This site

is mobile

responsive

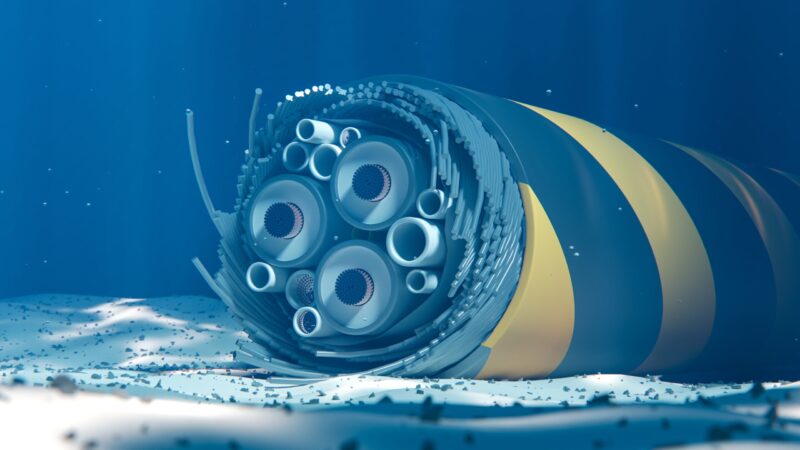

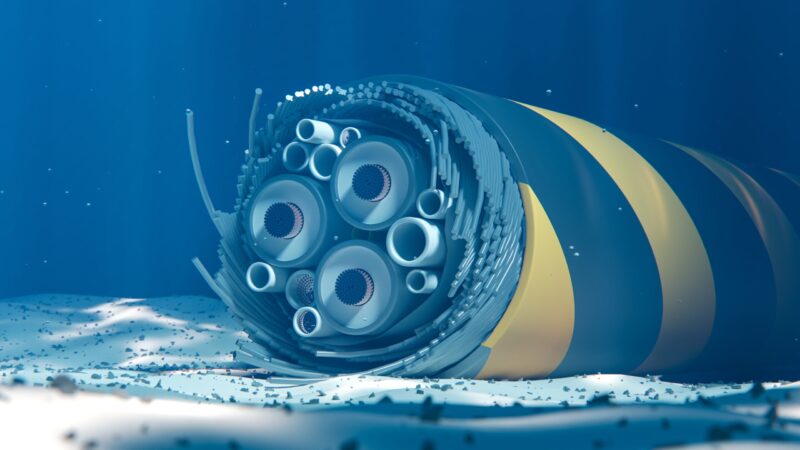

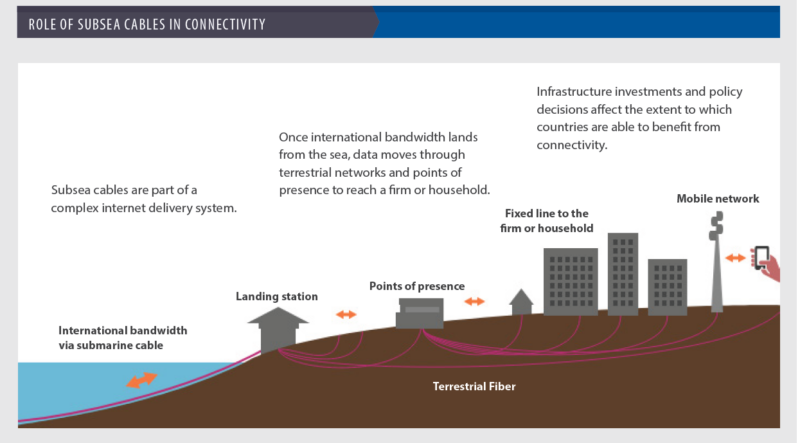

In today’s digitally driven world, the demand for high-speed, reliable data transmission has reached unprecedented levels. Submarine cables, often overlooked, are the backbone of global connectivity and the internet’s infrastructure. These undersea marvels are vital for supporting data centres that underpin modern digital services. Remarkably, almost 97% of international data is transmitted through submarine communication cables laid on the ocean floor, enabling faster and large-scale data sharing across the globe1.

The telecommunications industry landscape is evolving, with Over-The-Top (OTT) providers like Google, Meta, Microsoft and Amazon leading the charge. These tech giants, recognising the increasing demand for bandwidth to support their platforms, have shifted from merely purchasing capacity to actually owning submarine cables. As of February 2024, Google and Meta had invested in 29 and 15 submarine cable systems, respectively. This move highlights new opportunities for growth in the submarine cable market as these companies work to meet the ever-growing demands of a connected world.

Malaysia is at the forefront of enhancing internet connectivity, with 29 submarine cable networks, including those under construction, and six (6) cable landing stations significantly improving the nation’s digital infrastructure. This robust network is critical for the development of cutting-edge digital services like cloud computing, big data analytics, and the Internet-of-Things (IoT). Increasing the number of submarine cable landings will reduce latency, improve bandwidth, and enhance the overall quality of internet service in the country.

Regular maintenance is crucial for ensuring the reliability and efficiency of submarine cables. Historically, cabotage policy, which reserves maritime and shipping activities for its citizens,2 created complexities for foreign vessels performing specialised tasks such as the installation, maintenance, and repair of submarine cables.

However, starting on 1 June 2024, Malaysia’s Ministry of Transport (MOT) announced an exemption from the cabotage policy for foreign vessels engaged in these activities. This exemption allows foreign ships to obtain a Domestic Shipping License (DSL) within three (3) working days, down from the previous ten (10) working days3, thereby reducing bureaucratic delays, improving investor sentiment, and boosting network infrastructure investment in Malaysia.

Source: O’connor, A., Anderson, B., Brower, A., & Lawrence, S. (2020). Economic Impacts of Submarine Fiber Optic Cables and Broadband Connectivity in Malaysia. https://www.rti.org/publication/economic-impacts-submarine-fiber-optic-cables-and-broadband-connectivity-malaysia/fulltext.pdf

Aligned with the MyDIGITAL Blueprint, Malaysia aims to have the highest number of submarine cables landing in Southeast Asia by 2025. Reinstating the cabotage exemption is a step towards achieving Malaysia’s digital economy aspirations. By providing the necessary connectivity infrastructure, these cables help foster economic development and integration in Malaysia.

Improved connectivity is projected to significantly impact Malaysia’s economic growth with a 6.9% increase in GDP per capita due to submarine cable connectivity improvements. The new exemptions are expected to further boost economic growth4. The global submarine cable systems market is forecasted to grow at a Compound Annual Growth Rate (CAGR) of 9.2% from 2019 to 2027, reaching USD30.4 billion by 20275.

This efficiency is vital to making Malaysia an attractive destination for tech companies, fostering a more robust digital economy, and boosting Malaysia’s workforce capabilities in high-tech and specialised maritime services by transferring technical knowledge to local professionals. Data indicates a likely 3.6% increase in service sector job opportunities following subsea cable installations, a trend that is expected to accelerate with the new exemptions6.

From 2021 to March 2024, Malaysia approved nearly RM162 billion in digital investments, with data centres and cloud computing accounting for a substantial 76% or RM123.5 billion7. This includes notable projects by companies such as Microsoft, Amazon, GDS and YTL, which have generated over 3,693 new direct job opportunities.

The adoption of cloud and AI-based services has significantly increased the demand for submarine cable systems. As businesses rely heavily on cloud computing for data storage and processing and AI services for tasks like machine learning and analytics, the need for robust and secure connections between data centres and users has grown.

The Digital Ecosystem Acceleration (DESAC) scheme, launched under Budget 2022, aims to fortify Malaysia’s digital infrastructure and attract high-quality investments by offering tax incentives to companies investing in digital projects. This tax incentive is pivotal in nurturing high-income job opportunities and strengthening the local digital economy value chain. Through DESAC, Malaysia strives to position itself as a leading player in the regional digital economy, fostering a conducive environment for digital transformation and attracting more foreign investments in digital sectors, including submarine cable projects.

As the principal investment promotion agency of the country, MIDA assumes an integral role in promoting essential investments crucial for the nation’s economic progress. Facilitating exemptions from the cabotage policy for submarine cables aligns with the MADANI Government’s commitment to accelerating digital transformation across all sectors and advancing toward a high-income economy. These concerted efforts underscore Malaysia’s dedication to driving innovation, fostering economic growth, and positioning itself as a digital hub in the region.

For more information, contact the Business Services and Regional Operations Division at https://www.mida.gov.my/staffdirectory/business-services-and-regional-operations-division/.

1 Economic Impact of Submarine Cable Disruptions APEC Policy Support Unit. (2012). https://www.apec.org/docs/default-source/Publications/2013/2/Economic-Impact-of-Submarine-Cable-Disruptions/2013_psu_-Submarine-Cables.pdf

2 Seafarers; Rights International. (2018). Cabotage Laws of the World. Seafarers; Rights

International. Retrieved from http://ftp.elabor8.co.uk/sri/cabotage/flipbook/mobile/index.html

3 Ministry of Transport. (2024). eDSL. Ministry of Transport. https://edsl.mot.gov.my/edsl/public/user-guide

4 The Insight Partners. (2020). Subsea Cable Market Size Report, Share and Trends 2030. The Insight Partners. https://www.theinsightpartners.com/reports/subsea-cable-market

5 The Insight Partners. (2020). Subsea Cable Market Size Report, Share and Trends 2030. The Insight Partners. https://www.theinsightpartners.com/reports/subsea-cable-market

6 O’connor, A., Anderson, B., Brower, A., & Lawrence, S. (2020). Economic Impacts of Submarine Fiber Optic Cables and Broadband Connectivity in Malaysia. https://www.rti.org/publication/economic-impacts-submarine-fiber-optic-cables-and-broadband-connectivity-malaysia/fulltext.pdf

7 The Edge. (2024, July 18). Data centres account for 76% of Malaysia’s RM162b digital investments between 2021 and 1Q2024. The Edge Malaysia. https://theedgemalaysia.com/node/719499