Manufacturing opportunities for Malaysia

25 Jul 2024

The world is highly connected and the supply of goods criss-crosses the globe via logistical planning like clockwork. But world events have thrown a spanner in the works, causing supply-chain disruptions that have a great impact on economies. With China — a key manufacturer — mired in the ongoing China-US trade war, it has been challenging for companies to export their goods.

In JLL’s “Beyond China: Asia’s next manufacturing powerhouse” report released in May, the global real estate services firm reveals that India and Southeast Asia (SEA) nations — namely, Indonesia, Malaysia, the Philippines, Singapore, Thailand and Vietnam — that can mitigate and benefit from this situation.

“Over the past few years, companies have begun exploring the relocation of manufacturing outside of China. In Asia-Pacific, this near/re/friend-shoring trend has resulted in the China+1 strategy where companies add additional manufacturing bases outside of China to hedge against supply chain disruption by reducing reliance on a single country,” JLL says in a press statement on the report.

Nearshoring is the practice of transferring a business operation to a nearby country, especially in preference to a more distant one. Reshoring, on the other hand, is the practice of transferring a business operation that was moved overseas back to the country from which it was originally relocated. Friendshoring refers to the practice of locating parts of a company’s supply chain or manufacturing process to countries that are political or economic allies of the country where the company is based.

“Diversification within supply chains is a natural step for companies involved in manufacturing within the wider economic lifecycle of this region. We see Southeast Asia and India representing a natural complement to the existing production strength of China but feel that for companies to respond quickly to supply chain shifts, they need to adopt a flexible mindset towards land selection and funding options,” says JLL Asia-Pacific head of manufacturing strategy Michael Ignatiadis.

However, the report cautions companies from leaping on the bandwagon as they need to be able to adapt quickly given the ongoing volatile landscape.

“Land selection and the capital used will be key in determining success factors for companies. Alternative funding and new leasing options are becoming more readily available. These are enabling manufacturers to set up quickly and to pivot as needed if and when global trade and supply chains shift again,” the report says.

JLL notes that the nations in the report have strong fundamentals, which is why they are considered by companies to set up their manufacturing operations. “These fundamentals include a large population and labour pool, favourable costs and various incentives. From a manufacturing investment perspective, these factors position SEA and India as major manufacturing hubs for global markets.”

Another reason companies are looking elsewhere is also due to rising costs in China compared with SEA and India. Apart from the financial aspect, the report highlights, “Factors such as skilled labour, infrastructure, environmental regulations, proximity to suppliers and customers, and political stability contribute significantly to a factory’s long-term success and sustainability.”

Careful consideration of both financial and non-financial factors, as well as a country’s inherent benefits, is necessary to make an informed decision, JLL says.

Opportunities for Malaysia

The report points out opportunities for Malaysia and also the areas and the policies that are encouraging growth in the manufacturing sector. The industries where opportunities lie are rubber, machinery and equipment (M&E), food, chemical, transport, and electronics and electrical (E&E).

In the press statement, JLL Malaysia head of research and consultancy Yulia Nikulicheva says, “Malaysia’s manufacturing sector has attracted a significant amount of foreign direct investment in recent years, particularly in the E&E segment. The country is home to six of the top 12 semiconductor manufacturers, contributing to 7% of Malaysia’s GDP (gross domestic product). Additionally, Malaysia ranks seventh globally in E&E exports. Other sectors such as pharmaceuticals, chemicals, and machinery and equipment are also experiencing increased investment volume.”

For the rubber industry, the report says, “Malaysia plays an important role in the rubber industry in SEA. It is also the sixth-leading producer of natural rubber in APAC (Asia-Pacific)”.

The key products include gloves, tyres, thread, automotive components and seals and O-rings.

The M&E industry has huge potential. From January to July 2022, Malaysia saw an increase of 25.5% in M&E exports totalling US$8.34 billion year on year, JLL reports. The key products here are industrial machinery, electrical equipment, and construction and mining machinery.

For the food industry, JLL says, “Malaysia wants to be one of the largest global suppliers of halal products. The Global Islamic Economy Indicator forecasts that the global halal market will expand from US$2.09 trillion in 2021 to almost US$3.27 trillion by 2028.” Food products include processed and canned foods, dairy products, beverages and snack foods.

The chemical industry contributes 6% to Malaysia’s GDP, according to JLL, and employs 292,969 workers, making up 12.5% of the total manufacturing employees. Products include petrochemicals, oleochemicals, plastics and polymers, and agrochemicals.

As for the transport industry, JLL highlights, “Malaysia has attracted many global automotive manufacturers to operate their flagship facilities in the country, including the first Porsche assembly plant outside of Germany, several regional distribution centres such as Volkswagen, Mercedes-Benz, BMW and Volvo’s regional EV (electric vehicle) hub. Other manufacturers like Proton, Perodua and Honda have also established manufacturing facilities in Malaysia, which is poised to become a regional hub for the EV industry.”

Products include automobiles, motorcycles, commercial vehicles, and EVs and components.

Lastly, for the E&E industry, JLL says, “Now one of the largest export-oriented industries in the country. It contributes 38% to Malaysia’s total exports and 78% to the net trade surplus.”

The key products include consumer electronics, electrical appliances, electronic components and semiconductors.

Key industrial areas; supportive policies

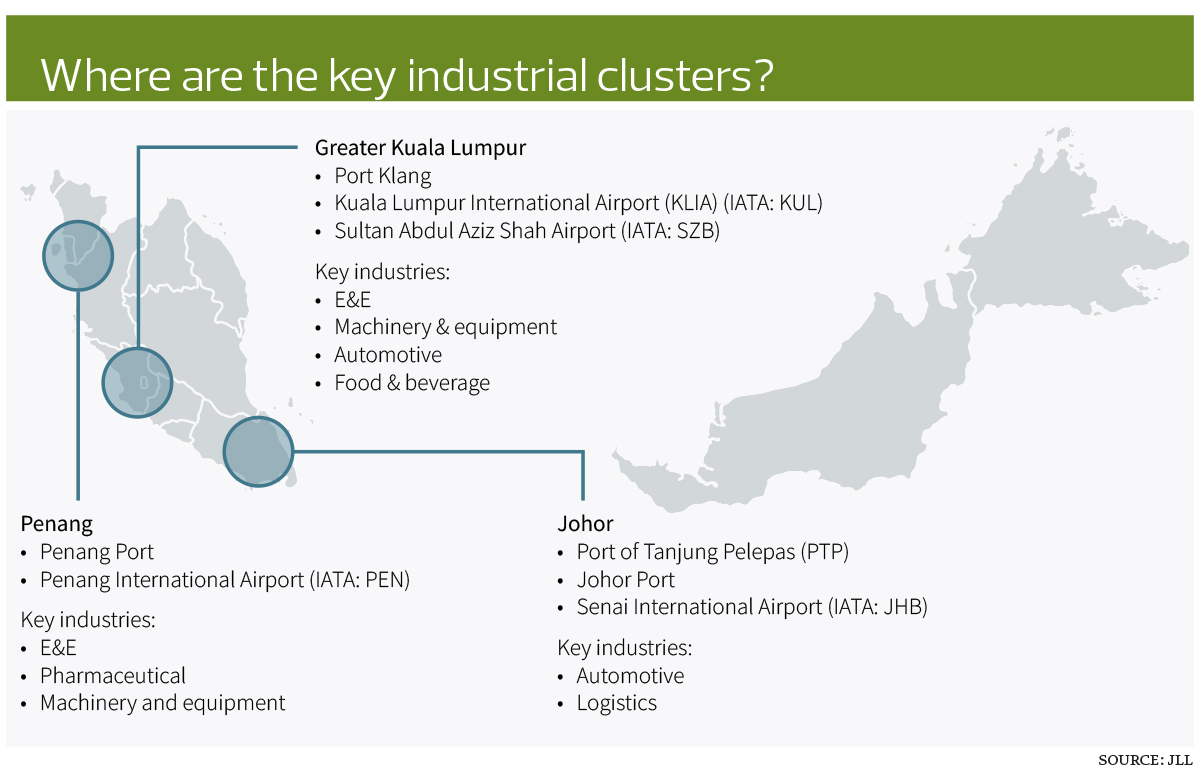

JLL highlights several key industrial clusters, mainly in Peninsular Malaysia, namely in Penang, Greater Kuala Lumpur and Johor.

In Penang, the key industries there include E&E, pharmaceutical, and machinery and equipment. The Penang Port and Penang International Airport are the two export/import hubs.

For Greater Kuala Lumpur, E&E, machinery and equipment, automotive, and food and beverage are key industries. Port Klang, Kuala Lumpur International Airport and Sultan Abdul Aziz Shah Airport are key transport hubs, JLL highlights.

Lastly, in Johor, key industries include automotive and logistics, with Port of Tanjung Pelepas, Johor Port and Senai International Airport being key hubs.

Policies that are supporting and providing direction within the industrial sector include the New Industrial Master Plan 2030 (NIMP 2030), the 12th Malaysia Plan and the National Fourth Industrial Revolution (4IR) Policy.

NIMP 2030 is a master plan that lays out the course for Malaysia from 2023 to 2030 to keep the country’s manufacturing industry and related services competitive globally.

“The NIMP 2030 aims to capitalise on rising global trends, supply chain disruptions, the present geopolitical scenario, digitalisation, and environment, social and governance (ESG) considerations,” JLL says.

At the same time, the 12th Malaysia Plan from 2021 to 2025 outlines the country’s commitment to achieve net zero greenhouse gas emissions by 2050. According to JLL, Malaysia holds the top ranking in SEA in the Energy Transition Index (World Economic Forum).

Lastly, 4IR looks to “increase manufacturing productivity; elevate the contribution of the manufacturing sector to the economy; strengthen innovation capacity and capability; and increase the number of high-skilled workers”.

These policies and initiatives provide a framework to work towards, and Malaysia looks to be in a good position to capitalise on the industrial needs of global players.

Source: The Edge Malaysia