and Mines Office, Environment Department and PLANMalaysia.

Lee said the committee had decided that data centres in Johor should focus on the use of renewable technology in addition to saving electricity and water. He added that JPPDNJ would also take into account the efficient use of electricity and water, with reference to industry best practices and other countries’ experiences.

While Malaysian regulators are playing catch-up with the industry’s boom, industry players are already working to ensure that the data centres can attract business from demanding digital companies that require them to be green.

“There’s no way that customers are going to give the business if they don’t pass the audit,” says another data centre industry player.

“Data centres are not regulated; it is a private business. I don’t deal with the government. The government is just my customer. There is no benchmark in the world to regulate data centres. If you don’t sell cars in Europe, you don’t have to comply with their emission standards.”

Source: The Edge Malaysia