Malaysia’s efforts to bring in foreign investors appear to be paying off, going by the slew of investment announcements involving big names and significant sums this year, from Amazon cloud unit’s US$6 billion planned investment here by 2037 announced in March to July’s announcement of Chinese automotive player Geely’s US$10 billion outlay to transform Tanjung Malim, Perak, into the region’s largest auto city.

Not forgetting also US semiconductor giant Texas Instruments’ RM14.6 billion expansion plan announced in June, followed by Tesla’s announcement in July of a strategic expansion into the Malaysian market, and the more recent AI facility venture that will see US chip giant Nvidia coming here.

In terms of total approved investments that comprise both domestic and foreign investments, the country has, from the start of the year till end-September, recorded RM225 billion worth of investments — the highest January-September cumulative sum in the last 10 years. The sum is 6.6% more than the RM211 billion that was recorded in the corresponding nine months in 2022.

The achievement is viewed positively by economists as they feel the Unity Government has managed to continue Malaysia’s trend of strong approved investment performance following the Covid-19 pandemic, but that same positivity is moderated by their expectation that plenty more needs to be done — both in facilitating the realisation of these investments, and attracting more investments.

Malaysia’s share of private investments or realised approved investments, in relation to the GDP, which has been dropping since 2017, has yet to recover to pre-pandemic levels. Sustainable economic growth is driven by private investments and savings, rather than consumption and government spending.

“It is heartening to see that (the approved investments) continues to remain at a high level as investments are one of the key indicators for the current year and future growth prospects,” said Sunway University Business School professor of economics Dr Yeah Kim Leng.

This elevated investment performance will boost investor confidence, economic growth and the national transformation to higher value-added activities via investments, predominantly in the medium- to high-tech space, he said.

Furthermore, he noted that Putrajaya had kept to its commitment of moving the share of investments between foreign and domestic sources closer to an equilibrium, with approved investments for 9M2023 comprising 55.9% (RM125.7 billion) foreign direct investment (FDI) and 44.1% (RM99.3 billion) domestic direct investment (DDI) .

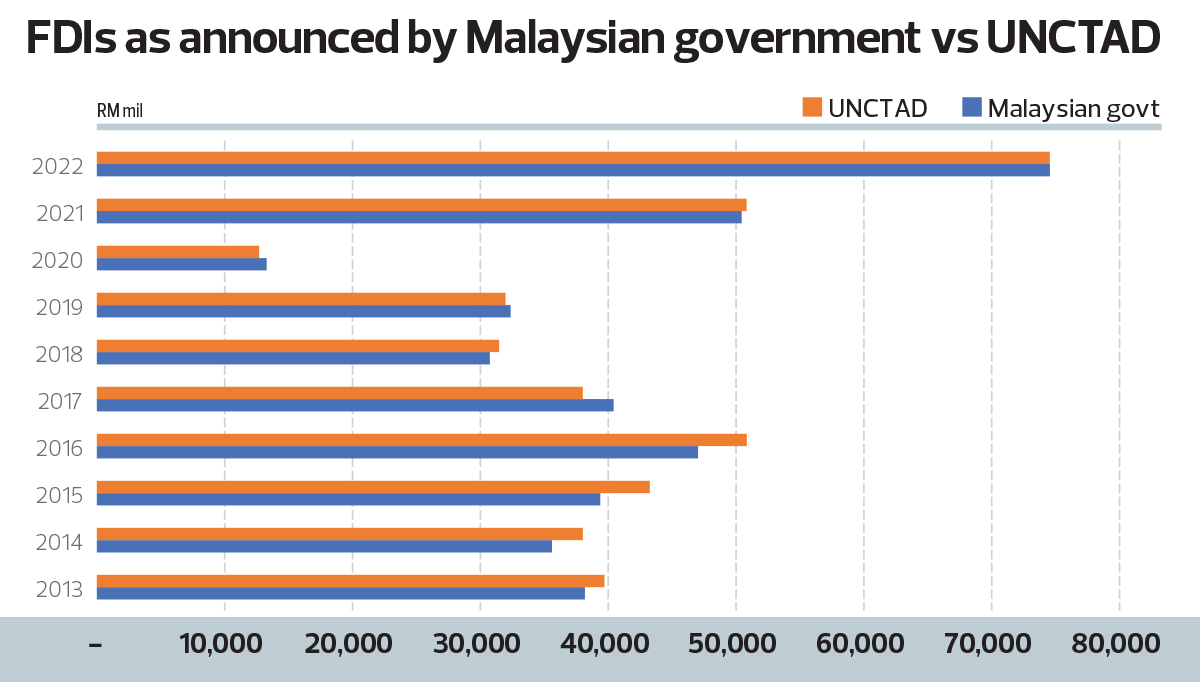

In comparison, FDI made up 61% (RM163.3 billion) of approved investments last year with 39% (RM104.4 billion) DDI. Note, however, the approved FDI figure of RM163.3 billion was still short of the RM230.07 billion committed FDI announced by the government last year, suggesting that some investments remained in the pipeline.

Malaysia must walk the talk and act quickly

Even after investments have been approved, a lot has to be done on the government’s part to translate these investments into realised investments that can in turn positively impact the economy, said Socio-Economic Research Centre (SERC) executive director Lee Heng Guie.

So, walking the talk to make sure committed and approved investments are realised is key.

In October, Minister of Investment, Trade and Industry Tengku Datuk Seri Zafrul Abdul Aziz said only close to 80% or RM593.5 billion of the RM753.9 billion in approved investments between 2018 and June 2023 were successfully implemented.

Given Malaysia’s past performance, SERC’s Lee expects only 80% of the country’s approved investments this year to be realised. A lot is dependent on the government’s efforts in facilitating the implementation of the investments.

“Depending on the type of investment — brown or greenfield — it will be realised at different rates. Greenfield investments will take longer as investors will have to look for land and build a factory, this will take time. Hopefully, the government realises this and understands the urgency for them — federal, state and local authorities — to work together.

“These investments have been approved, so make sure they get the best support and facilitation until their projects commence operations. I am sure MITI (the Ministry of Investment, Trade and Industry) continues to monitor the progress and provides policy intervention as necessary,” Lee said.

In other words, while approved investments serve as a good indicator of private investment levels that can be expected in the years ahead, these investments may still fall through or be delayed due to unexpected risks.

Aside from the possible lack of facilitation on the part of the government, external factors, such as the potential US recession that looms on the horizon, may derail investment plans.

Such a risk, coupled with a moderating implementation pace may result in a drop in approved realised investments to 70%, said Yeah.

“The most important is to ensure that the facilitation of the investments is expeditious, as the quicker they are realised the less impact external developments will have in the event of a change in the form of an adverse downturn,” he added.

Malaysia still lagging behind its neighbours

It is worth noting also that despite its record nine-month approved investments achieved this year, Malaysia is behind its regional neighbours when it comes to gross fixed capital formation (GFCF) relative to GDP, which measures how much of the new value that is added in an economy is invested rather than consumed.

“This is one of the key structural issues that has plagued the Malaysian economy,” Bank Muamalat Malaysia Bhd chief economist Dr Mohd Afzanizam Abdul Rashid said.

Generally, the higher the GFCF, the higher a country’s productivity growth tends to be, and in turn its GDP growth. Hence, it is considered a meaningful indicator of future business activity, business confidence and economic growth patterns.

According to the World Bank, Malaysia is behind its neighbours with a GFCF of 18.23% in 2022, while other Asean member states range between a low of 20.64% (Singapore) and a high of 31.44% (Myanmar). In contrast, Malaysia had a much higher GFCF in the early 1990s before the Asian Financial Crisis, at above 40%.

An optimum GCFC level for an economy ranges between 25% to 30%, said Sunway University’s Yeah, to allow for a good balance of consumption and investment.

This suggests there is still room for Putrajaya to push the dial in attracting more private investments or invest more from its coffers — something which its fiscal space, unfortunately, does not warrant.

Another systemic issue is Malaysia’s sizeable reliance on unskilled labour, which results in the nation’s labour productivity growth declining, hence the economy is not growing at its full potential.

“To unlock this potential, the government needs to put its money into (building up) the right resources so that the economy becomes highly competitive and be able to grow much faster. According to World Bank data, the share of Malaysia’s research and development (R&D) spending to GDP is about 0.95% in 2020. This was in stark contrast to South Korea (4.8%), China (2.41%) and Singapore (1.89%),” Afzanizam said.

“Clearly, the government needs to invest more in education, be it from primary to tertiary education. We also need to invest in healthcare so that our society is healthy to work and do business. And that goes hand in hand with good infrastructure that facilitates the country’s productivity journey,” he added.

Source: The Edge Malaysia

Malaysia makes good start wooing some big names over, but it has lots more to do

Content Type:

Duration: