This site

is mobile

responsive

The new era of trade is being accelerated by the progress of globalisation, economic liberalisation, and the rapid advancement of information and communication technology (ICT). Services, in particular, have emerged as a dominating force in today’s trade, becoming an important engine for economic development.

In Malaysia, the services sector accounts for the most significant share of the country’s Gross Domestic Product (GDP), representing 57.7 per cent in 2019. This sector also has a huge impact on the development and growth of other industries, thus complementing the country’s overall economic performance.

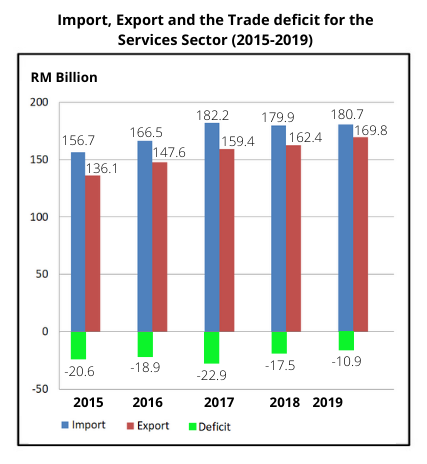

Nonetheless, Malaysia is a net importer of services rendered by foreign service providers. This means that residents are paying to utilise services provided by non-residents, which has resulted in a services trade deficit. According to the Department of Statistics Malaysia (DOSM), Malaysia has recorded a deficit in services trade current account since 1947, except for the period between 2007 and 2011.

Taking the case of 2019, Malaysia’s export of services reached a record high of RM169.8 billion, but the import of services amounted to RM180.7 billion, which translates to a trade deficit of RM10.9 billion.

Nonetheless, this shortfall is at its lowest deficit level in the past five years, primarily due to a slowdown of construction activities in the country following the completion of oil and gas related mega projects and the lack of new mega projects thereafter. This trade deficit is also contributed by payment for services to shipping companies and foreign airlines, as well as the use of intellectual property, insurance and pension services.

Traditionally, Malaysia’s services exports are highly concentrated in the travel industry. Hence, the improvements of Malaysia’s export of services in 2019 was contributed by favourable performance in air transport, given the increase of international air passengers due to the expansion of low-cost carriers and direct flights to international routes. This, coupled with better performance in the contract manufacturing industry eased the deficit impact to the international trade in services account.

However, given the widespread impact of the COVID-19 pandemic, it is forecasted that there will be repercussions on the trade in services account in 2020 as a result of travel restrictions and weaker market demands. Recognising these challenges, the Malaysian Investment Development Authority (MIDA) is intensifying its efforts to diversify and identify niche industries that may benefit from the current scenario to bolster Malaysia’s exports of services going forward.

MIDA is focusing on attracting more investment-based services to set up their operations in Malaysia. This is expected to indirectly contribute to higher exports and import substitutions. Among these investment-based services include maintenance, repair and overhaul (MRO) operations, regional establishments, healthcare, green technology, logistics and tourism.

On the domestic investments front, MIDA continues to encourage the growth and strengthening of capabilities of local service providers through various initiatives such as:

As Malaysia’s lead agency for investments and industrial development, MIDA has a long track record of supporting both domestic and international businesses as they explore new growth opportunities in the country and beyond.

Investors are encouraged to fully utilise MIDA’s assistance and facilitation to plan, kick-start, implement and expand their projects in the country efficiently and successfully.