MIDA Insights – Services

This site

is mobile

responsive

As more trade deals are shifting towards the ASEAN region, Malaysia is gearing up to be the go-to place for trade. Malaysia’s trade value is steadily increasing amidst economic challenges and on-going trade tensions globally. According to MATRADE, in 2019, Malaysia recorded its largest trade surplus since 2009 valued at RM137.39 billion, an increase of 11 per cent compared to the previous period. Malaysia aims to continue this favourable trend, making it a preferred destination for investors and businesses.

The Malaysia Shipping Master Plan 2017-2022, endorsed by the Ministry of Transport has outlined many targets for the maritime industry as the theme “Revitalising Shipping for a Stronger Economy” aims to improve every aspect of the maritime ecosystem.

Besides, the Eleventh Malaysia Plan (11MP) 2016-2020 defines at developing all the sectors driving the economy, especially the services and manufacturing sectors. It also outlined the strategies to unleash the growth of logistics sub-sectors to facilitate and enhance trade.

In line with this aspiration, major ports are expanding their capacities. Port Klang, Malaysia’s largest port plans to increase its capacity by 50 per cent to 30 million twenty-foot equivalent units (TEUs) per annum by the year 2040 whereas the Port of Tanjung Pelepas (PTP) is developing a new berth that will add 3.5 million TEUs to its current capacity by the year 2025. Initiatives such as the Digital Free Trade Zone (DFTZ), which aims to intensify export and import via e-Commerce, will further drive the growth of trade in Malaysia.

While most of Malaysian trade are handled by major ports which cater containerised handling services, there is a high market potential for specialised ports for specific sectors such as the oil and gas, mining and agricultural product sectors.

Several dedicated ports that are already available include the one in Port Dickson for Shell’s refinery and in Lumut which is operated by Vale of Brazil, a global leader in mining. Recent developments for specialised ports includes the Carey Island to make available for the Halal Silk Route Initiative, the Palm Oil Industrial Cluster (POIC) Lahad Datu for the palm oil industry, the Kuala Linggi International Port (KLIP) for oil and gas activities and the Kuantan Integrated Maritime Hub (KIMH) for shipbuilding, ship repair and offshore structure fabrication.

Such positive developments will create more maritime traffic into the region, therefore, creating other spin-offs such as the need for bunkering services.

In addition, the International Maritime Organization (IMO)’s enforcement on sea-going vessels to use low sulphur fuel oil will generate requirements for LNG bunkering, benefitting Malaysia as one of the world largest suppliers of LNG. Based on Ministry of Transport (MOT), the Malaysian bunkering services accounts for about four million metric tonnes in annual fuel sales to shippers in Port Klang and Port of Tanjung Pelepas. With the bunkering services in Singapore valued at RM2 billion, Malaysia’s market size is estimated to be at least three times more.

As Malaysia is strengthening efforts in making the country a leading bunkering destination in the region, with developments such as Pengerang Integrated Petroleum Complex (PIPC) and PTP, Malaysia is on track and competing closely to Singapore, the world’s largest bunkering hub.

The maritime industry offers a vast amount of market potential for businesses. With vast resources (oil and gas, palm oil, timber and other agricultural products) available and strategic location as the gateway for the Southeast Asia market, Malaysia’s trade will continue to strengthen.

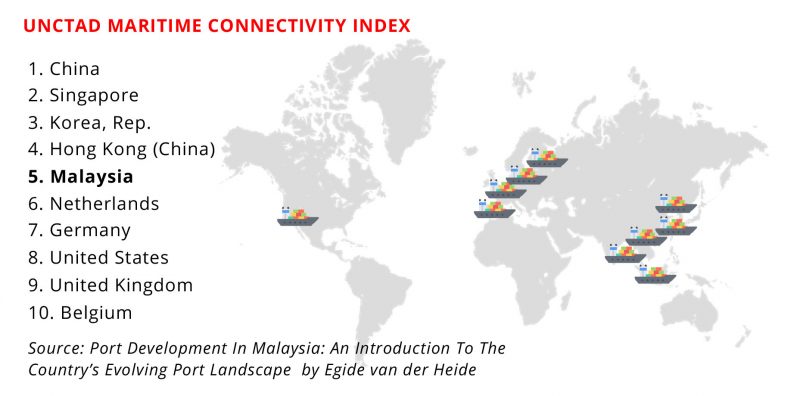

Furthermore, Malaysia is ranked as the world’s fifth-best country by the United Nations Conference on Trade and Development (UNCTAD) in terms of shipping connectivity. This has placed Malaysia among the top destination for businesses and trade. MIDA will continue to intensify efforts in promoting the industry and attract local and foreign investments to create more employment opportunities and strengthening the maritime logistics ecosystem.