This site

is mobile

responsive

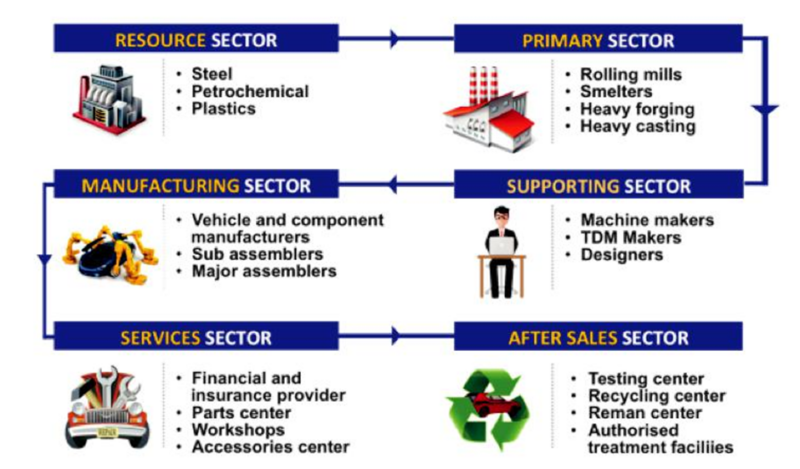

Diagram 1: Automotive Ecosystem

Malaysia continues to be an attractive base for global automotive manufacturers. Honda, Toyota, Nissan, Mercedes-Benz and BMW are some of the global automotive companies which have set up their operations in the country to take advantage of buoyant consumer demands. Geely Auto Group, a leading automobile player from China acquired PROTON shares in 2017. This demonstrates the keen interest of China investors to leverage Malaysia to penetrate the ASEAN market. International component manufacturers, such as ZF, Delphi, Continental, Nippon Kayaku, PD Kawamura, Akashi Kikai, Denso and Bosch have also made Malaysia their base to launch their products in the region.

Malaysia’s automotive industry has come a long way. It was the establishment of national car Industry projects, PROTON and PERODUA that transformed the country from a mere motor car assembler into a car manufacturer. Today, the PROTON plant in Tanjung Malim is fully automated, adopting robotic technology and is designed for high volume production and efficiency, using lean manufacturing processes.

The industry remains as an important and strategic part of the country’s manufacturing sector, contributing 4% to Malaysia’s GDP and continues to be the 3rd largest automotive market in ASEAN. There are currently 28 manufacturing and assembly plants in Malaysia for passenger vehicles, commercial vehicles, motorcycles and scooters, as well as automotive parts and components. In addition to assembly and manufacturing, the ecosystem also covers a wide range of activities in research and design, product and process development, materials management, and after-sales services. The industry has certainly boosted the development of engineering, auxiliary and supporting industries. It also contributes to skills development and the upgrading of technological and engineering capabilities. As the global trend is moving towards digitisation and new business models are expected to rise, there will be no exception for the automotive industry in Malaysia. It is expected that technology-driven trends such as diverse mobility, autonomous driving, electrification and connectivity will shape the industry in 10 to 15 years. Although the future of the automotive industry in Malaysia presents some challenges, it also provides many new opportunities.

Seize Growing Opportunities

The Government announced the National Automotive Policy 2020 to address the growing trends and advance Malaysia as a regional leader in manufacturing, engineering, technology and sustainable development in the

automotive sector. Malaysia welcomes strategic investment particularly in the areas of Next- Generation Vehicles (NxGV), electric and autonomous vehicles and related core and critical components such as engine,powertrain, Light and Radio Detection and Ranging (LIDAR and RADAR), Advance Driver Assistance System (ADAS), EV battery and its battery management system.

Companies in the automotive industry can avail themselves to the various government facilitation such as the Pioneer Status or Investment Tax Allowance incentives for promoted products as listed in Table 1.

Malaysia’s automotive industry has embarked on the journey towards Energy Efficient Vehicles (EEV) since 2014. EEV is defined as vehicles that meet a set of defined specifications in terms of carbon emission level (g/km) and fuel consumption (l/100km). EEV includes fuel-efficient vehicles, hybrid, EV and alternatively fuelled vehicles such as CNG, LPG, Biodiesel, Ethanol, Hydrogen and also Fuel Cells.

Based on the investment data as at June 2021, MIDA has approved over 50 projects within the EEV ecosystem with an approved investment value amounted to RM8 billion. There is still much room for expansion in Malaysia’s EV ecosystem as the deployment of Electric Vehicles in Malaysia is still gaining traction.

MIDA expects that electric vehicles will steadily gain popularity and become more mainstream, particularly since there is a growing demand for green transportation in the ASEAN region.

MIDA is actively exploring and attracting quality investments into Malaysia within the EV ecosystem.

Recently an investment worth RM4.3 billion from SK Nexilis of South Korea to manufacture electro-deposited copper foil for EV batteries has been approved. Malaysia continues to welcome more of such investments to further elevate the EV ecosystem in the country.

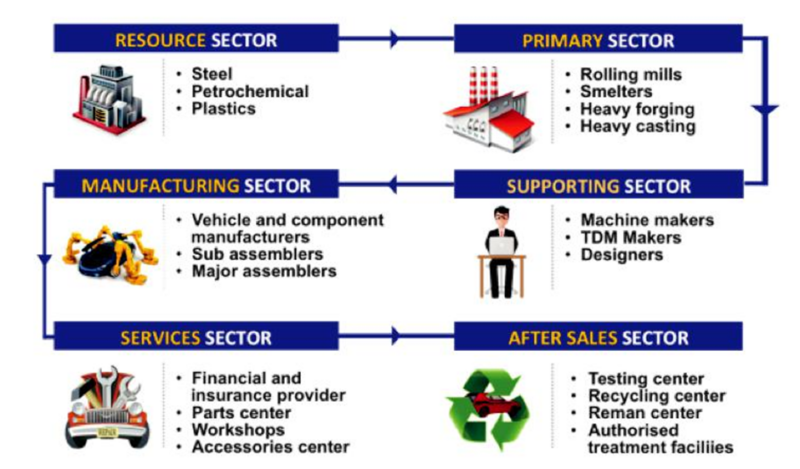

Table 1: List of Promoted Products

Companies in the automotive industry can avail themselves to the various government facilitation such as the Pioneer Status or Investment Tax Allowance incentives for promoted products as listed in Table 1.

Malaysia’s automotive industry has embarked on the journey towards Energy Efficient Vehicles (EEV) since 2014. EEV is defined as vehicles that meet a set of defined specifications in terms of carbon emission level (g/km) and fuel consumption (l/100km). EEV includes fuel-efficient vehicles, hybrid, EV and alternatively fuelled vehicles such as CNG, LPG, Biodiesel, Ethanol, Hydrogen and also Fuel Cells.

Based on the investment data as at June 2021, MIDA has approved over 50 projects within the EEV ecosystem with an approved investment value amounted to RM8 billion. There is still much room for expansion in Malaysia’s EV ecosystem as the deployment of Electric Vehicles in Malaysia is still gaining traction.

MIDA expects that electric vehicles will steadily gain popularity and become more mainstream, particularly since there is a growing demand for green transportation in the ASEAN region.

MIDA is actively exploring and attracting quality investments into Malaysia within the EV ecosystem.

Recently an investment worth RM4.3 billion from SK Nexilis of South Korea to manufacture electro-deposited copper foil for EV batteries has been approved. Malaysia continues to welcome more of such investments to further elevate the EV ecosystem in the country.

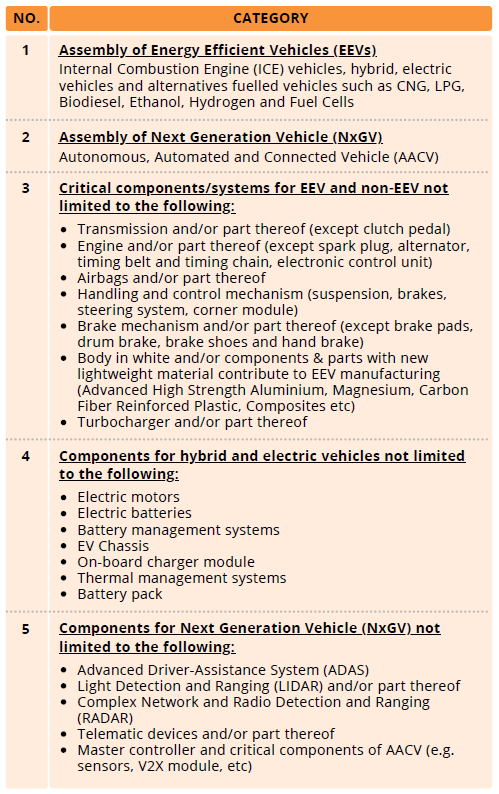

Diagram 2: Evolution of Automotive Electronics

Source: Altium Resources

Shortage of Microchips

Interestingly, as the industry evolves, automotive electronics technologies such as autonomous driving, electric vehicles and in-car infotainment are also penetrating the automotive industry. Vehicles are transforming into the ultimate electronic device. Automotive electronics are expected to constitute near a third of the total cost of the entire car.

In recent years, vehicle sensor improvements have led to increasingly advanced autonomous driving technologies that enable higher awareness and visibility. The special advanced features in the vehicle include adaptive cruise control, park assistance, lane-keep assistance, pedestrian detection, and traffic-sign recognition. As vehicle technologies are moving towards connected vehicles and autonomous driving, the functions of microchips in a vehicle have become extremely crucial. Studies showed that automotive electronics per vehicle have increased over the years (as per Diagram 2.)

This trend arose due to efforts made by automakers to improve the fuel economy and emission control as well as high demand of lower cost and higher performance semiconductors.

Unfortunately despite the Covid- 19 pandemic recovery initiatives, the automotive industry was impacted by supply chain disruptions caused by a severe shortage of microchips, which is expected to last until 2023. Several measures were deployed to address the shortage such as facility expansion, adjusting orders, production schedules and prices.

However the lasting impact resulted in Daimler and BMW having to cut back the number of shifts or completely stop production at several of their factories. General Motors has temporarily paused its North American factories. The supply disruption also continues to hammer a range of global automakers including Toyota that announced a slash in its global output by 40% in September.

Elsewhere, Ford in recent news has announced that the company was forced to suspend its Ford Fiesta production at a German plant due to chip shortages by a Malaysian supplier. This also goes to show how important Malaysia is to the global automotive market as there are over 50 semiconductor producers with factories in Malaysia; some of the big names include ST Micro, Robert Bosch, Intel, Infineon, NXP and Texas Instrument.

Way Forward

It is very important to ensure a sustainable semiconductor production, so as to revive the automotive industry during the pandemic recovery period.

MIDA as the Government’s principal investment promotion agency continues at the forefront to facilitate investors and ensuring that Malaysia continues as an investor-friendly destination for long term growth of both foreign and domestic businesses.

MIDA is strengthening efforts to encourage more investments in the automotivebased industry especially projects strongly related to the E&E based sectors. Such investments would enhance transfer of technologies and expertise, create new capacities and contribute to the creation of high-value jobs.

The ecosystem based approach will solidify Malaysia’s position as a competitive and profitable investment destination in line with the National Investment Aspirations (NIA) to propel the country’s long term growth through the flow of sustainable quality investments, in new and complex growth areas, well beyond the current COVID-19 situation.

MIDA welcomes interested investors and stakeholders to engage industries in Malaysia and collaborate through various facilitation offered by the Government.

For more information, forward your enquiries to MIDA’s Transportation Technology Division or visit www.mida.gov.my