This site

is mobile

responsive

Understanding Investment Data

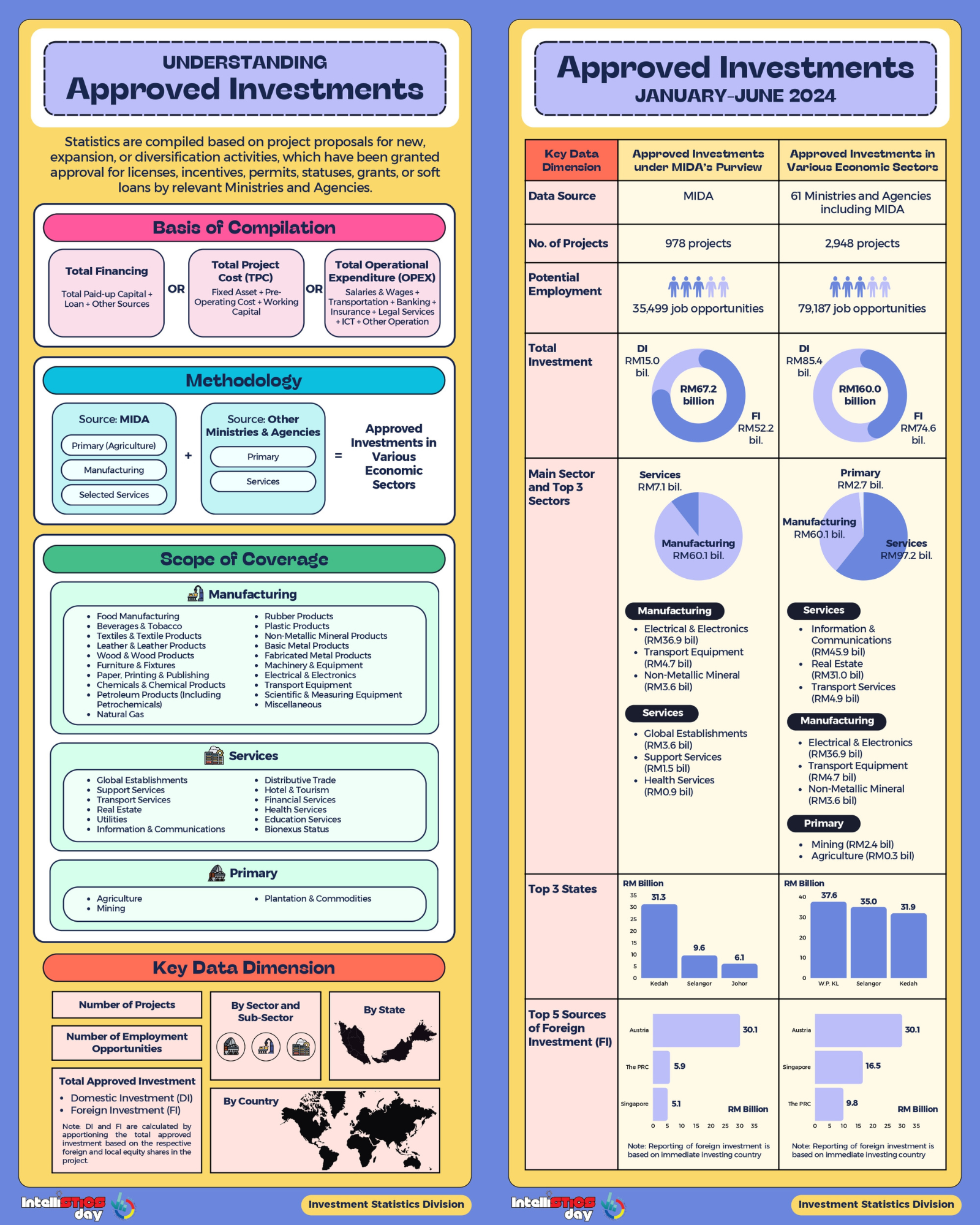

Understanding Approved Investment

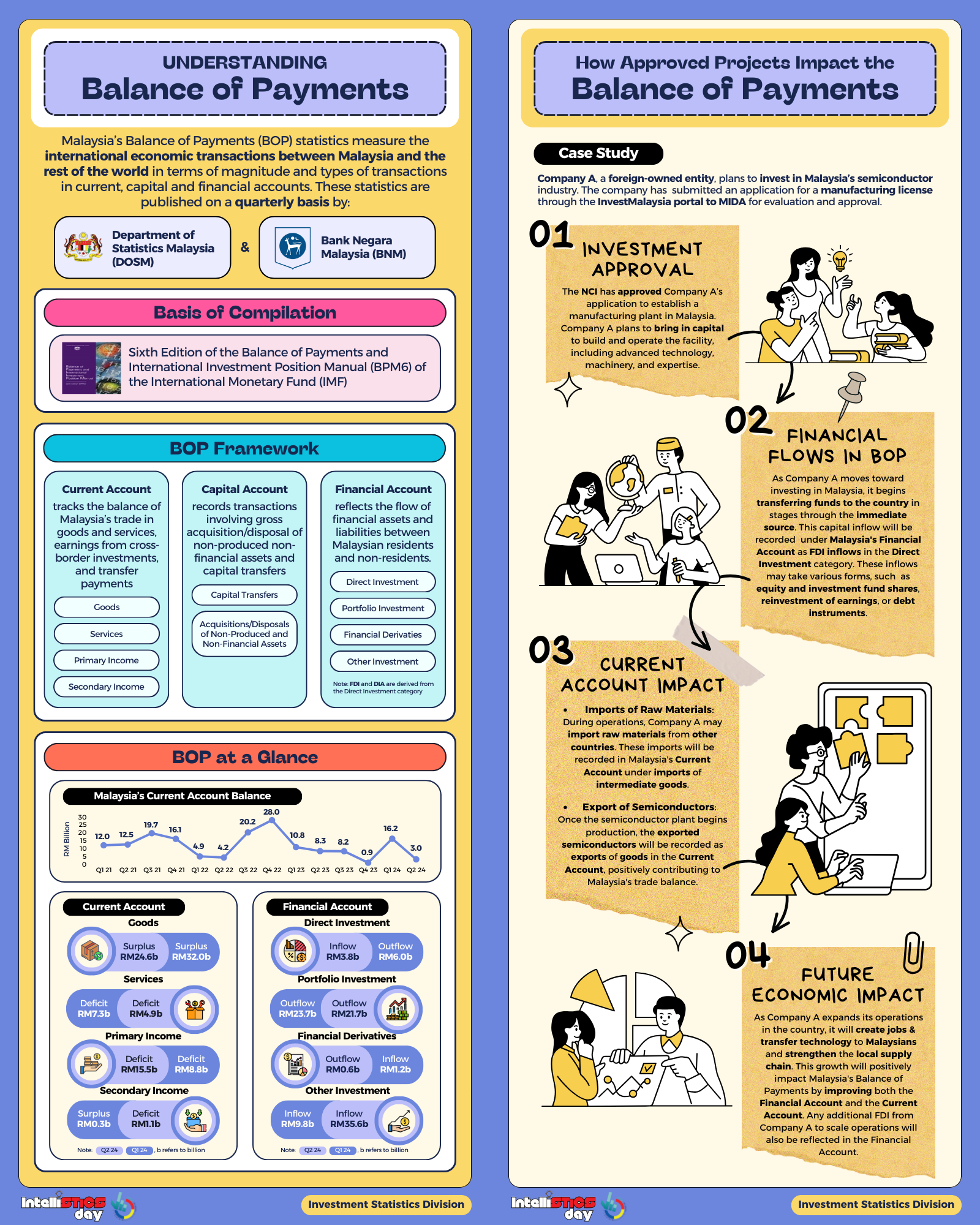

Understanding Balance of Payments

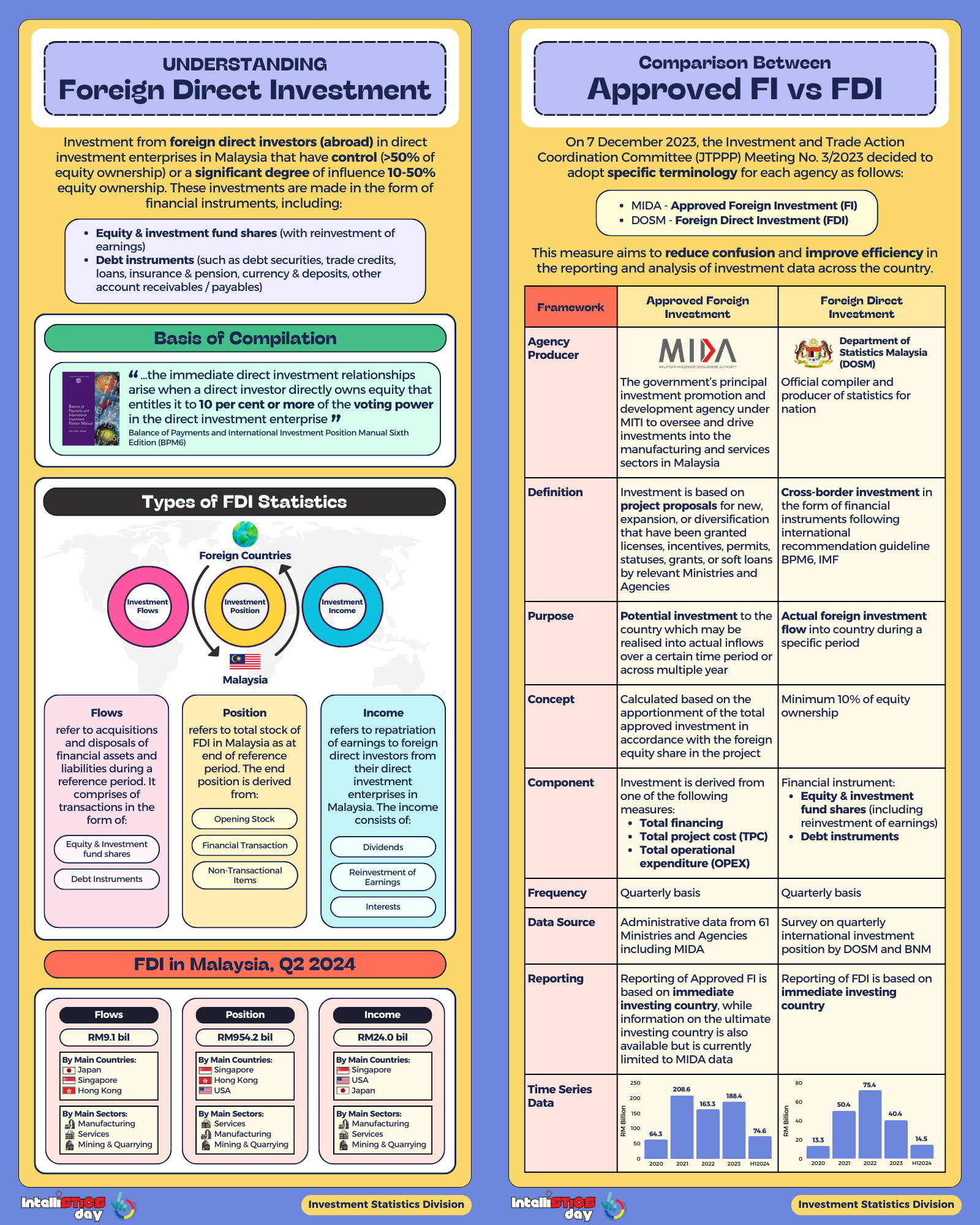

Understanding FDI vs Approved FI

Approved Investments (Overall)

Approved Private Investments in Various Economic Sectors, January-September 2025 / January-September 2025 / January-December 2024

| Summary | Number | Potential Employment | Domestic Investment (RM million)* |

Foreign Investment (RM million)* |

Total Capital Investment (RM million)* |

||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Jan-Sept, 2025 | Jan-Sept, 2024 | Jan-Dec, 2024 (R) | Jan-Sept, 2025 | Jan-Sept, 2024 | Jan-Dec, 2024 (R) | Jan-Sept, 2025 | Jan-Sept, 2024 | Jan-Dec, 2024 (R) | Jan-Sept, 2025 | Jan-Sept, 2024 | Jan-Dec, 2024 (R) | Jan-Sept, 2025 | Jan-Sept, 2024 | Jan-Dec, 2024 (R) | |

| Primary Sector | 20 | 47 | 75 | 28 | 416 | 463 | 1,867.8 | 5,265.6 | 6,620.5 | 1,650.1 | 1,054.0 | 1,525.9 | 3,517.9 | 6,319.5 | 8,146.3 |

| Manufacturing Sector | 885 | 800 | 1,108 | 72,672 | 58,040 | 87,695 | 20,710.0 | 21,880.3 | 31,591.8 | 73,091.3 | 66,939.2 | 88,891.7 | 93,801.4 | 88,819.4 | 120,483.6 |

| Services Sector | 3,969 | 4,451 | 6,499 | 80,066 | 83,945 | 119,560 | 111,843.3 | 122,570.5 | 174,894.1 | 76,009.2 | 34,245.0 | 80,856.1 | 187,852.5 | 156,815.6 | 255,750.2 |

| Total | 4,874 | 5,298 | 7,682 | 152,766 | 142,401 | 207,718 | 134,421.1 | 149,716.4 | 213,106.4 | 150,750.6 | 102,238.2 | 171,273.7 | 285,171.7 | 251,954.5 | 384,380.1 |

| Summary | Number | Potential Employment | Domestic Investment (USD million)* |

Foreign Investment (USD million)* |

Total Capital Investment (USD million)* |

||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Jan-Sept, 2025 | Jan-Sept, 2024 | Jan-Dec, 2024 (R) | Jan-Sept, 2025 | Jan-Sept, 2024 | Jan-Dec, 2024 (R) | Jan-Sept, 2025 | Jan-Sept, 2024 | Jan-Dec, 2024 (R) | Jan-Sept, 2025 | Jan-Sept, 2024 | Jan-Dec, 2024 (R) | Jan-Sept, 2025 | Jan-Sept, 2024 | Jan-Dec, 2024 (R) | |

| Primary Sector | 20 | 47 | 75 | 28 | 416 | 463 | 443.7 | 1,281.2 | 1,484.4 | 391.9 | 256.4 | 342.1 | 835.6 | 1,537.6 | 1,826.5 |

| Manufacturing Sector | 885 | 800 | 1,108 | 72,672 | 58,040 | 87,695 | 4,919.2 | 5,323.7 | 7,083.4 | 17,361.4 | 16,286.9 | 19,930.9 | 22,280.6 | 21,610.6 | 27,014.3 |

| Services Sector | 3,969 | 4,451 | 6,499 | 80,066 | 83,945 | 119,560 | 26,566.1 | 29,822.5 | 39,213.9 | 18,054.4 | 8,332.1 | 18,129.2 | 44,620.5 | 38,154.6 | 57,343.1 |

| Total | 4,874 | 5,298 | 7,682 | 152,766 | 142,401 | 207,718 | 31,929.0 | 36,427.3 | 47,781.7 | 35,807.7 | 24,875.5 | 38,402.2 | 67,736.7 | 61,302.8 | 86,183.9 |

Note :

* – Due to rounding, figures presented in this table may not add up precisely to the totals provided

(R) – Revised Figures

Jan-Sept 2025 : US$1 = RM4.21

Jan-Sept 2024 : US$1 = RM4.11

2024 : US$1 = RM4.46

Approved Private Investments By Major Foreign Investors (Ultimate Source), January-September 2025 / January-September 2024 / January-December 2024

| Foreign Investor | January-September 2025** | January-September 2024** | January-December 2024 (R)** | |||

|---|---|---|---|---|---|---|

| Number | Foreign Investment* (RM million) |

Number | Foreign Investment* (RM million) |

Number | Foreign Investment* (RM million) |

|

| Singapore | 249 | 52,675.9 | 215 | 12,194.6 | 315 | 24,906.9 |

| The People’s Republic of China | 230 | 35,768.3 | 119 | 15,443.5 | 189 | 28,249.6 |

| United States of America (USA) | 59 | 11,323.4 | 38 | 10,926.8 | 69 | 33,515.7 |

| Foreign Investor | January-September 2025** | January-September 2024** | January-December 2024 (R)** | |||

|---|---|---|---|---|---|---|

| Number | Foreign Investment* (USD million) |

Number | Foreign Investment* (USD million) |

Number | Foreign Investment* (USD million) |

|

| Singapore | 249 | 12,512.1 | 215 | 2,967.1 | 315 | 5,584.5 |

| The People’s Republic of China | 230 | 8,496.0 | 119 | 3,757.5 | 189 | 6,334.0 |

| United States of America (USA) | 59 | 2,689.6 | 38 | 2,658.6 | 69 | 7,514.7 |

Note :

* – Due to rounding, figures presented in this table may not add up precisely to the totals provided

** – Reporting of foreign investment is based on the ultimate source

(R) – Revised Figures

Jan-Sept 2025 : US$1 = RM4.21

Jan-Sept 2024 : US$1 = RM4.11

2024 : US$1 = RM4.46

Approved Private Investments by Major Foreign Investors (Immediate Source), January-September 2025 / January-September 2024 / January-December 2024

| Foreign Investor | January-September 2025** | January-September 2024** | January-December 2024(R)** | |||

|---|---|---|---|---|---|---|

| Number | Foreign Investment* (RM million) |

Number | Foreign Investment* (RM million) |

Number | Foreign Investment* (RM million) |

|

| Singapore | 379 | 79,057.5 | 346 | 23,783.7 | 496 | 42,174.4 |

| The People’s Republic of China | 224 | 24,798.0 | 124 | 12,190.5 | 187 | 14,200.0 |

| Hong Kong SAR, China | 92 | 8,665.2 | 49 | 1,707.4 | 74 | 12,986.2 |

| Foreign Investor | January-September 2025** | January-September 2024** | January-December 2024 (R)** | |||

|---|---|---|---|---|---|---|

| Number | Foreign Investment* (USD million) |

Number | Foreign Investment* (USD million) |

Number | Foreign Investment* (USD million) |

|

| Singapore | 379 | 18,778.5 | 346 | 5,786.8 | 496 | 9,456.2 |

| The People’s Republic of China | 224 | 5,890.3 | 124 | 2,966.1 | 187 | 3,183.9 |

| Hong Kong SAR, China | 92 | 2,058.2 | 49 | 415.4 | 74 | 2,911.7 |

Note :

* – Due to rounding, figures presented in this table may not add up precisely to the totals provided

** – Reporting of foreign investment is based on the immediate source

(R) – Revised Figures

Jan-Sept 2025 : US$1 = RM4.21

Jan-Sept 2024 : US$1 = RM4.11

2024 : US$1 = RM4.46

Approved Private Investments by State, January-September 2025 / January-September 2024 / January-December 2024

| State | January-September 2025 | January-September 2024 | January-December 2024 (R) | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Domestic Investment* (RM million) |

Foreign Investment* (RM million) |

Total Capital Investment* (RM million) |

Domestic Investment* (RM million) |

Foreign Investment* (RM million) |

Total Capital Investment* (RM million) |

Domestic Investment* (RM million) |

Foreign Investment* (RM million) |

Total Capital Investment* (RM million) |

|

| Johor | 39,478.7 | 51,597.3 | 91,076.0 | 7,719.1 | 10,381.6 | 18,100.7 | 18,814.5 | 29,686.5 | 48,501.1 |

| Selangor | 27,883.3 | 24,012.7 | 51,896.0 | 48,996.2 | 20,308.2 | 69,304.4 | 75,971.5 | 25,891.7 | 101,863.1 |

| Wilayah Persekutuan Kuala Lumpur | 28,259.3 | 17,626.9 | 45,886.2 | 42,175.9 | 17,206.7 | 59,382.5 | 49,754.7 | 39,454.9 | 89,209.6 |

| State | January-September 2025 | January-September 2024 | January-December 2024 (R) | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Domestic Investment* (USD million) |

Foreign Investment* (USD million) |

Total Capital Investment* (USD million) |

Domestic Investment* (USD million) |

Foreign Investment* (USD million) |

Total Capital Investment* (USD million) |

Domestic Investment* (USD million) |

Foreign Investment* (USD million) |

Total Capital Investment* (USD million) |

|

| Johor | 9,377.4 | 12,255.9 | 21,633.3 | 1,878.1 | 2,525.9 | 4,404.1 | 4,218.5 | 6,656.2 | 10,874.7 |

| Selangor | 6,623.1 | 5,703.7 | 12,326.8 | 11,921.2 | 4,941.2 | 16,862.4 | 17,034.0 | 5,805.3 | 22,839.3 |

| Wilayah Persekutuan Kuala Lumpur | 6,712.4 | 4,186.9 | 10,899.3 | 10,261.8 | 4,186.5 | 14,448.3 | 11,155.8 | 8,846.4 | 20,002.2 |

Note :

* – Due to rounding, figures presented in this table may not add up precisely to the totals provided

** : Proposed state details not available

(R) – Revised Figures

Jan-Sept 2025 : US$1 = RM4.21

Jan-Sept 2024 : US$1 = RM4.11

2024 : US$1 = RM4.46

Approved Investments (Manufacturing Sector)

Overview: Projects Approved, January-September 2025 / January-September 2024 / January-December 2024

| January – September 2025 | January – September 2024 | January – December 2024 (R) | |||||||

|---|---|---|---|---|---|---|---|---|---|

| New | Expansion/ Diversification |

Total | New | Expansion/ Diversification |

Total | New | Expansion/ Diversification |

Total | |

| Number | 492 | 393 | 885 | 506 | 294 | 800 | 691 | 417 | 1,108 |

| Potential Employment |

40,991 | 31,681 | 72,672 | 35,502 | 22,538 | 58,040 | 50,502 | 37,193 | 87,695 |

| Total Capital Invesment*(RM million) |

60,342.8 | 33,458.6 | 93,801.4 | 36,798.5 | 52,020.9 | 88,819.4 | 49,768.8 | 70,714.8 | 120,483.6 |

| – Domestic Invesment* | 10,442.7 | 10,267.3 | 20,710.0 | 14,000.3 | 7,879.9 | 21,880.3 | 17,192.5 | 14,399.3 | 31,591.8 |

| – Foreign Investment* | 49,900.1 | 23,191.2 | 73,091.3 | 22,798.2 | 44,141.0 | 66,939.2 | 32,576.3 | 56,315.5 | 88,891.7 |

| January – September 2025 | January – September 2024 | January – December 2024 (R) | |||||||

|---|---|---|---|---|---|---|---|---|---|

| New | Expansion/ Diversification |

Total | New | Expansion/ Diversification |

Total | New | Expansion/ Diversification |

Total | |

| Number | 492 | 393 | 885 | 506 | 294 | 800 | 691 | 417 | 1,108 |

| Potential Employment |

40,991 | 31,681 | 72,672 | 35,502 | 22,538 | 58,040 | 50,502 | 37,193 | 87,695 |

| Total Capital Invesment*(USD million) |

14,333.2 | 7,947.4 | 22,280.6 | 8,953.4 | 12,657.2 | 21,610.6 | 11,158.9 | 15,855.3 | 27,014.3 |

| – Domestic invesment* | 2,480.4 | 2,438.8 | 4,919.2 | 3,406.4 | 1,917.3 | 5,323.7 | 3,854.8 | 3,228.6 | 7,083.4 |

| – Foreign Investment* | 11,852.8 | 5,508.6 | 17,361.4 | 5,547.0 | 10,739.9 | 16,286.9 | 7,304.1 | 12,626.8 | 19,930.9 |

Note :

* – Due to rounding, figures presented in this table may not add up precisely to the totals provided

(R) – Revised Figures

Jan-Sept 2025 : US$1 = RM4.21

Jan-Sept 2024 : US$1 = RM4.11

2024 : US$1 = RM4.46

Manufacturing Projects Approved By Major Foreign Investors – Ultimate Source, January-September 2025 / January-September 2024 / January-December 2024

| Foreign Investor | January – September 2025** | January – September 2024** | January – December 2024 (R)** | |||

|---|---|---|---|---|---|---|

| Number | Foreign Investment* (RM million) |

Number | Foreign Investment* (RM million) |

Number | Foreign Investment* (RM million) |

|

| The People’s Republic of China | 149 | 33,912.2 | 77 | 10,797.4 | 121 | 22,792.0 |

| Singapore | 67 | 7,742.4 | 63 | 3,887.8 | 95 | 5,838.9 |

| British Virgin Islands (BVI) | 2 | 6,597.4 | 2 | 112.7 | 2 | 112.7 |

| Foreign Investor | January – September 2025** | January – September 2024** | January – December 2024 (R)** | |||

|---|---|---|---|---|---|---|

| Number | Foreign Investment* (USD million) |

Number | Foreign Investment* (USD million) |

Number | Foreign Investment* (USD million) |

|

| The People’s Republic of China | 149 | 8,055.2 | 77 | 2,627.1 | 121 | 5,110.3 |

| Singapore | 67 | 1,839.0 | 63 | 945.9 | 95 | 1,309.2 |

| British Virgin Islands (BVI) | 2 | 1,567.1 | 2 | 27.4 | 2 | 25.3 |

Note:

* – Due to rounding, figures presented in this table may not add up precisely to the totals provided

** – Reporting of foreign investment is based on the ultimate source

(R) – Revised Figures

Jan-Sept 2025 : US$1 = RM4.21

Jan-Sept 2024 : US$1 = RM4.11

2024 : US$1 = RM4.46

Manufacturing Projects Approved By Major Foreign Investors – Immediate Source, January-September 2025 / January-September 2024 / January-December 2024

| Foreign Investor | January – September 2025** | January – September 2024** | January – December 2024 (R)** | |||

|---|---|---|---|---|---|---|

| Number | Foreign Investment* (RM million) |

Number | Foreign Investment* (RM million) |

Number | Foreign Investment* (RM million) |

|

| The People’s Republic of China | 135 | 22,964.9 | 73 | 7,878.5 | 107 | 9,762.7 |

| Singapore | 136 | 20,516.0 | 121 | 10,510.4 | 178 | 15,069.8 |

| Hong Kong SAR, China | 48 | 8,406.6 | 20 | 1,515.6 | 33 | 12,750.9 |

| Foreign Investor | January – September 2025** | January – September 2024** | January – December 2024 (R)** | |||

|---|---|---|---|---|---|---|

| Number | Foreign Investment* (USD million) |

Number | Foreign Investment* (USD million) |

Number | Foreign Investment* (USD million) |

|

| The People’s Republic of China | 135 | 5,454.8 | 73 | 1,916.9 | 107 | 2,189.0 |

| Singapore | 136 | 4,873.2 | 121 | 2,557.3 | 178 | 3,378.9 |

| Hong Kong SAR, China | 48 | 1,996.8 | 20 | 368.8 | 33 | 2,858.9 |

Note :

* – Due to rounding, figures presented in this table may not add up precisely to the totals provided

** – Reporting of foreign investment is based on the immediate source

(R) – Revised Figures

Jan-Sept 2025 : US$1 = RM4.21

Jan-Sept 2024 : US$1 = RM4.11

2024 : US$1 = RM4.46

Manufacturing Projects Approved by State, January-September 2025 / January-September 2024 / January-December 2024

| State | January – September 2025 | January – September 2024 | January – December 2024 (R) | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Domestic Investment* (RM million) |

Foreign Investment* (RM million) |

Total Capital Investment* (RM million) | Domestic Investment* (RM million) |

Foreign Investment* (RM million) |

Total Capital Investment* (RM million) | Domestic Investment* (RM million) |

Foreign Investment* (RM million) |

Total Capital Investment* (RM million) | |

| Johor | 5,181.4 | 13,467.4 | 18,648.7 | 2,038.0 | 5,973.9 | 8,011.9 | 5,046.3 | 9,165.1 | 14,211.4 |

| Kedah | 1,359.4 | 14,441.2 | 15,800.7 | 550.5 | 32,060.7 | 32,611.2 | 1,421.4 | 42,629.1 | 44,050.5 |

| Pulau Pinang | 3,479.5 | 12,306.6 | 15,786.1 | 2,070.6 | 10,072.4 | 12,143.1 | 3,529.0 | 13,784.0 | 17,313.0 |

| State | January – September 2025 | January – September 2024 | January – December 2024 (R) | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Domestic Investment* (USD million) |

Foreign Investment* (USD million) |

Total Capital Investment* (USD million) | Domestic Investment* (USD million) |

Foreign Investment* (USD million) |

Total Capital Investment* (USD million) | Domestic Investment* (USD million) |

Foreign Investment* (USD million) |

Total Capital Investment* (USD million) | |

| Johor | 1,230.7 | 3,198.9 | 4,429.6 | 495.9 | 1,453.5 | 1,949.4 | 1,131.5 | 2,055.0 | 3,186.4 |

| Kedah | 322.9 | 3,430.2 | 3,753.1 | 133.9 | 7,800.7 | 7,934.6 | 318.7 | 9,558.1 | 9,876.8 |

| Pulau Pinang | 826.5 | 2,923.2 | 3,749.7 | 503.8 | 2,450.7 | 2,954.5 | 791.3 | 3,090.6 | 3,881.8 |

NNote :

* – Due to rounding, figures presented in this table may not add up precisely to the totals provided

(R) – Revised Figures

Jan-Sept 2025 : US$1 = RM4.21

Jan-Sept 2024 : US$1 = RM4.11

2024 : US$1 = RM4.46

Manufacturing Projects Approved by Industry, January-September 2025 / January-September 2024 / January-December 2024

| Industry | January – September 2025 | January – September 2024 | January – December 2024 (R) | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Domestic Investment* (RM million) |

Foreign Investment* (RM million) |

Total Capital Investment* (RM million) | Domestic Investment* (RM million) |

Foreign Investment* (RM million) |

Total Capital Investment* (RM million) | Domestic Investment* (RM million) |

Foreign Investment* (RM million) |

Total Capital Investment* (RM million) | |

| Electrical & Electronics | 3,786.2 | 18,221.2 | 22,007.4 | 1,885.1 | 45,077.4 | 46,962.6 | 2,497.1 | 53,309.5 | 55,806.5 |

| Chemicals & Chemical Products | 4,666.9 | 12,869.3 | 17,536.2 | 2,907.9 | 4,066.2 | 6,974.1 | 4,207.6 | 6,417.5 | 10,625.1 |

| Transport Equipment | 2,823.0 | 9,901.6 | 12,724.6 | 2,495.7 | 4,520.6 | 7,016.3 | 3,560.1 | 12,265.2 | 15,825.3 |

| Basic Metal Products | 269.0 | 9,618.7 | 9,887.7 | 1,170.6 | 46.5 | 1,217.1 | 1,180.0 | 384.8 | 1,564.8 |

| Non-Metallic Mineral Products | 885.4 | 6,641.1 | 7,526.6 | 2,210.8 | 2,027.8 | 4,238.6 | 3,069.3 | 2,223.6 | 5,292.9 |

| Industry | January – September 2025 | January – September 2024 | January – December 2024 (R) | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Domestic Investment* (USD million) |

Foreign Investment* (USD million) |

Total Capital Investment* (USD million) |

Domestic Investment* (USD million) |

Foreign Investment* (USD million) |

Total Capital Investment* (USD million) |

Domestic Investment* (USD million) |

Foreign Investment* (USD million) |

Total Capital Investment* (USD million) |

|

| Electrical & Electronics | 899.3 | 4,328.1 | 5,227.4 | 458.7 | 10,967.7 | 11,426.4 | 559.9 | 11,952.8 | 12,512.7 |

| Chemicals & Chemical Products | 1,108.5 | 3,056.8 | 4,165.4 | 707.5 | 989.3 | 1,696.9 | 943.4 | 1,438.9 | 2,382.3 |

| Transport Equipment | 670.5 | 2,351.9 | 3,022.5 | 607.2 | 1,099.9 | 1,707.1 | 798.2 | 2,750.0 | 3,548.3 |

| Basic Metal Products | 63.9 | 2,284.7 | 2,348.6 | 284.8 | 11.3 | 296.1 | 264.6 | 86.3 | 350.8 |

| Non-Metallic Mineral Products | 210.3 | 1,577.5 | 1,787.8 | 537.9 | 493.4 | 1,031.3 | 688.2 | 498.6 | 1,186.7 |

Note :

* – Due to rounding, figures presented in this table may not add up precisely to the totals provided

(R) – Revised Figures

Jan-Sept 2025 : US$1 = RM4.21

Jan-Sept 2024 : US$1 = RM4.11

2024 : US$1 = RM4.46

Approved Investments (Services Sector)

Approved Private Investments In Services Sector,

January-September 2025 / January-September 2024 / January-December 2024

| Services Sector | Number | Potential Employment | Domestic Investment (RM million) * | Foreign Investment (RM million) * | Total Investment (RM million) * | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Jan-Sept, 2025 | Jan-Sept, 2024 | Jan-Dec, 2024 (R) | Jan-Sept, 2025 | Jan-Sept, 2024 | Jan-Dec, 2024 (R) | Jan-Sept, 2025 | Jan-Sept, 2024 | Jan-Dec, 2024 (R) | Jan-Sept, 2025 | Jan-Sept, 2024 | Jan-Dec, 2024 (R) | Jan-Sept, 2025 | Jan-Sept, 2024 | Jan-Dec, 2024 (R) | |

| Information and Communications | 551 | 1,497 | 2,404 | 22,548 | 35,399 | 48,576 | 32,364.6 | 45,885.2 | 75,043.5 | 67,411.4 | 19,323.2 | 60,967.7 | 99,776.0 | 65,208.4 | 136,011.2 |

| Real Estate | 849 | 1,005 | 1,349 | 14 | 0 | 0 | 56,564.3 | 49,301.9 | 64,549.4 | 0.0 | 0.0 | 0.0 | 56,564.3 | 49,301.9 | 64,549.4 |

| Utilities | 27 | 21 | 25 | 16 | 0 | 0 | 9,732.3 | 7,736.6 | 11,067.9 | 0.0 | 0.0 | 0.0 | 9,732.3 | 7,736.6 | 11,067.9 |

| Distributive Trade | 1,136 | 948 | 1,411 | 49,661 | 35,054 | 54,678 | 716.3 | 605.7 | 1,461.2 | 6,500.1 | 4,541.5 | 6,642.6 | 7,216.3 | 5,147.2 | 8,103.9 |

| Support Services | 1,184 | 758 | 979 | 4,497 | 600 | 1,567 | 5,668.6 | 9,953.1 | 11,966.3 | 1,363.6 | 327.3 | 896.1 | 7,032.2 | 10,280.4 | 12,862.3 |

| Financial Services | 33 | 36 | 46 | 225 | 176 | 215 | 4,444.4 | 3,295.4 | 3,330.4 | 444.3 | 1,028.8 | 1,040.4 | 4,888.7 | 4,324.1 | 4,370.7 |

| Transport Services | 34 | 56 | 83 | 258 | 10,502 | 11,186 | 747.7 | 4,066.5 | 4,830.8 | 218.3 | 4,384.2 | 6,591.8 | 966.0 | 8,450.7 | 11,422.6 |

| Hotel and Tourism | 23 | 14 | 17 | 1,596 | 871 | 1,072 | 922.2 | 611.3 | 814.0 | 14.1 | 654.9 | 654.9 | 936.3 | 1,266.2 | 1,468.9 |

| Health Services | 1 | 1 | 2 | 381 | 537 | 1,192 | 308.7 | 868.8 | 1,219.7 | 0.0 | 0.0 | 0.0 | 308.7 | 868.8 | 1,219.7 |

| Education Services | 76 | 61 | 96 | 727 | 493 | 640 | 227.4 | 246.1 | 594.0 | 0.5 | 1.2 | 19.5 | 227.9 | 247.3 | 613.5 |

| Global Establishment | 46 | 54 | 84 | 143 | 313 | 434 | 0.0 | 0.0 | 0.0 | 54.8 | 3,983.9 | 4,043.2 | 54.8 | 3,983.9 | 4,043.2 |

| Other Services | 9 | 0 | 3 | 0 | 0 | 0 | 146.7 | 0.0 | 16.9 | 2.0 | 0.0 | 0.0 | 148.7 | 0.0 | 16.9 |

| Total | 3,969 | 4,451 | 6,499 | 80,066 | 83,945 | 119,560 | 111,843.3 | 122,570.5 | 174,894.1 | 76,009.2 | 34,245.0 | 80,856.1 | 187,852.5 | 156,815.6 | 255,750.2 |

| Services Sector | Number | Potential Employment | Domestic Investment (USD million) * | Foreign Investment (USD million) * | Total Investment (USD million) * | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Jan-Sept, 2025 | Jan-Sept, 2024 | Jan-Dec, 2024 (R) | Jan-Sept, 2025 | Jan-Sept, 2024 | Jan-Dec, 2024 (R) | Jan-Sept, 2025 | Jan-Sept, 2024 | Jan-Dec, 2024 (R) | Jan-Sept, 2025 | Jan-Sept, 2024 | Jan-Dec, 2024 (R) | Jan-Sept, 2025 | Jan-Sept, 2024 | Jan-Dec, 2024 (R) | |

| Information and Communications | 551 | 1,497 | 2,404 | 22,548 | 35,399 | 48,576 | 7,687.6 | 11,164.3 | 16,825.9 | 16,012.2 | 4,701.5 | 13,669.9 | 23,699.8 | 15,865.8 | 30,495.8 |

| Real Estate | 849 | 1,005 | 1,349 | 14 | 0 | 0 | 13,435.7 | 11,995.6 | 14,473.0 | 0.0 | 0.0 | 0.0 | 13,435.7 | 11,995.6 | 14,473.0 |

| Utilities | 27 | 21 | 25 | 16 | 0 | 0 | 2,311.7 | 1,882.4 | 2,481.6 | 0.0 | 0.0 | 0.0 | 2,311.7 | 1,882.4 | 2,481.6 |

| Distributive Trade | 1,136 | 948 | 1,411 | 49,661 | 35,054 | 54,678 | 170.1 | 147.4 | 327.6 | 1,544.0 | 1,105.0 | 1,489.4 | 1,714.1 | 1,252.4 | 1,817.0 |

| Support Services | 1,184 | 758 | 979 | 4,497 | 600 | 1,567 | 1,346.5 | 2,421.7 | 2,683.0 | 323.9 | 79.6 | 200.9 | 1,670.4 | 2,501.3 | 2,883.9 |

| Financial Services | 33 | 36 | 46 | 225 | 176 | 215 | 1,055.7 | 801.8 | 746.7 | 105.5 | 250.3 | 233.3 | 1,161.2 | 1,052.1 | 980.0 |

| Transport Services | 34 | 56 | 83 | 258 | 10,502 | 11,186 | 177.6 | 989.4 | 1,083.1 | 51.9 | 1,066.7 | 1,478.0 | 229.5 | 2,056.1 | 2,561.1 |

| Hotel and Tourism | 23 | 14 | 17 | 1,596 | 871 | 1,072 | 219.1 | 148.7 | 182.5 | 3.3 | 159.3 | 146.8 | 222.4 | 308.1 | 329.4 |

| Health Services | 1 | 1 | 2 | 381 | 537 | 1,192 | 73.3 | 211.4 | 273.5 | 0.0 | 0.0 | 0.0 | 73.3 | 211.4 | 273.5 |

| Education Services | 76 | 61 | 96 | 727 | 493 | 640 | 54.0 | 59.9 | 133.2 | 0.1 | 0.3 | 4.4 | 54.1 | 60.2 | 137.5 |

| Global Establishment | 46 | 54 | 84 | 143 | 313 | 434 | 0.0 | 0.0 | 0.0 | 13.0 | 969.3 | 906.6 | 13.0 | 969.3 | 906.6 |

| Other Services | 9 | 0 | 3 | 0 | 0 | 0 | 34.8 | 0.0 | 3.8 | 0.5 | 0.0 | 0.0 | 35.3 | 0.0 | 3.8 |

| Total | 3,969 | 4,451 | 6,499 | 80,066 | 83,945 | 119,560 | 26,566.1 | 29,822.5 | 39,213.9 | 18,054.4 | 8,332.1 | 18,129.2 | 44,620.5 | 38,154.6 | 57,343.1 |

Note :

* – Due to rounding, figures presented in this table may not add up precisely to the totals provided

(R) – Revised Figures

Jan-Sept 2025 : US$1 = RM4.21

Jan-Sept 2024 : US$1 = RM4.11

2024 : US$1 = RM4.46

Approved Investments (Primary Sector)

Approved Private Investments In Primary Sector,

January-September 2025 / January-September 2024 / January-December 2024

| Primary Sector | Number | Potential Employment | Domestic Investment (RM million)* |

Foreign Investment (RM million)* |

Total Capital Investment (RM million)* |

||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Jan-Sept, 2025 | Jan-Sept, 2024 | Jan-Dec 2024 (R) | Jan-Sept, 2025 | Jan-Sept, 2024 | Jan-Dec 2024 (R) | Jan-Sept, 2025 | Jan-Sept, 2024 | Jan-Dec 2024 (R) | Jan-Sept, 2025 | Jan-Sept, 2024 | Jan-Dec 2024 (R) | Jan-Sept, 2025 | Jan-Sept, 2024 | Jan-Dec 2024 (R) | |

| Agriculture | 2 | 13 | 14 | 28 | 328 | 369 | 13.5 | 675.7 | 766.8 | 0.0 | 0.0 | 0.0 | 13.5 | 675.7 | 766.8 |

| Mining | 18 | 30 | 35 | 0 | 27 | 27 | 1,854.3 | 4,570.7 | 5,782.0 | 1,650.1 | 1,054.0 | 1,525.9 | 3,504.4 | 5,624.6 | 7,307.9 |

| Plantation & Commodities | – | 4 | 26 | – | 61 | 67 | – | 19.1 | 71.6 | – | 0.0 | 0.0 | – | 19.1 | 71.6 |

| Total | 20 | 47 | 75 | 28 | 416 | 463 | 1,867.8 | 5,265.6 | 6,620.5 | 1,650.1 | 1,054.0 | 1,525.9 | 3,517.9 | 6,319.5 | 8,146.3 |

| Primary Sector | Number | Potential Employment | Domestic Investment (USD million)* |

Foreign Investment (USD million)* |

Total Capital Investment (USD million)* |

||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Jan-Sept, 2025 | Jan-Sept, 2024 | Jan-Dec 2024 (R) | Jan-Sept, 2025 | Jan-Sept, 2024 | Jan-Dec 2024 (R) | Jan-Sept, 2025 | Jan-Sept, 2024 | Jan-Dec 2024 (R) | Jan-Sept, 2025 | Jan-Sept, 2024 | Jan-Dec 2024 (R) | Jan-Sept, 2025 | Jan-Sept, 2024 | Jan-Dec 2024 (R) | |

| Agriculture | 2 | 13 | 14 | 28 | 328 | 369 | 3.2 | 164.4 | 171.9 | 0.0 | 0.0 | 0.0 | 3.2 | 164.4 | 171.9 |

| Mining | 18 | 30 | 35 | 0 | 27 | 27 | 440.4 | 1,112.1 | 1,296.4 | 391.9 | 256.4 | 342.1 | 832.4 | 1,368.5 | 1,638.5 |

| Plantation & Commodities | – | 4 | 26 | – | 61 | 67 | – | 4.7 | 16.0 | – | 0.0 | 0.0 | – | 4.7 | 16.0 |

| Total | 20 | 47 | 75 | 28 | 416 | 463 | 443.7 | 1,281.2 | 1,484.4 | 391.9 | 256.4 | 342.1 | 835.6 | 1,537.6 | 1,826.5 |

Note :

* – Due to rounding, figures presented in this table may not add up precisely to the totals provided

(R) – Revised Figures

Jan-Sept 2025 : US$1 = RM4.21

Jan-Sept 2024 : US$1 = RM4.11

2024 : US$1 = RM4.46

Investment Performance

Gain Valuable Insight from Our Collection of Reports

Click here to download the latest statistical data

Explore the current business landscape in Malaysia

Malaysia’s dynamic and robust economy offers investors a multitude of opportunities within the manufacturing and services sectors.

Manufacturing

Main engine of Malaysia’s

economic growth with forward

and backward industrial linkages

and enabler of Industry 4.0

Services

Ever expanding sector with

an increasing focus on high

technology, providing

competitive advantages

for other industries