This site

is mobile

responsive

The semiconductor industry is the primary enabling technology in every production line in the world. Semiconductor devices are essential components of electronic circuits and are made primarily from silicon. They can be found in almost every electrical device such as smartphones, computers and even coffee machines. Companies that operate in the semiconductor industry generally belong to one of these groups:

Industry forces and digital innovations are reshaping the semiconductor industry. Together, these companies design, manufacture and sell products such as memory chips, microprocessors, integrated circuits and complex systems-on-a-chip (SOC). R&D spending is a crucial metric for semiconductor companies as improvements in manufacturing processes can help to drive down production costs, which leads to higher margins for semiconductor companies. With R&D spending expected to increase, profit margins are expected to expand over the next few years.

Trends within the Semiconductor Industry

The investment outlook in the semiconductor industry is potentially attractive given its value propositions. Estimates published by Gartner and Statista predicts semiconductor sales revenue to grow at a CAGR of 6.17% and hit USD503 billion in 2020.

The semiconductor industry is relatively consolidated, with the top nine companies making up approximately 59% of worldwide semiconductor sales revenue. Wireless communication is the largest end-use segment for semiconductor products. Growth in this segment is expected to continue on the back of increasing smartphone penetration rates and infrastructure spending in preparation for 5G networks.

Steady increases in IoT hardware spending will be a significant source of revenue for the semiconductor industry in the future. Notable trends in the semiconductor industry include:

Challenges Ahead

Challenges are inevitable in any industry but recognising them is the crucial stepping stone to enable industry stakeholders to effectively map out strategies to overcome them.

The semiconductor industry is challenged with concerns driven by innovation and technological developments moving at a drastic pace. The industry needs to continuously inject new innovations in enhancing the value chain of the industry. It is crucial for the local semiconductor industry to develop a pool of product design talents and address issues such as intellectual property protection, licensing and research and development (R&D) spending.

Not forgetting, the ability for Malaysia to adapt and adopt new technology efficiently will pose as challenge whilst determining Malaysia’s competitiveness in the global value chain. As the global technological trends led by top semiconductor and technology nations will affect and shape the local industries, Malaysia can no longer be playing catch-up but must actively strive to build its expertise and niche.

Gearing up the Future

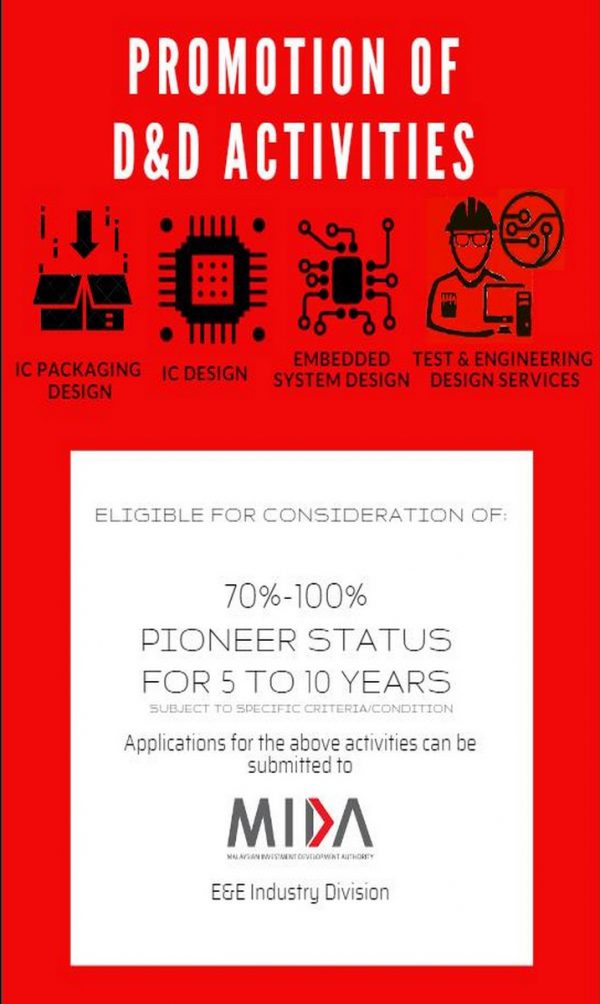

Recognising the importance of innovation and design activities to further spur the growth of the industry in Malaysia for coexistence with global technology transformation trends, MIDA continues to encourage companies to undertake design and development (D&D) activities in the E&E industry. These activities are eligible for incentives of 70% – 100% Pioneer Status for 5 to 10 years subject to specified criteria or conditions. Other eligible activities for the incentives include D&D and services of:

a) integrated circuit (IC) design;

b) IC packaging design;

c) Embedded system design;

d) Test and engineering design services for E&E clusters and its connecting supply chain ecosystem.

Any queries and applications for the above activities can be submitted to E&E Industry Division of MIDA:(https://bit.ly/2Z7ZdUY).