This site

is mobile

responsive

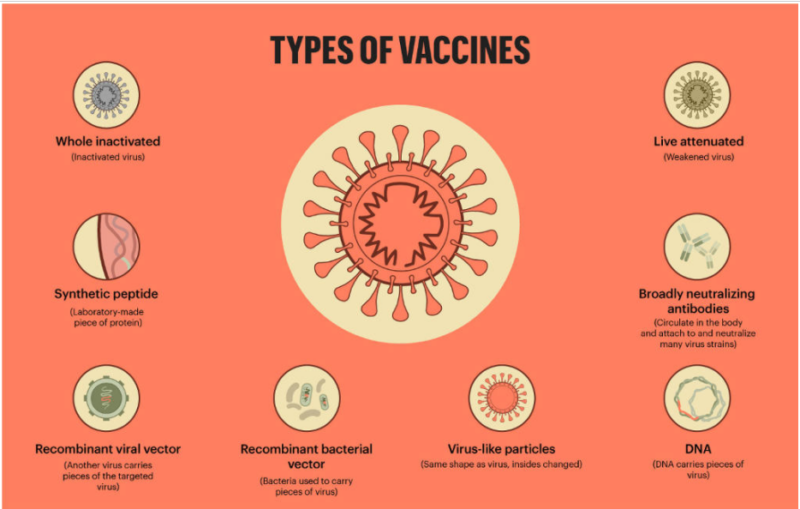

There is a general consensus that the safeguarding of livelihoods is tied to controlling the spread of a pandemic, that is until effective vaccines are produced. Vaccines are complex biological products used to prevent rather than treat diseases. Traditionally, vaccines are made of dead or weakened virus molecules, known as antigens that trigger defensive white blood cells in the immune system to create antibodies. These antibodies then bind to the virus and neutralise it.

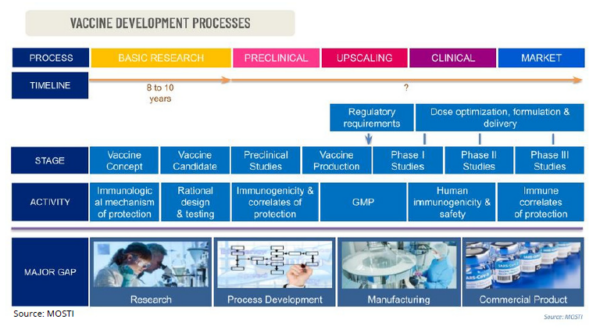

Every vaccine production has its own unique challenges but it typically follows a similar series of process, from initial academic research to manufacturing and distribution to hospitals and doctor’s offices. It would certainly require clinical trials as well as approvals from a national or regional regulatory agency before they are allowed for public distribution.

When a large portion of the population has been vaccinated and is immune to a particular disease, even those susceptible are considered protected because the likelihood of an outbreak is reduced. This is known as a herd immunity. Chickenpox, measles, mumps, and polio are examples of diseases that have achieved herd immunity due to vaccines.

For COVID-19, scientists are divided about how much of a population must receive vaccinations to prevent new outbreaks, with estimates ranging from less than half to over 80 percent. Some experts believe that herd immunity for this coronavirus is unreachable, in part due to variable vaccination rates. Nonetheless, given the urgent need to return to normalcy, world economies are in a race to produce COVID- 19 vaccines.

Most COVID-19 vaccines approved for at least a limited use have been developed by firms and research groups in China, Russia, and the US. Among the first vaccines approved were the Messenger RNA (mRNA)-based vaccines by Pfizer-BioNTech and Moderna. Meanwhile, China has approved six of its candidates – most of which are being used by other countries. In contrast, Russia has approved three vaccines, of which one of these (Sputnik V) is being distributed globally, including in Austria, Hungry, Slovakia, and South Korea. Certain vaccines, such as those produced by the UK’s University of Oxford and British- Swedish company AstraZeneca, are cheaper and easier to store and transport than other vaccines.

In the ASEAN region, many biopharmaceutical companies are acknowledging the growing opportunities in the vaccine production value chain. Currently, there are five vaccine-producing countries namely Indonesia, Thailand, Singapore, Vietnam and Myanmar. In Indonesia, Bio Farma has been working with Sinovac, as China has pledged to work with Indonesia early this year to produce COVID-19 vaccines. In Thailand, AstraZeneca is partnering with local Thai biopharmaceutical manufacturer, Siam Bioscience to roll out locally produced COVID-19 vaccine. In Singapore, BioNTech is planning to set up a regional centre and factory for its vaccines there.

In Malaysia, nine companies have been approved for a Manufacturing Licence and/or incentives to produce vaccines. Malaysian Vaccines and Pharmaceuticals (MVP) is actively producing vaccines, specifically for animals, while Pharmaniaga LifeScience and Solution Biologics are conducting the fill-and-finish of Sinovac and CanSino Bio’s COVID-19 vaccines respectively. Hence, there is still much room for vaccine manufacturing companies to fill up in various areas of the vaccine supply chain, particularly in local vaccine production and R&D.

Opportunities in Malaysia

With billions of vaccines required around the world, Malaysia is seeking to contribute to the vaccine production effort. The country’s competitive advantages in its well-established manufacturing sector provide valuable opportunities for investors. Interested stakeholders are encouraged to consider the following opportunities in Malaysia’s pharmaceutical industry.

1.Business-friendly policies

With the recent news and advancements, the Government has announced the following enhanced incentives under

Budget 2021 to attract further investment in the manufacturing of pharmaceutical products in Malaysia:

Additionally, as part of the National Economic Recovery Plan (PENJANA) initiative, Malaysia is offering a special Relocation Incentive until December 2022 for new investments in the manufacturing sector, including the pharmaceutical industry that provides:

These incentives go alongside the currently existing ones offered by MIDA, such as grants for R&D, training expenses, machinery modernisation and automation.

2.Improving local manufacturing standards to guarantee efficacy, quality and safety

Pharmaceutical manufacturers in Malaysia are closely monitored and regulated by the National Pharmaceutical Regulatory Agency (NPRA), which is the executive arm of the Drug Control Authority (DCA), a regulatory body created under the Ministry of Health (MOH). Manufacturing companies are set to a high standard in compliance with the Good Manufacturing Practice (GMP)and Good Clinical Practice (GCP) certifications.

The Government seeks to establish self-sufficiency through local vaccine production following its experiences in procuring vaccines during the COVID-19 pandemic.

Acknowledging the lack of vaccine production for human, the Government has mandated the commissioning of the National Vaccine Development Roadmap (NVDR) with the target of making Malaysia a human vaccine producer within the next 10 years, equipped with a complete ecosystem made ready for the research and development (R&D) and local manufacturing of vaccines.

3.R&D Capabilities

There is significant interest in the Malaysian pharmaceutical research community regarding the prospects of developing knowledge and capabilities in vaccine development, especially for the latest ‘revolutionary’ mRNA technology employed.

It has also been reported that the Institute of Medical Research (IMR) of the National Institutes of Health (NIH), MOH is currently developing Inactivated Virus and mRNAbased COVID-19 vaccines, representing the tip of local vaccine research capabilities. The Government has also signed a Bilateral Investors Agreement with the Coalition for Epidemic Preparedness Innovation (CEPI) to enable Malaysia to gain access to vaccine R&D, technology transfer and new expertise for local researchers.

Malaysia is also the first country outside of China to conduct clinical trials for an inactivated COVID-19 vaccine made by the Institute of Medical Biology Chinese Academy of Medical Sciences, China (IMBCAMS) involving 3,000 volunteers.

4.Growing Demand for Halal Pharmaceuticals

The production of halal medicine improves access to other global Islamic markets. Malaysia is a forerunner in the global halal drug market. As a leader in the halal pharmaceutical sector, Malaysia is leveraging on existing advantages.

The Government has recently revised its standards on halal pharmaceuticals and has also began issuing Halal Standards for medical devices.

The success story of Malaysia as the pioneer in the Halal industry began in 1974 when the Research Centre for the Islamic Affairs Division in the Prime Minister’s Office started to issue halal certification letters for products that met the halal criteria at that time.

Today, Malaysia has over 150 companies that have obtained a halal certification from the Department of Islamic Development Malaysia (JAKIM) for various pharmaceutical products such as over-thecounter drugs (OTC), health and food supplements, and traditional medicines segments.

For more information on the incentives provided for vaccine manufacturers, please visit MIDA’s website at

www.mida.gov.my.