This site

is mobile

responsive

Machinery &

Equipment

The high-technology machinery and equipment (M&E) sector in Malaysia significantly bolsters various manufacturing industries, including electronics, automotive, aerospace, medical, oil and gas (O&G), and food production. As these industries expand due to consistent foreign direct investments (FDI) and domestic direct investments (DDI), the M&E industry follows suit.

Malaysia boasts one of ASEAN’s largest and strongest M&E sectors, providing tailored products, end-to-end manufacturing, and comprehensive solutions to domestic and international manufacturers. Over 85% of M&E companies are SMEs, employing a highly skilled workforce. The sector primarily exports products to ASEAN countries, the USA, and China.

Globally, the M&E industry is projected to be worth RM19.8 trillion by 2023, with a predicted annual growth rate of 6.4% from 2023 to 2027. In Malaysia, the industry is expected to outpace global growth, targeting a 10.1% annual increase during the same period. Investors are encouraged to explore opportunities in semiconductor manufacturing M&E and electric vehicle (EV) battery production M&E. Malaysia excels in producing specialised back-end semiconductor manufacturing M&E, while potential exists for producing front-end semiconductor manufacturing M&E and catering to the growing EV battery market.

The booming EV battery market anticipates a remarkable surge, with battery cell demand projected to reach 3,900 gigawatt-hours by 2030. In response, numerous giga factories are planned for construction worldwide. To comply with Environmental, Social, and Governance (ESG) requirements, M&E players can contribute by producing ESG-compliant products and solutions. Malaysian M&E companies like Vitrox Corporation Berhad, Greatech Technology Berhad, Favelle Favco Berhad, and UWC Berhad have embraced the ESG agenda, anticipating brand growth and better market access.

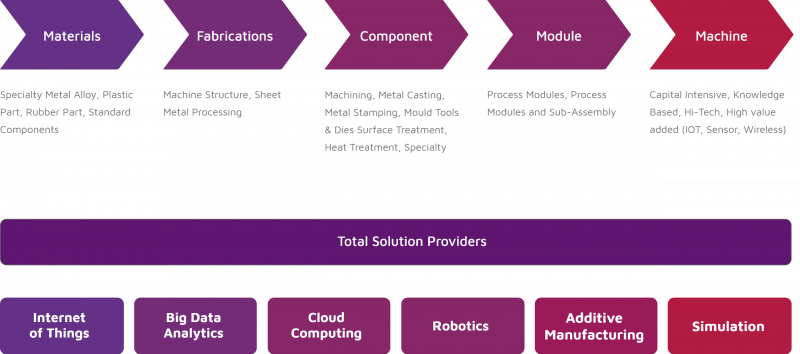

The Malaysian M&E industry is categorised into specialised M&E for specific industries, metalworking M&E, power generating M&E, and general industrial M&E, reflecting its diverse contribution to various sectors.

For more statistics, please click here

In the first seven months of 2022, Malaysia witnessed a 25.5% rise in machinery and equipment (M&E) exports, totaling RM34.4 billion year-on-year. The M&E sector is a significant contributor, ranking seventh in Malaysia’s export sectors with a value of RM49.9 billion in 2021, comprising 4% of total exports.

Notably, the industry achieved a remarkable 26.6% growth in 2021 from RM39.5 billion in 2020, serving markets including Singapore, the United States, China, Indonesia, and Thailand. An important M&E export segment focuses on machinery for semiconductor manufacturing, parts, and accessories, valued at RM8.8 billion in 2021, representing 17.5% of total M&E exports.

The rise of Industry 4.0 is reshaping business operations. Malaysia’s machinery and equipment (M&E) companies are already adopting Industry 4.0 solutions, utilizing technologies like IoT, Big Data Analytics, Cloud Computing, Robotics, and Additive Manufacturing. This convergence of technologies offers novel solutions across the M&E value chain. As automation becomes essential for survival in the evolving manufacturing landscape, Malaysia’s expertise in robotics and factory automation presents promising opportunities for investors seeking manufacturing sector development.

Semiconductor

Palm Oil

Food Processing

Malaysia is a destination for investments, especially for high technology and high-value products. We have world-class infrastructure and a matured supply chain. Certainly, when looking to invest in Malaysia, the best authority to consult is MIDA. Being the principal investment promotion agency in the country, they are well-equipped and ever-ready to provide support and facilitation, in terms of incentive available, location and more