MSIA offers local E&E firms help in accessing global market

07 Jul 2021

In many respects, Malaysia’s electrical and electronics (E&E) sector owes surging demand for its products to the pandemic, which has made many technology and tech-related products nearly indispensable, if not indispensable.

Furthermore, Covid-19 and the numerous disruptions to operations have led to local industry players finally banding together so that their voices are heard. Taking it a step further, smaller companies under the umbrella of the newly formed Malaysia Semiconductor Industry Association (MSIA) now have a platform to reach out to global players in the E&E ecosystem, providing them with even more business opportunities.

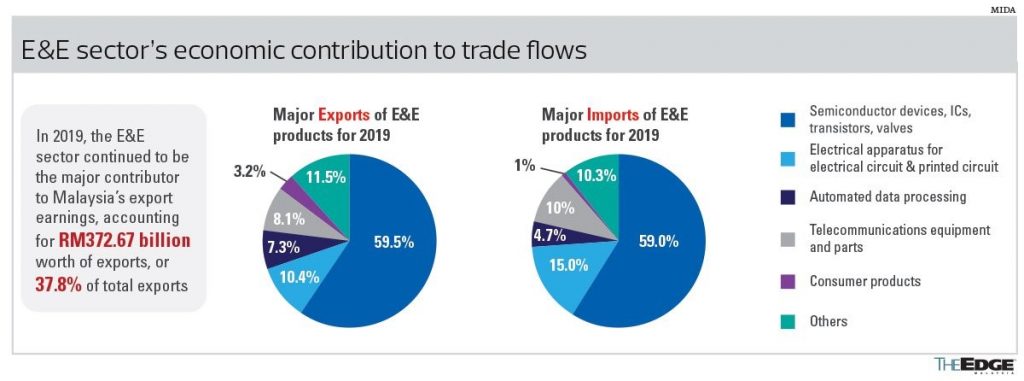

Players in Malaysia’s E&E industry currently employ more than 575,000 people, their output last year contributing to 6.8% of the country’s gross domestic product (GDP). The sector’s economic contribution to trade flows was even more impressive. Yet, how significant is the contribution of local companies to this virtuous cycle?

E&E products accounted for the biggest share of the country’s total exports last year at 39.4%, or RM386.11 billion, which was 3.5% higher than the year before. The increase was due to more exports of electronic integrated circuits (ICs), apparatus for transmission or reception of voice, images and data, as well as parts for electronic ICs to support the switch to working from home during the pandemic.

According to MSIA president Datuk Seri Wong Siew Hai, the astronomical numbers have been driven mainly by large multinational corporations (MNCs) and big local players.

Smaller E&E firms should be more outward-looking and more active in exploring business opportunities in overseas markets via digital platforms in order to capitalise on growing demand, he says.

“Today, the biggest help that local companies need is [in gaining] market access. We have got to do something for them. I think our association could play an important role in bringing these companies abroad,” he tells The Edge in a phone interview.

An industry association whose members comprise companies incorporated in Malaysia and individuals who are involved directly or related to the semiconductor industry, electronics systems and products, automation, medical devices and their industry supply chain, MSIA was officially registered in January this year.

According to Wong, MSIA aims to be the collective voice of the semiconductor and electronics industry, as E&E industry players in Malaysia need representation, having been previously represented by their respective countries’ chambers of commerce but not as an industry.

For instance, German companies are aided by the Malaysian-German Chamber of Commerce and Industry, the Americans by the American Malaysian Chamber of Commerce, and the Japanese by the Japanese Chamber of Trade & Industry, Malaysia.

“The local companies, basically, have no voice and they are loosely organised. So, we decided that it is time for the Malaysian E&E industry to be properly represented,” Wong explains.

Currently, MSIA’s members include Bursa Malaysia-listed companies Inari Amertron Bhd, Greatech Technology Bhd, JF Technology Bhd, Globetronics Technology Bhd, ViTrox Corp Bhd, Pentamaster Corp Bhd, UWC Bhd, QES Group Bhd and K-One Technology Bhd.

Its MNC members include Intel, Dell, Lam Research, Micron, Broadcom, Jabil, Hotayi Electronic, Renesas, Texas Instruments, Infineon, Agilent Technologies, Keysight Technologies, Osram, Western Digital and Analog Devices.

“Today, our association has about 110 members, which I think is quite remarkable considering that we just started less than six months ago. We have companies from not just Malaysia but also the US, Europe, Canada, Taiwan, Japan and China. As long as you are in the major supply chains of the E&E sector, you’re welcome to join us,” he says.

Including Wong, a total of 18 members from various states throughout the country sit on the MSIA board. Datuk P’ng Soo Hong — vice-president (VP) and managing director of manufacturing operations at First Solar Malaysia Sdn Bhd — is the association’s VP1 while Datuk Lim Yong Jin, a former regional president for Asia-Pacific at Plexus Corp, is VP2.

Other board members include Inari CEO Lau Kean Cheong, Greatech CEO Tan Eng Kee and JF Tech CEO Dillon Atma Singh.

Wong observes that over the years, the government and E&E industry players had talked about forming a nationwide semiconductor association, but nobody really had the purpose and energy to do it — that is, until the pandemic hit.

“Many companies didn’t know what to do during the lockdown and they needed help to move forward. It was then that they realised they must do something about it. Fortunately, with the support and encouragement from the Malaysia Productivity Corp (MPC), Ministry of International Trade and Industry (Miti), Malaysian Investment Development Authority (Mida), Economic Planning Unit (EPU) and Bank Negara Malaysia, we successfully formed the MSIA early this year.”

MSIA’s four main objectives are: Firstly, to strategically develop the country’s semiconductor industry by nurturing and growing a complete semiconductor ecosystem; secondly, to elevate the global market position and value chain of local semiconductor companies by enhancing their capabilities and capacities; thirdly, to highlight the industry’s challenges and build positive relationships with the government and its agencies, as well as other industry associations and chambers of commerce; and lastly, to collaborate with the government on the formulation of strategies and policy advocacy to enable Malaysia’s semiconductor industry to be globally competitive.

Wong says MSIA has already got the ball rolling. Even before the association was officially formed, MSIA and the Electrical & Electronics Productivity Nexus (EEPN) — of which Wong is also chairman — launched the Electrical and Electronics Marketplace Malaysia (EEMM) in November 2020.

The EEMM is a business-to-business (B2B) online marketplace portal specifically developed for the E&E industry in Malaysia, with the objective of helping local companies gain access to the global market.

“The portal is live. Once we get more local companies to sign up, which is free for the first two years, it will be easier for foreign companies to search and find out more about them. Today, most of the marketplace operators take commissions, but we don’t. Our only intention is to promote the local companies, and if foreign companies want to do deals with them, they can go direct [to them] as we don’t get involved,” Wong stresses.

Those who are familiar with the E&E industry know that Malaysia is a key player in the global semiconductor supply chain, and that it is the largest semiconductor trading partner of the US — the undisputed technology leader in advanced semiconductor chip design.

About 7% of total global semiconductor trade flows through Malaysia, while US trade with Malaysia accounts for 24% of all US semiconductor global trade. In fact, the US imports more semiconductors directly from Malaysia than from any other country.

That is why MSIA is in the midst of working together with the Malaysia External Trade Development Corporation (Matrade) to organise a programme dubbed Semicon Connect, which will provide business matching between Malaysian E&E companies and targeted global customers and markets.

“We will ask the Malaysian companies which customers, market segments and sub-sectors that they want to go into, and we will try to link them with the potential customers,” Wong explains.

Before the pandemic, he recalls, trade fairs and exhibitions were regularly held. But today, as most countries have imposed travel restrictions, many local companies, especially the smaller ones, need help in business matching.

“We plan to launch Semicon Connect in the second half of the year. Our pilot project is to focus on the US market only. For example, if you want to get in touch with an American electric vehicle company, we could help you. If successful, we could go to other countries, possibly Europe, next year. Like it or not, the chambers of commerce only focus on their own agenda in Malaysia. But in the MSIA, we will be helping each other. We are all in the same team, the Malaysian E&E team,” Wong declares.

Creating the ‘Inari waterfall effect’

Wong points out that MSIA is also collaborating with EEPN to encourage big corporations, be they local or foreign, to buy local.

“We hope to create what I call the ‘Inari waterfall effect’. Over the last five years, Inari has bought more than RM2.5 billion worth of equipment from local companies. And that’s just Inari alone. There are also foreign MNCs that are doing the same, which benefits a lot of local companies and they now have a chance to go global.”

Moreover, he observes that MNCs are operating manufacturing facilities all over the world, and they may be using similar equipment that the local companies are currently supplying to them in Malaysia.

“That’s why we are trying to promote ‘buy local’, especially in the areas of automation and test equipment, which I think our local companies are very capable in, and they could beat the rest of the world. If you look at their quality, service, pricing … I’m very confident that they can do it.”

Wong points out that as the US, China, Taiwan and South Korea are announcing multibillion-dollar plans to strengthen their positions in the semiconductor space, there will be plenty of business opportunities for local companies to capture.

“We want to make sure that the small companies can grow together with the big companies, and the local companies can grow together with the MNCs. Technology is changing rapidly nowadays, so everyone must grow together,” he urges.

Source: The Edge Markets