Can Malaysia capitalise on its data centre ambitions?

13 Jan 2025

DATA centres (DCs), which have grown in importance in the age of digitalisation, took centre stage in 2024 owing to the massive foreign direct investments (FDI) into the sector and Putrajaya’s recent approval of a total DC capacity of 4gw, making Malaysia a “DC powerhouse” in the region and a prominent player on the global stage. Still, questions remain over the full benefits to be gained from such resource-hungry investments.

A whopping RM90.2 billion in FDI for 12 DCs were committed between 2021 and June 30, 2024, according to the Malaysian Investment Development Authority (Mida). These were primarily by major tech companies like Nvidia, ByteDance, Microsoft, Google and Singapore Telecommunications, which are major data users and processors.

Google, for instance, announced in October a US$2 billion (RM8.9 billion) investment to build its first DC in Malaysia. The global tech giant is also investing US$1 billion in DCs in Thailand. Meanwhile, Singapore substantially bumped up its DC investments to US$5 billion in 2024 from US$850 million in 2022.

Increasing data usage, cloud computing and artificial intelligence (AI) have accelerated the need for DCs, which provide the facilities to store and process data. In other words, they are essential infrastructure to support the digital economy. However, the AI boom has necessitated a new type of DC that supports real-time processing and data storage, often requiring proximity to end-users.

The DC boom is not unique to Malaysia. According to a report by global consulting firm McKinsey & Co, the global demand for DC capacity could rise at an annual rate of between 19% and 22% from 2023 to 2030 to reach annual demand of 171gw to 219gw globally.

“This contrasts with the current demand of 60gw, raising the potential for a significant supply deficit. To avoid a deficit, at least twice the DC capacity built since 2000 would have to be built in less than a quarter of the time,” it said in an Oct 29 report.

In Asia-Pacific, current DC capacity exceeds 10,500mw and is expected to more than double to 24,800mw by 2028, spurred by increasing adoption of cloud computing and AI, which in turn will benefit several industries across the value chain.

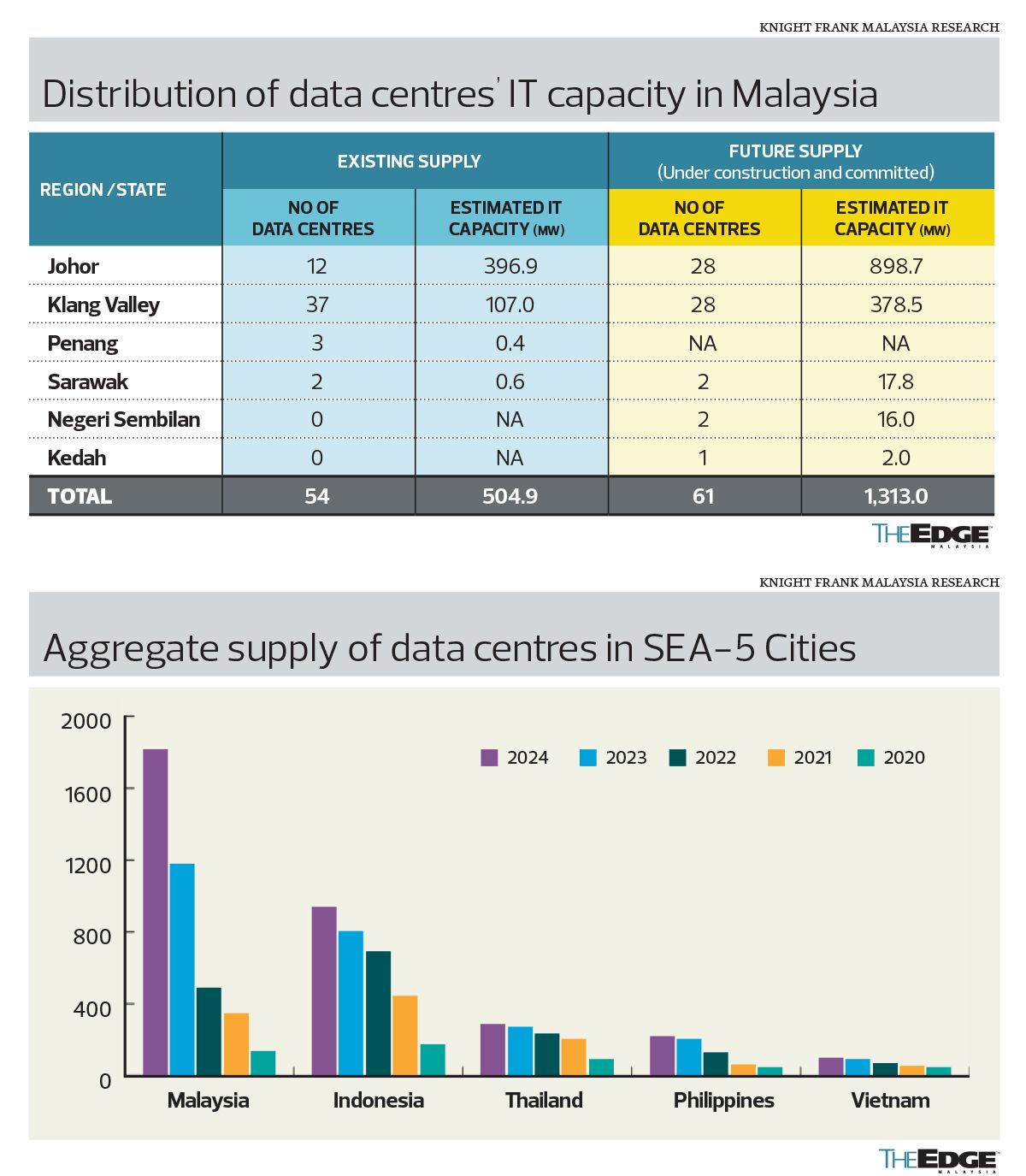

According to reports, Singapore currently has more than 70 DCs with a total capacity of 1.4gw. But Malaysia will soon eclipse its southern neighbour, as utility giant Tenaga Nasional Bhd (KL:TENAGA) has signed 31 electricity supply agreements (ESA) with DC operators in the country, for a total energy demand of 4,700mw.

The acceleration in DC capacity is mind-boggling in that Malaysia’s DC market in 2023 only had 40DCs with 100mw to 150mw — a development that took almost 20 years to achieve.

There are two kinds of DC operations — DC colocation and hyperscale DC. In the past, most DCs were built to focus mainly on DC colocation, which is a service provided by DC operators to companies that would rent space, power and connectivity in the DC to host their own servers and IT equipment. As a result, the growth in DC capacity has been in stages, depending on the digitalisation efforts of these companies.

On the other hand, hyperscale DCs are typically massive and purpose-built facilities designed to support the tremendous computing and storage demands of cloud computing, big data and other data-intensive applications. Major investors in hyperscale DCs are usually large technology players such as Apple, Google, Microsoft, Amazon Web Services, Facebook, Alibaba, Tencent and ByteDance.

Debate over benefits of DC investments

However, beneath the fanfare of major investments made by global companies, there are questions about the real economic benefits of the DC boom to Malaysia. Will it translate into the economic multipliers promised?

Industry observers and experts say the DC boom in the country is a positive development as it supports the digital economy and will create new jobs, among other benefits.

But a big drawback of DCs is their voracious appetite for land, electricity and water. They also require a consistent and steady supply of electricity at all hours of the day for data processing and cooling systems.

Malaysia currently has a peak electricity demand of close to 20gw. Putrajaya’s recent approval of a total DC capacity of 4gw makes the country Asean’s top DC hub. But will this put a tremendous strain on its resources?

Can the increase in electricity usage lead to higher GDP growth?

Sunway University Business School professor of economics Yeah Kim Leng says Malaysia is benefiting from the initial stage of DC development, which is attracting FDI and construction projects. The multiplier effect that comes from being a DC hub will come after the completion, he tells The Edge.

“Malaysia can specialise in data services, particularly those related to generative AI, which have applications across various sectors like healthcare and services, leading to improved service quality and innovative solutions. This will enable Malaysia to progress beyond semiconductors and acquire the technology transfer from having big tech companies in the country,” he adds.

According to Knight Frank’s SEA-5 Data Centre Opportunity Index report, Malaysia attracted RM141.72 billion in digital investments in the first 10 months of 2024 — three times the approved digital investments for the whole of 2023 (RM46.2 billion). These investments are expected to create 41,078 job opportunities.

The report also highlights that DCs are a critical component in powering the growing digital economy and that their operations demand substantial energy and water to ensure uninterrupted functionality of servers, cooling systems and other IT equipment.

“The sudden surge in data centre investments in Malaysia, especially in Johor over the past two years, has raised concerns about the nation’s and the state’s ability to handle the increased demand for electricity and water resources. Stakeholders are questioning whether the existing infrastructure can sustainably support this rapid growth without compromising environmental commitments and local communities,” Knight Frank says in a December 2024 report.

In this regard, it was reported that the Johor government has taken a strategic and decisive stance to reject nearly 30% of DC applications.

At the federal level, Prime Minister Datuk Seri Anwar Ibrahim cautioned against rushing to build DCs, especially if they do not add value to Malaysians in terms of high-income jobs and knowledge-sharing. “The traditional approach of providing support and incentives to investors without taking into account the economic spillover achieved is no longer sustainable,” he said in his Budget 2025 speech, noting high quality investments were preferred.

Following the announcement, Treasury secretary-general Datuk Johan Mahmood Merican said Putrajaya was working on restructuring its incentive packages for DC investments to ensure broader economic benefits, and that it would be announced in mid-2025.

“We are rethinking this enthusiasm with data centres. They are large in terms of capex, but sometimes they don’t necessarily create many high-skilled jobs. And sometimes, they consume a lot of electricity and water,” he added.

Source: The Edge Malaysia