Forest City designated Special Financial Zone (SFZ) status will induce Foreign Direct Investment (FDI) into Johor, provided its incentives are strategically programmed.

Globus Holdings Limited (HK) director Faez Jumabhoy said the incentives should align strategically to lower costs and facilitate business operations conducive to Johor’s growth.

The veteran in international real estate and banking, with over 30 years’ experience, shared his views on how Johor would benefit from the SFZ status.

He said Forest City’s SFZ status held potential to complement Singapore, which is a financial hub reachable via the SecondLink, while Johor leveraged on its extensive air and sea-port infrastructure.

SFZs and Special Economic Zone (SEZ) that are supported by neighbouring countries’ respective governments were more likely to succeed in a shorter time frame, due to coordinated planning for mutual advantages.

Singapore and Zurich recently topped the Economist Intelligence Unit’s 2023 Worldwide Cost of Living survey.

With both governments’ sponsorship (Malaysia-Singapore), Johor may serve to ease some of the cost of living and inflationary pressures faced.

“The cost of living in Johor is also significantly lower with diverse educational institutions, retail malls, recreations and water parks, even without taking into account the currency exchange rate,” he said.

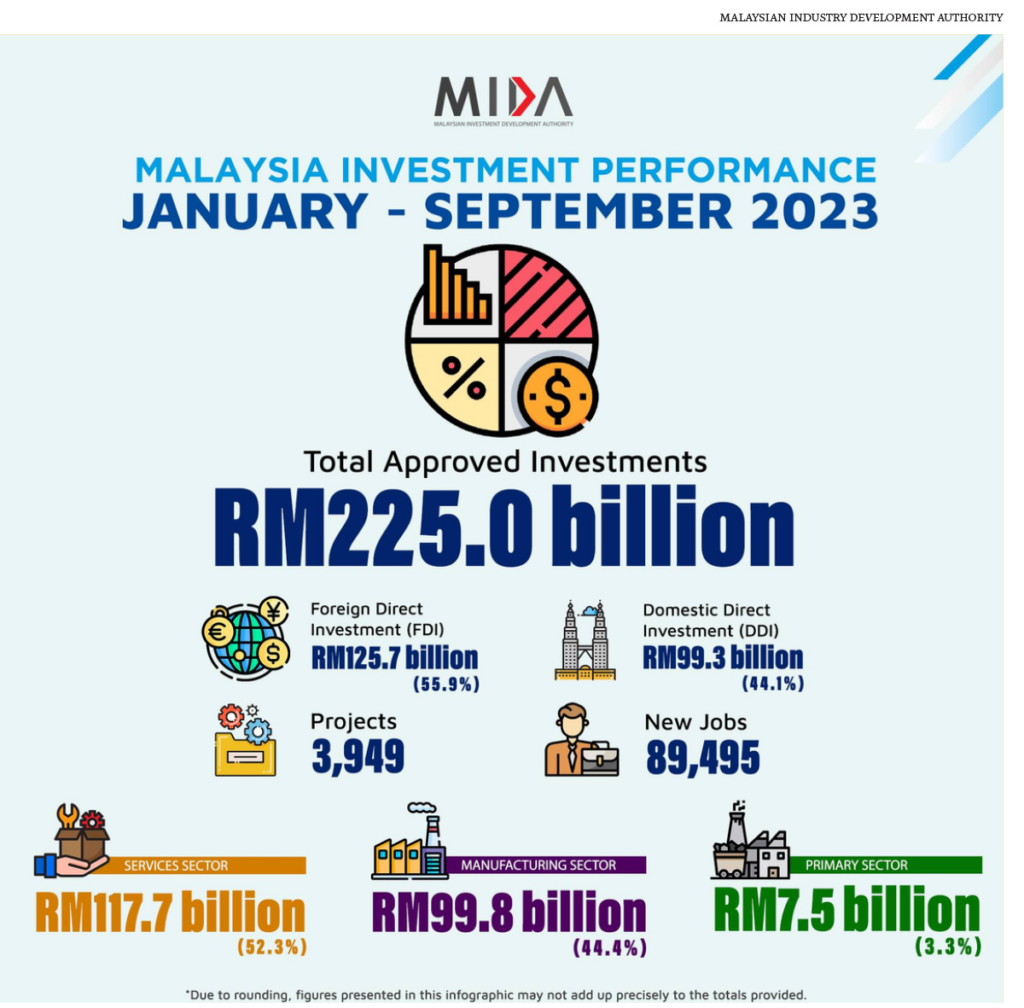

He added that Malaysia had a strong and diverse economy that was not solely dependent on any one particular source of revenue.

It also offers excellent air and sea ports in strategic locations that affords opportunities for foreign investors when bundled with the right set of incentives and policies.

Faez said Forest City SFZ would have a multiplier effect on domestic markets and economies, benefiting society in the long run.

Source: NST

Forest City’s SFZ expected to yield economic benefits for Johor

Content Type:

Duration: