This site

is mobile

responsive

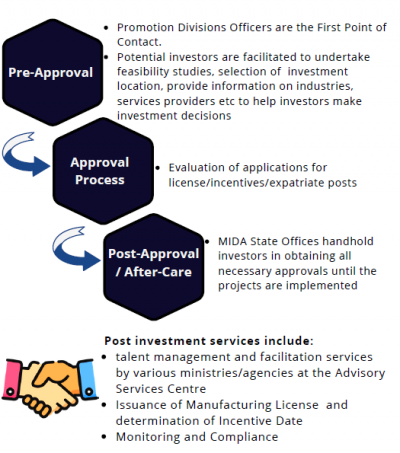

MIDA, through its Licensing and Incentive Compliance & Monitoring Section (PPPG) provides the aftercare services for manufacturing and services companies. According to the United Nations Conference on Trade and Development (UNCTAD), aftercare services is defined as the range of activities from post-establishment facilitation services to developmental support by the Investment Promotion Agencies to retain and encourage followon investment.

Since its establishment on 1st January 2011, PPPG is one of the most critical elements in the complete cycle of the Foreign Direct Investment (FDI) and Domestic Direct Investment (DDI) promotion, facilitating and assisting manufacturing and services companies in the implementation and operations of their projects after the approval of manufacturing license and/or incentive.

PPPG is entrusted to analyse the company’s investment journey in Malaysia and encourage the periodic reviews of postinvestment. The ongoing surveillance activities cover the process of reviewing the investor’s business risk, due diligence and company’s reform.

The monitoring platforms also serve as an initial warning system that allows identifying earlier, potential compliance issues. Amongst the services provided by PPPG include evaluation of post licensing applications under the Industrial Coordination Act (ICA), 1975 and evaluation and monitoring of post incentive applications under the Promotion of Investments Act (PIA), 1986 for Pioneer Status and Investment Tax Allowance and the Income Tax Act (ITA), 1967 for Income Tax Exemption (P.U.(A) 112 & P.U.(A) 113).

What is Post Licensing? Applications submitted to MIDA that are related to Manufacturing Licence and conditions, after the issuance of the Manufacturing Licence Certificate, such as:

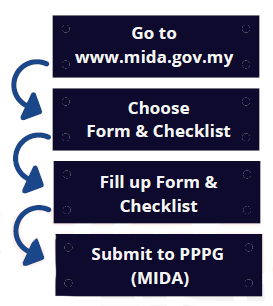

How to Apply for Post Licensing Approvals? Example: Company has changed its factory location to a new location and the company request to amend the information in the Manufacturing License Certificate Just a Few Steps…

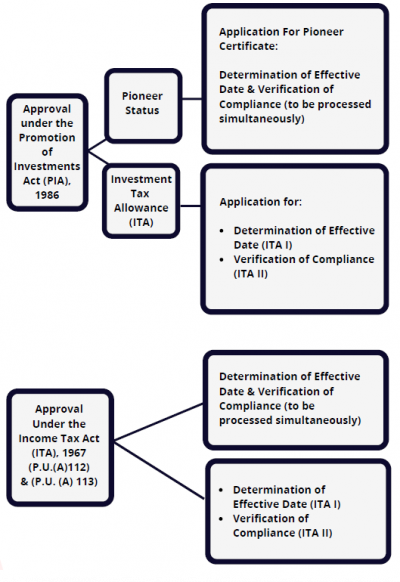

What is Post Incentive Approval? For projects which have been approved with tax incentives, companies are required to submit Post Incentive Applications to MIDA to determine the Effective Date of the incentives and Verification of Compliance’s conditions before they can proceed to claim the tax incentive from the Inland Revenue Board (IRB).

Services provided for Post Incentive Applications:

Companies with approved Pioneer Status incentive are required to submit their application for issuance of Pioneer Certificate within 24 months from the date of the Incentive Approval Letter. At the same time, the company must achieve 30% of its commercial production or installed capacity (for manufacturing projects) or had issued its first sales invoice (for services projects).

There are two stages where the company is required to submit its application: i. ITA I – Determination of Effective Date (ITA I Form) ii. Verification of Compliance (ITA II Form) A company is given two years from the date of the approval letter to submit an application for ITA I, Determination of Effective Date, by providing the first qualifying capital expenditure invoice.

A company is required to submit the ITA II application for the Verification of Compliance before submitting claims to the IRB and before the incentives period expires.

Companies are to submit an Annual Compliance Report to MIDA and IRB for each year of assessment during the effective incentive period. The Annual Compliance Report is to be verified by a qualified External Auditor.

MIDA encourages investors to practice good governance and implement robust compliances through the facilitation of the exchange information and coordination among institutions engaged in or connected with industrial development. To further enhance MIDA’s role of assisting investors, senior representatives from key agencies are stationed at MIDA’s headquarters in Kuala Lumpur to advise investors on government policies and procedures. These representatives include officials from the Ministry of Human Resources, Immigration Department, Royal Customs Malaysia, Department of Environment, Tenaga Nasional Berhad and Telekom Malaysia Berhad.

For further information on MIDA’s Post Approval Activities, please visit MIDA’s website at www.mida.gov.my