This site

is mobile

responsive

As the principal agency responsible for the promotion of investments as well as the coordination of industrial development and selected services sectors in Malaysia, the Malaysian Investment Development Authority (MIDA)’s role is not only confined to attracting companies that intend to invest in the country, but also includes facilitating the implementation of investment projects.

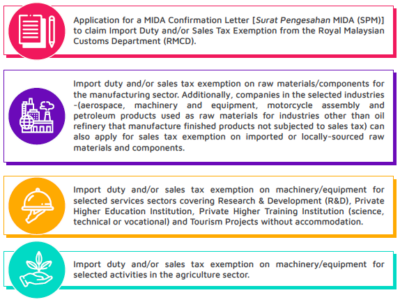

One of the facilitations provided by the Government to further accelerate the growth of industry in Malaysia is the import duty and/or sales tax exemption under the provisions of Section 14(2) Customs Act 1967 and/or Section 35(3) Sales Tax Act 2018 to manufacturers and investors in the selected services sector.

Implementing a new project involves massive costs, including but not limited to: the purchasing of machinery, equipment, sample materials, prototypes, raw materials and components. To alleviate these heavy cost burdens at the starting point of a project, and in keeping with Malaysia’s business-conducive investment environment, companies engaging in manufacturing and selected services sectors can benefit from the following investment facilities:

These investment facilities have proven to be vital in assisting investors in their project implementation, while spurring sustainable growth within industries.

As Malaysia embraces the Fourth Industrial Revolution (IR4.0) and the various technologies involved, MIDA has taken steps to revamp its existing business processes to increase delivery efficiency of its investment facilitation services, thereby further enhancing the ease of doing business in Malaysia. Since July 2020, investors have been able to submit digital applications for import duty and/or sales tax exemptions, following the launch of the enhanced version of JPC Online Application Module. This module helps companies obtain timely approvals for their import duty and/or sales tax exemption applications.

Effective 25 July 2022, companies may apply for import duty and/or sales tax exemption for the Export/Free Zone (FZ)/Licensed Manufacturing Warehouse (LMW) market for iron and steel raw materials/components under HS Code 7201 to 7316. All applications can be submitted through the InvestMalaysia portal at investmalaysia.mida.gov.my.

To learn more about these supporting facilitations, contact MIDA Tariff Section or email to [email protected].