Malaysia’s E&E defied global trends, but overall export outlook still bleak – Analysis

20 Oct 2022

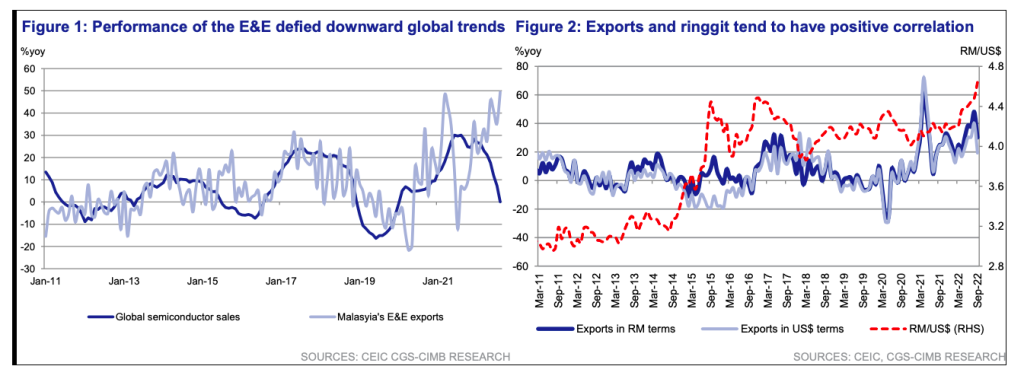

The performance of Malaysia’s electrical and electronics (E&E) sector has defied downward global trends as shipments continued to outperform global sales in September 2022, noted an equity research outfit.

The latest official numbers released by the Department of Statistics (DOSM) show that Malaysian exports of E&E products to China grew 36.5% year-on-year (y-o-y), in contrast with the moderation in shipment by regional peers.

“We suspect that part of the strength could be due to attractive cost given ringgit’s weaker performance. [Figure 2] shows that Malaysia’s exports and ringgit tend to have positive correlation. That said, E&E exports will likely start to come down amid normalised global demand for E&E products,” CGS CIMB Research said in a note yesterday.

China, in particular, has the largest market share in semiconductor at 31.5% and is likely to lead the slow growth onwards amid its own domestic growth issues as well as being affected by the US trade restrictions, it said.

Malaysia recorded a trade surplus of RM31.71 billion in September, a new record high for the country, beating the previous high of RM31.5 billion in December 2021.

The trade surplus expanded 20.9% from RM26.23 billion in September 2021, according to the Ministry of Trade and Industry.

Exports to major trading partners notably Asean, the US, the European Union and Japan recorded double-digit growth, with exports to Japan registering the highest monthly value ever.

In the same note, CGS CIMB Research said that export prospects for palm oil remain quite bleak, as Indonesia has extended its export duty exemption of the product for the second time from October till endy-ear, putting domestic palm oil exports in a more prolonged suppression.

On the positive side, it noted that on Oct 11, 2022, Malaysia resumed its exports of fresh chicken, reversing a ban that began on May 23, 2022, as supply stabilised. That said, it added that the share of exports of live animals and prepared meat products are minimal at 0.2% to total exports.

“Overall, we could see some sustained strength from the weaker ringgit. However, the pressure from the global economic slowdown will likely be stronger towards the end of the year as reflected by the contraction in the global manufacturing PMI reading at 49.8 in October, the first retreat below the neutral 50.0 level since June 2020,” it said.

As such, the research house has maintained its expectation of a moderating GDP growth rate in 2023F at 5.0% compared with an expansion of 7.3% this year.

Source: The Malaysian Reserve