HQ 2.0: The Next-Generation Command Centre

This site

is mobile

responsive

In the wake of today’s ever-changing business needs, multinational corporations (MNCs) are reconfiguring their headquarters by splitting head office functions to align more closely to where business needs are in markets outside their home territory. MNCs are dividing their corporate centre structures to offshore locations by relocatingfunctional leadership and shared services functions that are involved in decision-making roles.

This rising trend of MNCs building a ‘second hub outside home’ to house their senior leadership team is based on the principle that having the right people is more important than where the company is located, as long as travel costs and communication between multiple sites are efficiently well-managed.

Dividing these hubs provides closer proximity to customers and supply chains, improves operational efficiency, and optimises the quality of products and services while achieving speed to market more cost-effectively. All of these factors are likely to shape not just where, but how business hubs will operate around the globe for decades to come.

MNCs are on a search for a location to build hubs that will support global operations such as sourcing and procurement including selecting suppliers, managing terms and pricing of contracts, planning product capacity, centralising distribution of products, and consolidating shared services functions.

These organisations are getting more sophisticated in choosing different cities to house their various business units, each running independently. It is clear that decision-making dynamics have begun to change and that multinationals are adopting a migratory shift to bundle key support services for specific business units into one single location. Despite the stiff competition with neighbouring countries, Malaysia’s position stands out strongly in continuing to attract MNCs to set up their hubs within the ASEAN region.

A Seismic Shift in How Hubs Diverge

Interestingly, what has become more evident in the last couple of years is the ‘divergence of hub structures’ is being streamlined more and more by infusing digital technology.

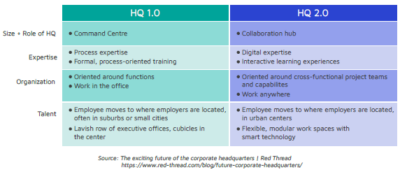

New forces of change are bringing about “leaner” hub structures that are focused on essential strategic and innovative business functions. Instead of operating a command centre, the new breed of headquarters will serve as a dynamic collaboration hub, connecting professionals from cross-functional departments. Instead of solely focusing on process expertise, hubs will now emphasise digital expertise and interactive solutions.

Although headquarter hubs will continue to provide centralised functional support, it will be a smaller and leaner unit composed of truly critical and strategic services. Automation will strip away transactional work, leaving behind only strategic work functions that leaders have long aspired to deliver.

By incorporating new digital tools, such as Robotic Process Automation (RPA), natural language processing, and cognitive computing, hubs will become more productive and easily scalable. Thus, as the volume of transactional work shrinks, these traditional command centres will either be upgraded or repurposed to perform higher-value work.

In tandem with more work being automated, PwC estimates that the cost of headquarter hubs will shrink by 25 per cent to 40 per cent within the next five years. Although this will require additional investments in IT, these costs can still be offset by reduced complexity and staff numbers.

Digital Talents are Hub Catalysts

For most MNCs, C-Suites have always been at the heart of command centres. Though the role of C-Suites will continue to evolve, there will be a greater emphasis on strategic planning.

Rather than merely exerting control over business units, the C-Suite’s focus will shift to attracting, retaining, and developing the right talent while transitioning lower-value work away from the HQ. In addition, there is an increasing concentration on driving strategy towards capabilities that differentiate the company from its competitors such as leveraging data to make informed decisions, and using Artificial Intelligence (AI) and automation to increase innovation and efficiency.

This transformation of the role of the headquarters and its scope of work will create a major shift in the recruitment, development, and deployment of talent, where the most critical skills will be digital, analytical, and communication-oriented.

Whereas past strategies concentrated on recruiting an army of basic functional talents. MNCs are now increasingly on the lookout for specialised experts with know-how of relevant digital technologies, such as data scientists, digital engineers, and analytics experts.

Introducing HQ 2.0

Headquarters 2.0 (HQ2.0) are hubs that apply digital advances such as RPA and AI, which make new types of automated activities possible, thus eliminating a large portion of the work that these business units perform by simplifying fast work processes, utilising robust tools and technology, adopting flexibility and collaboration, which will allow the new generation of talent to work from anywhere.

The combination of new digital Industry 4.0–style platforms, robotics, intelligent machines, and advanced analytics is allowing MNCs to harness the explosion of data and fundamentally alter how and where work gets done.

Malaysia’s value proposition in the heart of Southeast Asia puts the country in a viable position to play the role of host for MNCs to house their digital headquarters in this part of the region.

American medical technology company Edwards Lifesciences (Edwards), which is a global leader in patient-focused innovations for structural heart disease and critical care monitoring, recently set up an analytics Centre of Excellence in Kuala Lumpur to attract employees with expertise in AI and machine learning, data management, and big data analytics (BDA) to better serve their Japan and the Asia Pacific (JAPAC) markets. Another recent example is Huawei, a major tech giant which has invested and made significant contributions to the growth in Malaysia’s ICT industry over the past 20 years.

Having initially established its operations in 2001 to provide training and technical support services, Huawei has since expanded its investments in the country through the establishment of its Global Operational Headquarters (GOHQ) which leads the strategic direction of the Group’s business in the Asia Pacific region and beyond.

In 2021, Huawei further expanded its GOHQ’s functions with additional business activities including the establishment of the Cloud and AI Business Group to undertake their Digital Infrastructure Hub, Digital Talent Hub, and Digital Ecosystem Hub initiatives.

This project will also involve the evolution of the GOHQ as a Regional 5G Capability Centre, preparing for the deployment of 5G in Malaysia that is expected to be ready by 2022.

In 2021, MIDA introduced the Principal Hub 3.0 (PH3.0) Tax Incentive Scheme, which aims to support companies to set up or expand their international and regional headquarter activities within Malaysia.

Similarly, another newly announced scheme under Budget 2021 to attract more MNCs to set up their global trading hubs in Malaysia is the Global Trading Center (GTC) Tax Incentive Scheme, which is targeted at bringing in more procurement and distribution hubs to further support global supply chains.

Both the PH3.0 and GTC offer attractive tax breaks of up to 10 years, and are available for companies that submit their applications to MIDA by 31 December 2022. Businesses that are keen to make the move here are encouraged to explore these business incentives offered by the Malaysian Government.

MIDA is ever ready to assist businesses which are looking to enter and/or expand in Southeast Asia, and that are looking to establish business hubs in Malaysia. More information on how we can further assist can be obtained by reaching out to the Business Services and Regional Operations Division of MIDA.