This site

is mobile

responsive

The weakening impact of the COVID-19 pandemic outbreak on global economies continued throughout 2021.The emergence of new virus variants led to the prolonging of tumultuous economic conditions, supply chain disruptions and labour issues.

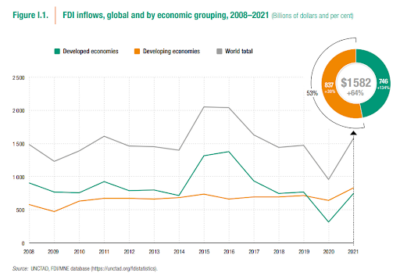

Despite this, the United Nation Conference on Trade and Development (UNCTAD)’s World Investment Report 2022 shows that global FDI inflows has increased by 64% to USD1.58 trillion in 2021, spurred by the growth in mergers and acquisitions (M&A) favourable financing conditions and increased infrastructure-related fiscal stimulus packages. This exceeds the pre-pandemic levels of FDI inflows by 6.9% (2019: USD1.48 trillion).

In Southeast Asia alone, FDI inflows rebounded in 2021, skyrocketing by 43.6% to USD175.3 billion after dropping 30.2% in 2020. This was an indication of the region’s continuous ability to attract global FDI, even in the face of challenging economic conditions. While developing countries like Malaysia were among the hardest hit, these nations’ foreign direct investment (FDI) inflows accounted for more than half of global FDI.

Particularly in Malaysia, higher FDI inflows were recorded in greenfield or new projects, with a massive rise (240%) in terms of investment value in 2021 contributed by large-scale investments in semiconductor projects.

Malaysia’s Resilient FDI Inflows

FDI inflows represent the value of cross-border transactions related to direct investment during a given period of time, creating stable and long-lasting relationships between economies. The resilience of FDI inflows in a developing country is crucial to allow the transfer of technology, promote healthy competition in the domestic market and support human capital development.

Malaysia’s FDI inflows resilience was proven when the country exceeded its pre-pandemic performance with RM48.1 billion in 2021 compared to the RM32.4 billion in 2019 (2020: RM13.3 billion), as reported by the Department of Statistics Malaysia (DOSM) in its annual Statistics of Foreign Direct Investment in Malaysia publication. The increase is primarily attributed to a larger net inflow in equities and investments fund shares. This indicates the maturity of Malaysia’s monetary policy, which allows for the repatriation of capital, interest, dividends and profits.

This policy is also a prerequisite for a trading nation such as Malaysia in strengthening the country’s position as a regional and global supply chain hub. The United States of America (USA), Singapore and the United Kingdom (UK) were the main countries for FDI inflows into Malaysia in 2021.

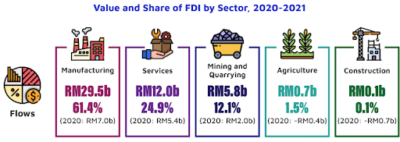

On a sectoral perspective, the manufacturing sector sustained its position as the biggest contributor to the country’s FDI inflows in 2021, amounting to RM29.5 billion (61.4%), followed by other sectors, namely services with RM12.0 billion (24.9%); mining and quarrying (RM5.8 billion; 12.1%), agriculture (1.5%) and construction (0.1%). In the manufacturing sector, electrical and electronics (E&E), transport equipment and other manufacturing industries outperformed other sub-sectors accounting for 62.4% of total manufacturing FDI inflows.

Positive Momentum of Approved FDI into Malaysia

In an effort to retain the stability of the investment climate in Malaysia, the Malaysian Investment Development Authority (MIDA) – government’s principal investment promotion agency under the Ministry of International Trade and Industry (MITI) continuously secured investments from foreign companies that seek to establish business hubs in a steady and well-integrated business ecosystem. This is reflected in the approved FDI performance reported by MIDA. In this context, approved FDI relates to proposed investments from foreign sources for projects which have been granted license, incentives or permit by MIDA and other ministries and agencies.

In 2021, a total of RM208.6 billion in FDI were approved in various economic sectors manufacturing, services and primary sectors, the highest FDI recorded since 2006. Approved FDI is a good lead indicator into the trend of future FDI inflows.

The electrical and electronics (E&E) industry accounted for 81.5% of approved manufacturing FDI, in line with the global technology up-cycle. MIDA approved FDI totalling RM146.3 billion in 2021 in the E&E industry, which remains the backbone of Malaysia’s manufacturing sector.

This robust growth has created a diverse ecosystem for the E&E industry and its supply chain in the country. Some notable projects approved include Risen Solar Technology, Intel, and AT&S.

Strong Growth Continues into 2022

Approved investments worth RM42.8 billion from 910 projects in the primary, manufacturing and services sectors were recorded in 1Q 2022. Of these investments, more than half or 65% (RM27.8 billion) were from foreign sources, signalling continued investor confidence in doing business in Malaysia.

After a gestation period of 12 to 24 months, these approved projects will be implemented and begin contributing to realised investments in the economy. This will subsequently create more economic spillover effects, including increased employment opportunities, a stronger supply chain and industrial ecosystem, as well as improved trade prospects.

As of 7 June 2022, MIDA has a total of 268 projects with proposed investments of RM14.4 billion in the pipeline for the manufacturing and services sectors. This positive trajectory further complements the 2022 Milken Institute Global Opportunity Index where Malaysia was ranked No. 1 in emerging Southeast Asia as the country with the most potential to attract foreign investors. Taking cognizance of this optimistic outlook, MIDA will double its effort in attracting more of these FDIs which are essentially the nation’s economic transformation agent particularly in high-technology sectors.

For more information on Malaysia’s investment performance, please contact MIDA’s Investment Statistics Division.