MIDA Insights – Services

This site

is mobile

responsive

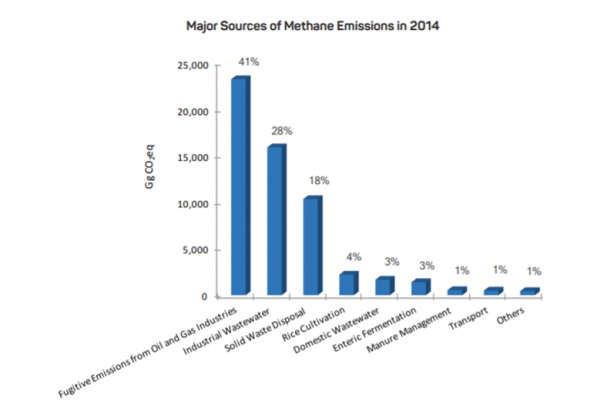

With fast-growing cities and ballooning population, developing countries like Malaysia are facing numerous challenges in sustainably managing wastes. The waste generated in Malaysia in 2005 was 19,000 tons per day at a recycling rate of 5%. The quantity rose to 38,000 tons per day thirteen years later in 2018, despite the increased recycling rate of 17.5%. This is alarming as the rate has exceeded the Japan International Cooperation Agency (JICA) study’s proposed rate of 30,000 tons per day in the year 2020. With limited space for landfills and rising costs of disposal, there is increased pressure and urgent need to tackle the waste management issue and reduce the impact on the environment and general well-being of the population. Statistics show that in Malaysia, the highest emission was from the fugitive emissions from the oil and gas industries, which accounted for about 41% of the CH4 emissions, followed by emissions from industrial waste water treatment and discharge amounting to 28% and solid waste disposal sites at 18%. Over 99% of the emissions from industrial waste water treatment and discharge was from palm oil mill effluent (POME).

To enhance solid waste management, Malaysia has taken a stepwise approach to privatise and centralise its solid waste management. The standard hierarchy of waste management involves five crucial steps; reuse, reduce, recycling, treatment and disposal. Currently, the most predominantly employed step in Malaysia is disposal. The Malaysian Government continues to promote a more effective way of waste management by encouraging the reuse and reduce method and ultimately reducing landfill wastes. Careful planning alongside efficient resource allocation and management are vital in achieving a sustainable solid waste management system.

Aside from consumer and household waste, the focus has also been on encouraging firms to reduce commercial waste generated from manufacturing activities. To curb waste generation, the Government provides targeted incentives to companies that undertake activities, which cater to environmental management, specifically recycling of waste such as toxic and non-toxic waste; chemicals and reclaimed rubber. These companies can be considered for income tax exemptions of 70% under Pioneer Status for the period of 5 years or Investment Tax Allowance of 60% on the qualifying capital expenditure incurred within a period of 5 years. The response has been promising with 313 recycling projects approved with total investments of RM7.6 billion as at December 2018, mainly from the rubber products industry with investments of RM2.34 billion followed by basic metal products (RM1.97 billion) and plastic products (RM1.27 billion).

In achieving more integrated waste management solutions, the Government had further extended the tax incentive for Green Technology through the Budget 2014. The incentive aims to encourage firms to revise their approach by incorporating a combination of waste management techniques including collection, storage, composting and disposal with other core recycling, recovery or waste treatment activities. These activities will strengthen the ecosystem of green technology in Malaysia and enhance firms’ operations to include a more holistic approach to waste management.

Waste recycling facilities are currently dispersed around the country, causing difficulties in recovering valuable waste materials and components that can be recycled. To mitigate this issue, the Waste Eco Park (WEP) incentive for developers, managers and operators was introduced under the Budget 2016 to centralise recycling companies from various industries under same locations. Through this initiative, a circular approach to waste management can be established in working towards zero waste production. Companies which undertake the activity of developing WEP with a minimum investment of RM50 million can be considered for income tax exemption of 70% on income derived from the rental of buildings, fees received from the usage of waste collection and separation facility and waste water treatment facility located in WEP from year assessment 2016 until year assessment 2025.

A dedicated WEP Manager is vital as to ensure that the coordination, implementation and operation of WEP are effective and efficient. The WEP Manager is also eligible for income tax exemption of 70% on the statutory income from services activity including management, maintenance, supervision and marketing. The WEP operators are the tenants/occupants from various types of industries that will be involved in waste management and services activities, these operators can contribute to the adoption of a more integrated waste management practice and achieve the Government’s target to reduce waste disposal, encourage waste recovery, increase waste recycling and support the ecosystem of waste management. These companies can enjoy either Income Tax Exemption of 100% on statutory income for a period of five (5) years, derived from the qualifying activities undertaken in the WEP; or Income Tax Exemption equivalent to 100% of qualifying capital expenditure (Investment Tax Allowance) incurred within a period of five (5) years. Furthermore, the Green Technology Incentive can be carried forward indefinitely until the allowance is fully utilised.

In parallel to the rapid expansion in economic growth, there has been a rise in environmental degradation in developing countries. Despite policies to encourage consumer waste management through recycling efforts, it should be noted that the main contributor to waste is the externalities from industrial processes. Therefore, there is a greater need to incorporate and shift to more integrated and sustainable waste management practices on all levels to improve and maintain environmental quality.