Pantech eyes better valuation with manufacturing unit IPO

31 Jul 2024

PANTECH Group Holdings Bhd (KL:PANTECH) is working towards the listing of two of its five manufacturing units on Bursa Malaysia as soon as practicable, in a move aimed at raising funds for expansion as well as gaining the group recognition as a maker of steel products rather than just a trader.

“The new listco is intended to uplift our profile as a global manufacturing business among new overseas clients since Pantech Group has historically been known as a trading company. Looking at the group’s historical price-earnings ratio (PER) of about seven to nine times, that shows us that Pantech is still regarded as a trading company, even with very viable manufacturing operations,” Pantech Group executive director Adrian Tan tells The Edge in an interview ahead of the group’s annual general meeting (AGM) on July 30.

Given Pantech’s financial performance, he says the group should be trading at “more than 10 times” PE multiples rather than single digits (see profitability chart).

“Internally, we have earmarked and prepared key personnel to move over to the new listed company (listco),” he adds, noting that an extraordinary general meeting (EGM) for shareholders’ approval will only be called once regulatory approval has been received.

When asked if the listing would happen this year, Tan says: “We are working diligently to secure all necessary approvals and will make the necessary announcements once more details are confirmed [or when there are updates from] the regulator.”

Going by the typical timelines for corporate exercises, if regulatory approval does not come within the next three months, it is likely that the listing will happen next year at the earliest as there needs to be 21 days’ notice to call an EGM and time to prepare the circular to shareholders. Tan declines to provide a timeline for the exercise.

In Pantech’s announcement to the stock exchange on April 25, the company said “it is essential for shareholders to note that the proposed listing may or may not realise as there is no guarantee that the required approvals would be obtained or the proposed listing [of Pantech Stainless & Alloy Industries Sdn Bhd (PSA) and Pantech Steel Industries Sdn Bhd (PSI)] will proceed”.

Tan says Pantech has submitted documents to the Securities Commission Malaysia (SC) to secure approval for the listing and is awaiting the green light. While the proposed exercise is not on its July 30 AGM agenda, the management expects to field questions on it.

He explains that the objective of the listing is to derive better valuations for the group’s two 100%-owned global manufacturing units PSA and PSI, which are “doing extremely well, have good margins and collectively contribute about 70% to the group’s manufacturing division”.

Main Market-listed Pantech has two main divisions, trading and manufacturing, both of which contribute almost equally to group revenue.

Pantech supplies products such as pipes, valves and fittings (PVF) flanges and other fluid transmission-related products to its customers in various industries locally and overseas. For the overseas market, 20% of revenue comes from its trading division and 70% from manufacturing. Its three biggest export markets are the US, Europe (Pantech owns UK-based Nautic Steels Ltd, which supplies to the continent) and the Middle East.

“We have been looking at expanding into South America and Africa. Pantech has established markets in the US and Europe, where we receive steady streams of orders. We are growing our South America presence for our products and hoping to make further inroads into the North African region. There is also interest from Egypt and Tunisia, so we’re hopeful about that,” says Tan.

On the proposed listco’s prospects, he says PSA and PSI serve about 30 export markets.

“The margins are good. Gross margins for the global business are at least 30% with sustainable net margins of 10% and 11%. The net margin for the group, as a whole, was 11% in FY2024. A few smaller manufacturing companies cater mainly to the local market and neighbouring countries, namely Thailand and Indonesia.”

Tan declines to elaborate on how much the flotation exercise is expected to raise or the likely market capitalisation of the listco but does say the proceeds will help the latter’s expansion plans.

“The listco will buy over Pantech’s manufacturing plants in Johor and Klang, which are currently being rented. The IPO proceeds will also be used to acquire technological upgrades to boost manufacturing capacity by another 20% to 25%. Some of the equipment needs to be modernised so as to reduce over-reliance on labour,” says Tan, declining to divulge the capital expenditure involved.

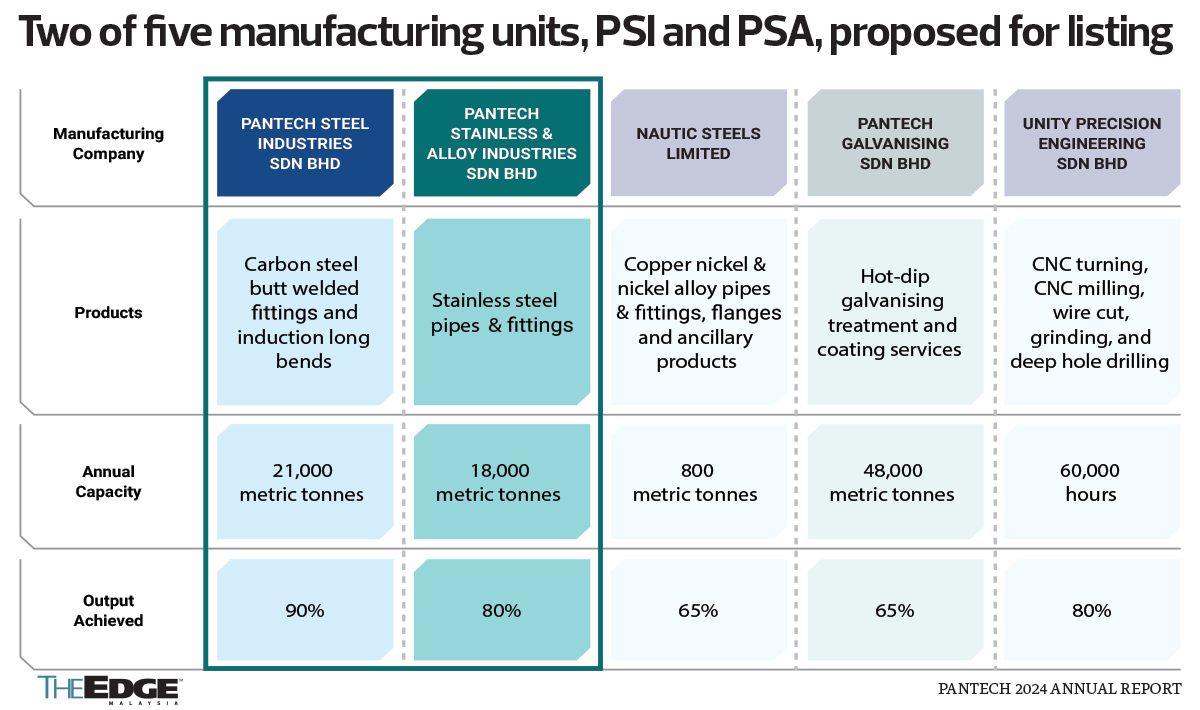

According to Pantech’s 2024 annual report, PSA and PSI had annual capacities of 21,000 tonnes and 18,000 tonnes, and had achieved 90% and 80% output respectively. In terms of tonnage, the companies make up nearly half of the 87,800-tonne total capacity at four of its manufacturing units. A fifth manufacturing unit, Unity Precision Engineering Sdn Bhd, has an annual capacity of 60,000 hours with 80% output achieved (see table). Pantech’s trading arm has a portfolio of more than 30,000 PVFs and ancillary products sourced globally, which make up an inventory worth RM198.11 million and contributed revenue of RM510.98 million to the group in FY2024. The manufacturing division contributed RM435.65 million.

It owns another facility in Johor following the acquisition of metal precision machining, engineering and turnkey solutions outfit Unity Precision Engineering Sdn Bhd for RM13 million in 2022. It also owns a galvanising plant in Johor and a plant in the UK, Nautic Steels, that produces fittings in special metals (copper nickel & nickel alloy).

Pantech was certified as one of only two companies operating in Malaysia to be genuine manufacturers of carbon steel buttweld fittings, in anti-circumvention crackdowns by the US Department of Commerce in 2018 and by the European Union (EU) in 2022.

“Pantech was only serving about a handful of European customers when the EU’s crackdown took place. But we gained new customers after being cleared by the authorities,” Tan points out.

Locally, the group has enjoyed a steady flow of orders from the engineering, procurement and construction contractors of projects such as that of Sarawak Shell Bhd at the F22, F27 and Selasih (FaS) gas field development off the coast of Sarawak as well as Petroliam Nasional Bhd’s Kasawari 1, a carbon capture and storage project, located off Sarawak, and the Jerun gas field development, also in the state.

“This past [financial] year, we have been doing rather well because there have been lots of projects like FaS. We supplied to Petroliam Nasional Bhd’s Kasawari 1, and we’re now on to Kasawari 2, to which we will continue to supply until its completion later this year,” says Tan.

“Contributions from the oil and gas sector still make up 40% of Pantech’s local maintenance orders as players have a major turnaround every three to four years alongside regular upkeep every six months. One of these projects, for instance, will need its maintenance next year so we have to be prepared to take their orders on.”

As at June 30, 2024, Pantech’s order book stood at RM400 million, with deliveries expected to be completed by next February.

For the fourth quarter ended Feb 29, 2024 (4QFY2024), Pantech registered a 21.6% higher net profit of RM28.7 million from RM23.6 million last year, on a 16.6% improvement in revenue to RM229.7 million. However, because of softer sales and lower average selling prices (ASPs), FY2024’s net profit of RM105.3 million was 9% lower than the RM115.6 million in FY2023. Revenue was 8.8% weaker y-o-y at RM946.3 million.

Tan explains that there was a sharp increase in freight rates in 2022 and in the price of raw materials then because of the Russia-Ukraine war, leading to a significant increase in ASP. “But [FY2024] was stable, with lower ASP and lower raw material prices, such that Pantech has continued to make good profits.

“In terms of revenue growth, we’re confident of a 10% increase in FY2025,” Tan adds, without commenting on earnings.

While Pantech does not have a dividend policy, it typically pays out 40% to 50% of its profits to shareholders. When the pandemic broke out, the group continued to pay out 1.89 sen and 2.3 sen a share in FY2020 and FY2021 respectively. It raised the annual payout to four sen a share in FY2022, followed by a record high of six sen a share in FY2023 and FY2024.

Impact on Pantech, prospects for listco

Although Pantech has yet to announce details on the proposed IPO, fund managers and an analyst whom The Edge spoke to believe there will be an issuance of new shares for the listco. This, they say, could have a dilutive impact on Pantech’s earnings, thus lowering profit attributable to its shareholders and causing downward pressure to the share price.

Year to date, Pantech has risen 23.3% to close at RM1.11 last Wednesday (July 17), reflecting a PER of 8.76 times.

“To make up for the shares carved out for the spin-off, Pantech will need at least 30% to 40% in earnings growth next year. Pantech’s anticipated capacity boost of 20% to 25% will help, otherwise earnings per share could drop substantially. But looking at Pantech’s strong balance sheet, I believe it can still pay annual dividends of six sen per share for the next three years and still be in a net cash position,” surmises the analyst, who declines to be named.

“For a counter related to the oil and gas industry, a dividend yield of 5.5% makes Pantech a great dividend stock, even if it is categorised as part of the industrial products and services index,” the analyst says.

The fund managers and analysts believe that the listco will garner investor interest if priced well, given that Pantech has built a commendable export business.

“We still don’t know the indicative PE for the listco, but assuming it will be at 12 times looking at other similar manufacturers of steel products which are trading averagely at a forward PE of 10.5 times, I would ascribe a premium to Pantech’s spin-off based on its historical performance. I would say that’s a fair PE for the listco,” says the analyst, who remains “neutral” on the listing based on a lack of concrete details and the expected dilution to EPS.

Bloomberg data shows that the two analysts covering the stock have “buy” calls with target prices of RM1.23 and RM1.35, indicating upside of at least 10.8%. But that is without pricing in the impact of the flotation exercise, given scant information on the matter.

“Management probably thinks a separate listing for the manufacturing division could give it a better valuation than what it is getting … Sometimes, splitting the company could be for succession planning such as enabling family members to take charge of the separate entities. Only time will tell [the real reason],” observes a fund manager.

Source: The Edge Malaysia